A little over a year ago (16 months to be precise), I published a blog post titled “Opportunities in Canadian REITs“, where I discussed a special situation investment opportunity.

The volatility of publicly-traded REITs at the time (early COVID with no vaccination in sight) created the perfect opportunity for those seeking to get exposure to high-quality commercial real estate at a massive discount.

I saw no downside at the time, and in this blog post, I will the results and lessons learned along the way.

Thesis Background

As a long-term investor, my hold period is usually at least several years. But this was a special situation; what I would call an opportunistic bet. For those not familiar with my original blog post, here’s a quick recap:

Canadian REITs (publicly traded real estate) dropped in value by 35-50% in a matter of weeks due to the pandemic. These REITs own and operate some of the most valuable real estate in Canada, and are managed by some of the sharpest professionals in the real estate industry. Considering that real estate prices in the private markets haven’t moved at all, this represented a fantastic opportunity.

The upside: lock-in high single-digit dividend yields and enjoy the 50%+ upside as the pandemic lockdowns ended and the REIT values corrected.

The downside: REITs employ low levels of leverage and have ample access to liquidity (being publicly traded) if the pandemic was prolonged. Not to mention, real estate has great terminal value as a hard asset.

Now let’s look at some specific names.

Real Estate Asset Classes

Residential

There was a residential REIT that represented a special situation inside of this special situation (deep, I know). Northview Apartment REIT (NVU.UN) was already in the process of being acquired by 2 large and well-capitalized REITs for $36.25, pre-pandemic.

Yet, despite this, the REIT continued to trade at a precipitous discount to the acquisition price (and fair value). This represented a fantastic arbitrage opportunity. Even if the acquisition didn’t go through, you owned quality cash-flowing real estate assets operated by an experienced team with a great track record, all at a discount. It was a no-brainer, even if we were in the middle of a pandemic.

The acquisition did go through, which meant that NVU.UN purchased at $27.40 led to a 36% gain in 6 months, or a 72% annualized IRR (including dividends, but not reinvested).

Canadian Apartment REIT (CAR.UN) and Mainstreet Equity (MEQ) are two more residential stocks I took positions in. CAR.UN is the largest apartment owner and operator in Canada, with buildings in the densest & most supply-constrained areas in Canada. They have a 20+ year track record of compounding value.

MEQ is a founder-led real estate operating company (slightly different from a REIT) that specializes in residential properties in Western Canada. The valuation was incredibly attractive at the onsight of the pandemic, it was incredible that their portfolio was acquirable at $30k per rental unit. They also have a 20+ year track record of compounding value.

Retail

Retail represented the largest allocation in my REIT portfolio. The market unfairly punished many retail names, as the lockdowns took hold. Investors concluded that lockdowns were going to destroy retail tenants.

But by digging deeper it was evident that these retail REITs had a stable tenant base since most were essential services (groceries, pharmacies, etc). These tenants remained open throughout the COVID-19 lockdown and as a result rent collection remained high. Given this, I concluded that the largest REIT opportunity was in retail, as they traded at the steepest discount compared to the other real estate sectors.

SmartCentres (SRU.UN) was not only my largest retail REIT position but my largest REIT position period. SRU.UN owns and operates open-air retail plazas that are anchored by Walmart. These plazas are situated in highly valuable locations. Last but not least, SmartCentres was run by an exceptional team and led by one of the greatest Canadian real estate entrepreneurs, Mitch Goldhar (who was also buying a ton of SRU.UN for his personal account, great sign!).

SmartCentres maintained high occupancy and rent collection rates throughout the pandemic.

