There are many investing strategies when it comes to investing in publicly traded companies. It can feel overwhelming, especially if you’re a busy entrepreneur like myself who dabbles in stock market investing on the side.

Full-time stock portfolio managers have time to work closely with analysts and debate implications of market developments,and the impact of current events on potential investments before deciding to buy or sell securities.

I, unfortunately, don’t have that time, so I’ve relied on a framework that has worked for me over the years. My approach is simple – I apply the same investing mindset used by angel investors but to the stock market.

What is angel investing

I’m sure you’ve thrown seen the term “angel investing” thrown around a lot. So what is it exactly?

Simply, angel investing is when you invest money into an early-stage startup.

It’s often reserved for high-net-worth individuals and deemed to be extremely risky. The idea is you invest in several early-stage startups, most of them fail but a handful might explode and deliver phenomenal ROI.

Now I don’t want to get into whether angel investing is a great asset class or not, and the mechanics of investing in early-stage startups (there are tons of content out there on this).

But rather I want to focus on the angel investing approach and mindset. When you invest money into an early-stage startup, you are locked in for a very long time, often 5-10 years. You can’t sell early, you can’t do much about short-term volatilities, and you won’t see money back (if ever) for a long time.

Angel investors are forced to think long-term. They analyze and critically define the “big picture” upfront in order to make an investment judgment call. Some of the items they analyze prior to investing are:

- the founders

- industry trends

- addressable market

- the product

- margins

- competitive moat

After making their bet into the startup, all they can do is wait. No worrying about short-term volatilities and no further investing actions. A friend of mine and fellow angel investor, Fahd Ananta summarized it succinctly in this tweet:

Applying the angel investing approach to public markets

You may have heard the phrase “private equity approach to public markets” used before. It’s a common talk track for many hedge funds. The idea is, hedge fund managers treat stocks like businesses, analyze the fundamentals and take long-term and concentrated positions (just like a PE firm would for private businesses). This is opposite to some hedge fund managers that buy/sell stocks rapidly, chase momentum of prices, and look for short-term profits.

Angel investing approach to public markets is somewhat similar, but more geared towards the individual investor. Where hedge fund managers have to answer to their investors, an individual investor only needs to answer to her own psychology.

Here’s how I’ve approached the stock market to make causal “angel investments” in stocks. I broke my framework down into 5 simple steps.

Step 1 – Assess the opportunity

As I mentioned, when making an angel investment in a startup, you need to take a long-term approach. In the same sense, find a publicly-traded company you believe will deliver superior performance over the next 10 years. Ignore your belief on where the stock might be in a year or in a few years, but rather where the company will be in the next decade. This will require you to remove yourself from the minutiae of analyzing just the current numbers and think bigger picture.

Assess critical aspects of the business like the industry, the management team, growth, addressable market, operating margins and competitive moat.

Step 2 – Take the position

Once you’ve decided that a company will deliver superior performance over the next 10 years, it’s time to take a position.

When angel investing in a start-up’s investment round – you write a cheque for 1 lump sum, and usually, that’s the extent of your investment in the company. Similarly, with this approach, you want to make your full investment in the stock upfront. The position size should be relative to your net worth and liquidity, but a meaningful size nonetheless.

If you plan on allocating $10k to the stock, do it in 1 shot. No buying the dips, selling the rips, dollar-cost averaging, use of options, none of that.

Why?

The more buy/sell decisions you make, the more likely you’re going to let your own psychology get the best of you and make a mistake. If you’re thinking in decades, which you should be, these dips, rips, and short-term price movements will be negligible anyway.

Not to mention, multiple buy/sell actions also takes time and mental energy that you could make better use of.

Step 3 – Monitor the investment

When you make an angel investment into a startup, you receive periodic updates from the founder. Similarly, public traded companies report performance on a quarterly and annual basis. The big picture foresight that you had when you decided to invest in a specific stock shouldn’t change or be impacted by quarterly, or even annual results. Therefore, be aware of the company’s performance for informational purposes, but not because you intend to make buy/sell decisions.

One thing you certainly should NOT do is monitor the stock price on a regular basis. You don’t plan to sell for a long time or add to your position, so there is no point in doing this. Save yourself the mental torment.

Step 4 – Stop thinking about it

An angel investor doesn’t constantly worry about the value of the startups she’s invested in because she knows liquidity is far away anyways, so what’s the point. Take this same mindset to your stock portfolio.

You’ve found a great company that you believe will outperform over the next decade. You’ve done the analytical work, made the judgment call, and placed your full bet into the company’s stock. It’s time to stop thinking about it. Go back to focusing on your day job, building your business, or whatever else you are working on. This will help protect you from yourself.

Step 5 – Build a portfolio

Angel investors have a really high-risk tolerance. Early-stage startups are unproven businesses. Although they might have massive potential, there’s a high probability of failure. The start-up ratio of failures to successes 10 to 1. Publicly traded companies are more established and stable, so your success rate ratio should theoretically be a lot better. Unlike a startup, it’s not often that a publicly traded company goes busts and right to zero.

