2020 was a volatile year for all asset classes, and multifamily real estate was no exception. I spent months looking at potential real estate investment opportunities but had a hard time finding anything of value. I thought I was going to finish the year empty-handed but managed to find a great investment opportunity last minute.

It did, however, require me to re-think my real estate investment strategy, given the context and events that took place in 2020.

In this article I will share my latest real estate acquisition approach – how I analyzed the deal, and the factors that drove me to change my real estate investing strategy.

My original real estate investing strategy

I’ve always been a big proponent of cash flowing real estate, it was the first major investment I made, and, have been slowly building my personal portfolio over the years.

My original strategy was to acquire turn-key rental properties that were already stabilized. Meaning, properties that were already fully tenanted and didn’t require any major renovations.

The reason for my approach was simple – I wanted to spend the least amount of time as possible on my real estate investments. I have operating businesses I would prefer to invest my time in, and I viewed real estate as a great way to protect the wealth I’ve already earned. With a property manager in place to manage tenants and minor issues, it worked very well over the past several years.

What changed and why

The Market

When I started investing in real estate, interest rates were around 4% and stabilized properties had cap rates of around 8%. Over the years, I’ve watched interest rates fall, and cap rates fall along with it. This meant that I’ve had to settle for lower and lower spreads between cap and interest rates.

Nowadays, interest rates are around 1.7-2% and cap rates on stabilized properties are 3.5-4%. These thin margins make passive real estate investing virtually impossible. The current market has effectively priced out passive investors.

The only option now is value-add investing, or buying a property that’s vacant and or needs significant amounts of work in order for it to be profitable. Value-add investing enables you to get a deep discount on a property, but it also means you have to invest a lot of time and money to get it up to par and cash-flowing.

Coronavirus

So you might be wondering:

“if you’re buying these value-add properties, who’s going to do all the work? I thought you were busy with your operating businesses?“

The Coronavirus wreaked havoc upon small businesses around the world, and my dad’s business was no exception. He ran an airport limo service for over a decade and overnight the pandemic had completely destroyed it. Luckily, my dad is also a real estate investor and has built up his own portfolio on the side.

But this also meant he had a lot more free time on his hands, and he decided to simply focus on real estate going forward. As a result, he could pursue value-add real estate deals and manage the construction for my deals as well. He is far better than me when it comes to anything construction-related and has way more experience with renovation projects. The timing aligned well, a silver lining to the unfortunate events that transpired in 2020.

So the answer to the question above is simply: my dad.

My latest real estate deal

Background

The deal originally appeared in my inbox in September 2020, sent to me by a local broker. Before I even had time to properly analyze it, it was already under contract. But a few weeks later, the same broker let me know that the deal fell apart and was in the market again.

The property was originally listed for $990k, and I offered $950k based on my calculation (explained below). I went back and forth with a couple of offers before the seller accepted a $950k offer with no financing condition, but vacant possession.

The property had 4 units, 2 of which were vacant. All units were in poor shape and in desperate need of renovation. The previous owners were an elderly couple who simply neglected the property. The property was in a fantastic location, in a great neighbourhood, and in close proximity to the local hospital and commercial town center. The neighbourhood was well kept, a quiet street with custom homes, and the property in question was by far the worst looking building.

Here are some pictures I took:

The numbers

The way I look at real estate investing can be summarized in 2 words: cash flow. I never speculate on asset appreciation or future rent increases.

I first calculated how much total equity needs to be invested to acquire and stabilize the property. The construction costs used in the model were pulled from a preliminary quote provided by a trusted contractor that has worked with my father for years. Construction costs were provided after a full walkthrough of the property and on a unit-by-unit basis. The estimated completion time for the full project is 4-6 months.

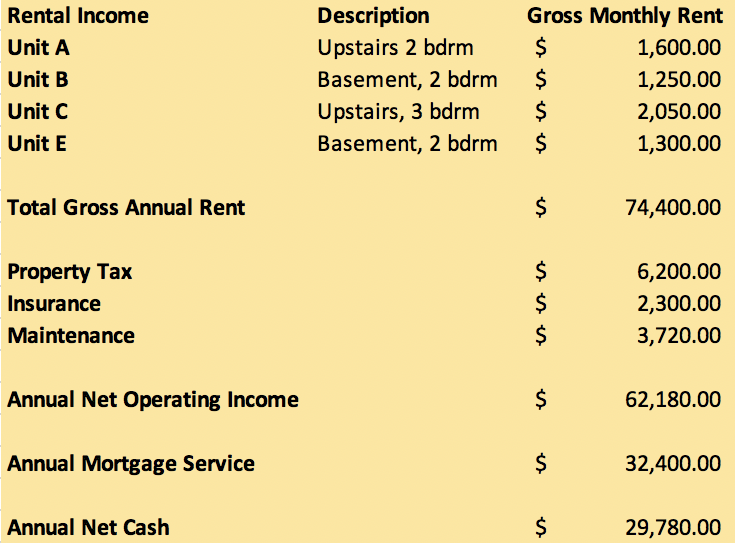

From there, I estimated what the gross rents and expenses will be once the property is fully occupied. The area I invest in I know quite well, meaning I am able to estimate rents and operating costs with great accuracy. In fact, I own another property that is within 15 minutes walking distance of this new acquisition.

Here is my total equity investment:

Once the property is stabilized, here is what the P&L should look like (tenant pays hydro/gas):

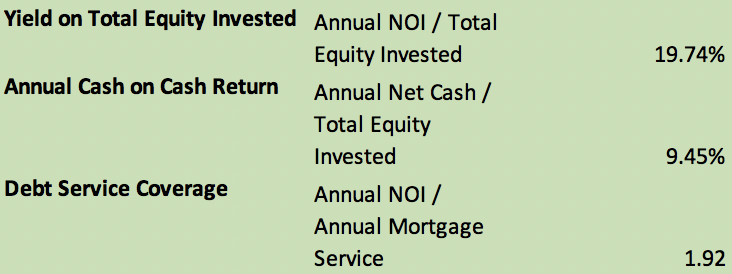

The key metrics I look at when evaluating a deal:

I look for yield on total equity invested above 15%, annual cash on cash return above 7%, and a debt service coverage above 1.5. As you can see, this deal exceeds all of my minimum criteria.

My analysis doesn’t include property appreciation estimates, but if cap rates on stabilized rental properties remain around 3.5-4% then the property could be worth $1.56m to $1.78m. Since I don’t plan to sell it for a long time, I don’t speculate on property appreciation.

I am also considering adding a 5th rental unit, which if feasible, would cost around $50k to $75k to do and generate an additional $13k to $15k in annual gross rental income (improving all of my metrics). My dad and his contractors are exploring this option and will confirm whether it’s possible or not soon. Even if we don’t go through with this plan, the base case on this property is good enough for my criteria.

Final thoughts

2020 was a turbulent year and an absolute roller coaster for all investors. I am grateful that I managed to find a deal that worked for me. What I found was rare; it took a long time for it to land on my desk. Given how competitive the market currently is, I don’t anticipate finding another deal like this for a while.

I hope my latest real estate acquisition gives insight into how I approach my latest deal and the factors that made me change my overall real estate investment strategy.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

3 thoughts on “My Latest Real Estate Deal and How My Strategy Has Changed”