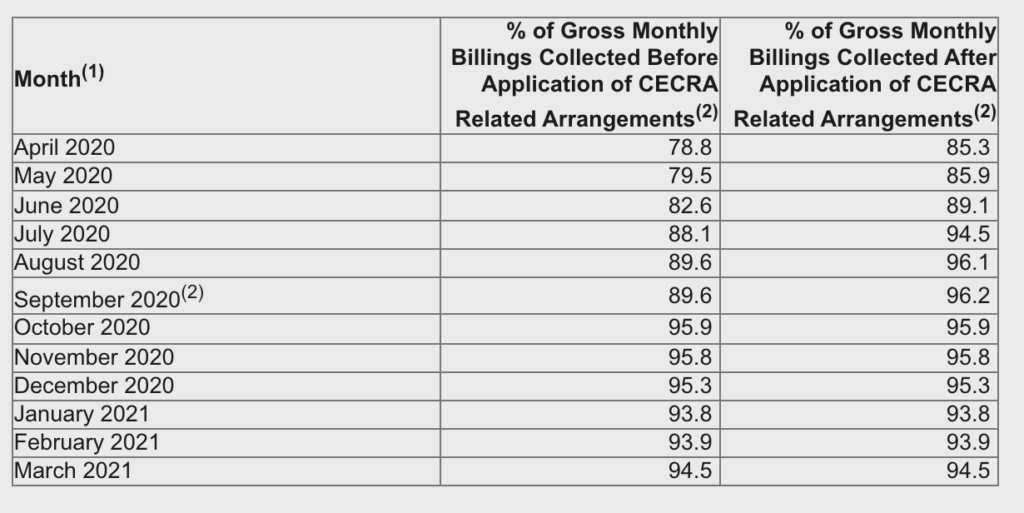

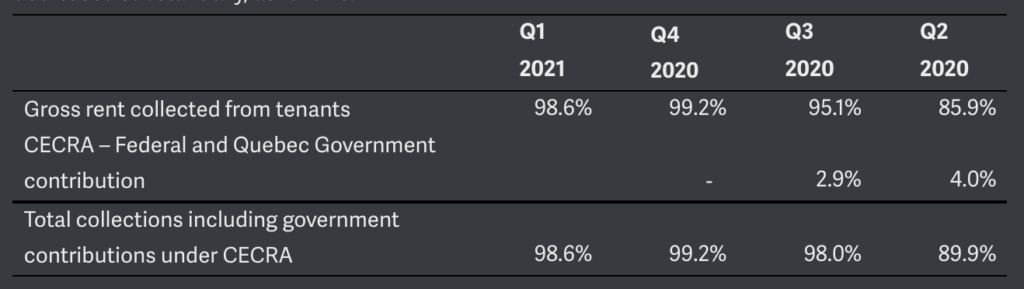

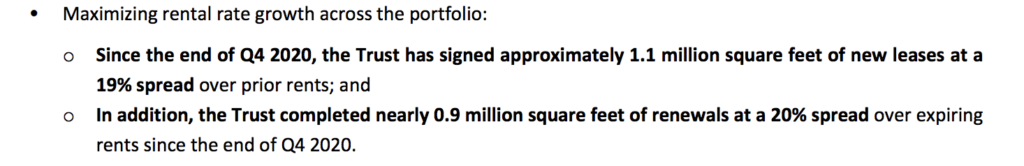

Along with SRU.UN, other REITs in my retail allocation included Crombie (CRR.UN) and Plaza (PLZ.UN). Crombie is the real estate arm of Sobey’s (one of Canada’s largest grocery chains), and Plaza owns and operates open-air retail in Eastern Canada. Both Crombie and Plaza maintained high occupancy and rent collections throughout the pandemic.

Plaza REIT

Industrial

Industrial real estate was a major beneficiary of COVID, due to the spike in eCommerce. Out of all the real estate asset classes, industrial experienced the highest rent growth throughout the pandemic (~20% YoY).

My only position in industrial was Dream Industrial (DIR.UN), which owns/operates a variety of industrial properties across Canada. Check out their rent growth details below:

Office

Office was one of the real estate asset class that I avoided. This is because, within a few weeks of the lockdowns, it was obvious that WFH was going to become a thing. I figured, even if only 10% of employees permanently worked from home post-pandemic, that would still have an absolutely devasting impact on office real estate value.

Allied Properties is an example of where the office is today. It is still down 30% since the pandemic started. They own very high-quality real estate, but they cater to the exact type of tenants that would easily be able to work from home (tech companies, digital agencies, etc).