Applying the angel investing approach to the stock market doesn’t mean making extremely risky bets into unproven penny stock companies. Remember what you’re applying here is the same framework used by angel investors – the long-term thinking, the upfront analysis, taking a full position, and ignoring short-term volatilities. An “angel investment” in the stock market could mean a mature multi-billion dollar company, a new IPO, or sure, even an obscure penny stock. What matters is superior company performance over the long term.

Since you’re only managing your own money, you can invest at your own pace. You might only have time to research, analyze and invest in 1 company per year – and that is totally fine. After a few years, you will have built a great “angel” portfolio of publicly traded businesses. Over the long run, a couple of your stocks may 10-20x, a few may 3-5x, a couple may double, and one might flatline or even decline. Your winners should more than make up for your losers. If you’re making sizeable bets (relative to your net worth and liquidity) into each company, this will eventually have a material impact on your net worth.

Think of your portfolio as similar to a traditional angel portfolio of startups, but with more established and stable businesses and therefore less extreme outcomes.

The coffee can portfolio

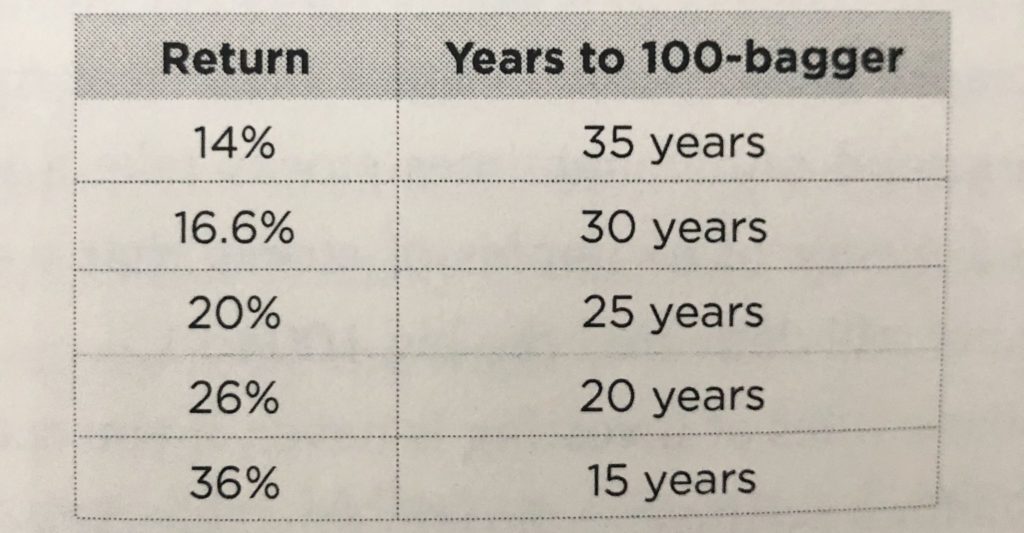

This approach is similar to the “coffee can portfolio” described by the financial author Chris Meyer’s in his book; 100 Baggers: Stocks that Return 100-to-1 and How to Find Them.

“The coffee can portfolio concept harkens back to the Old West, when people put valuable possessions in a coffee can and kept it under the mattress. The success of the program depended entirely on the wisdom and foresight used to select the objects to be placed in the coffee can, to begin with.”

Chris argues that the biggest hurdle to making superior returns over the long run is our own psychology. Humans have a terrible natural ability to stomach ups/downs and abstain from buying/selling based on short-term news or events. Chris argues that managing this temptation is the first step to achieving a 100 bagger. So add stocks to the proverbial “coffee can” and don’t touch them for 10+ years to reap the benefits.

The coffee can portfolio is a psychological framework to protect you from yourself, much like my angel investing approach to public markets.

Some of my angel investments in the public markets

I’ll preface this part by saying that the majority of my net worth is tied up in private assets (my real estate investments and private operating businesses like Viostream or PureFilters). I am not a huge public market investor by any stretch. But over the years, I’ve made angel bets in a handful of publicly traded companies and built a fairly concentrated equity portfolio.

Here are some of my bets:

InMode – a well-managed medical device company with a fantastic moat, great margins, superior track record, and a long runway in an ever-expanding industry.

Airbnb – the most influential real estate company of all time, creating and controlling the market for the exportation of single-family residences. The potential runway for the company is massive; it has the ability to expand beyond travel (though sticking to travel alone is still great).

Google – their search engine is perhaps the greatest business model in the history of capitalism, many misunderstand Google’s goose that lays golden eggs. Google’s search algorithm represents an impenetrable moat that will ensure the company prints money for many years to come.

Shopify – the massive eCommerce shift is fuelling the growth of the business, it has an all-star founding team that manages the business, and its powerful network effects protect its castle.

I plan on holding on to these investments for a very long time. I keep an eye out for new potential opportunities and typically make a 1 big bet once a year using my angel investing approach to public markets.

Final thoughts

My favourite thing about the angel investing approach to public markets is that it works. It works especially well if you’re like me – a busy entrepreneur/investor, interested in building your net worth, but not interested in stock trading or spending copious amounts of time doing it.

Though I am still early in building my stock portfolio (almost a decade in), I am confident this approach will continue to deliver superior results over the long term.

I hope this post was helpful in giving you a way to approach investing in publicly traded companies and building your own “angel” or “coffee can” portfolio of stocks.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

4 thoughts on “Angel Investing Approach to Public Markets”