ROI & Looking Forward

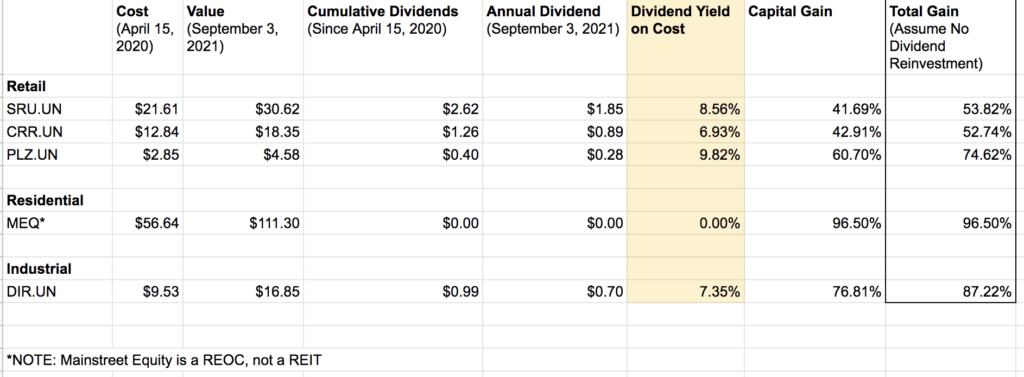

Below are the returns of the REITs I still hold today, broken down by position. I calculated the ROI based on the date that my blog post was published (April 15, 2020), though I started taking the majority of my positions in March 2020, where the cost was even lower across the board.

The goal of this investment wasn’t just for Total Gain, it was for Dividend Yield on Cost (cash flow). For a few positions, the cash yield from the annual REIT dividends is approaching double digits. This also assumes no personal leverage. But by employing a small amount of leverage (via margin or a pledged asset line), it could easily push the annual dividend yield on cost to double-digit territory. That’s ~10%+ cash distributions to own some of the highest quality real estate in Canada. Not to mention, most of these names have periodic dividend increases, so the Dividend Yield on Cost metric should continue to climb in the coming years.

These REITs represent an attractive passive cash flow vehicle. As well, this is as passive as it gets when it comes to income generated from real estate. No need to worry about construction, mortgages, tenants, or anything. Also, unlike corporate dividends, REITs pay out cash every month to unitholders.

Consider that I also made a private real estate investment last year, which had a target cash flow yield on cost of 9.45%. This private real estate investment generates less cash yield, has more risk, requires far more work (to both stabilize and maintain), and utilizes a decent amount of personal leverage.

Since the initial REIT investment, I have closed out some positions, but I will certainly be holding onto some of these higher-yielding REITs for the long run!

Lessons Learned

I’m a firm believer that you learn more from losing than making money. That wasn’t the case here, but there were still a few lessons learned along the way.

Volatility can be your friend

Public markets offer the gift (and curse) of volatility. Nowhere else will you be able to find high-quality real estate drop 50% in a matter of weeks. I understand that a pandemic is unprecedented, but the public market often punishes asset values harder than in private markets. Long-term investors understand that volatility is necessary and a critical path for an asset class to deliver value in the long haul. The lesson here is to continue to embrace volatility and harness opportunities when you see large movements in publicly traded securities.

Be opportunistic

Before the pandemic, I’ve never invested in REITs, only private real estate. By keeping an open mind and being opportunistic I immediately found a lucrative opportunity in something I’ve never considered before. Also, this style of “special situation” short-term investing is quite contrary to how I usually invest in the public markets. But I took the time to understand these REITs and developed the conviction to move forward.

Look into lateral opportunities

As mentioned, I had never looked at publicly traded real estate. But I had a high degree of experience and expertise in private real estate. These skills translated well into an adjacent opportunity, allowing me to quickly familiarize myself and make a bet. So consider the skills you currently have, is there a lateral (and more lucrative) opportunity you can apply them to? If there are no attractive opportunities currently in front of you, look left or right.

The world is unpredictable (luck is always a factor)

A bunch of events happened in the 16 months after publishing the blog post that I could not have predicted (which aided in the rebound of these REITs). A recorded amount of money was printed and handed to both consumers and businesses. This obviously helped REITs collect rent from their tenants, keeping their cash flow up. On top of that, vaccines were successfully developed in a record amount of time. The Canadian government did a great job quickly rolling out vaccines, which accelerated the reopening. All these events were unprecedented (but positively influencing) and I am acknowledging that luck played a factor here. I was prepared to hold on to these REITs for several years, but correction happened much faster than anticipated.

Stay humble, and accept that luck always plays a factor in investing!

Final Thoughts

Though these returns may not be as eye-popping as some of the crypto and tech returns made during the pandemic, I am quite happy with how this investment into Canadian REITs turned out. On a risk-adjusted basis, these REITs turned out to be an incredible investment opportunity as a result of the COVID-19 pandemic. The locked-in high dividend yields will also deliver great cash flow for years to come.

As Warren Buffett once said, “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” this investment is a perfect example of the latter.

DISCLAIMER: This blog post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Hi there! I’m Jay Vasantharajah, a Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences and passion for investing, entrepreneurship, personal financial management, and traveling the world.

Subscribe below, to get a couple of emails a month with free, valuable, and actionable content.

One thought on “Investment Review: Canadian REITs”