In the most recent Berkshire Hathaway shareholder meeting, there was a gem that Warren Buffett dropped: “I spend more time looking at balance sheets than I do income statements. Wall Street doesn’t pay much attention to balance sheets, but I like to look at balance sheets over an 8- or […]

Blog

I often think about this (paraphrased) quote from Sam Zell: “Every day you choose to hold an asset, you’re also choosing to buy it. Would you buy the assets you own at current prices? If the answer is no, then you should sell.” The more experience I gain as an […]

Each year I pick the top 3 books I read and share them with my mailing list. I will leave links to prior years’ top 3 at the bottom of this post. My top 3 book picks of 2024 (in no particular order) are as follows… Pick #1 – Private Equity […]

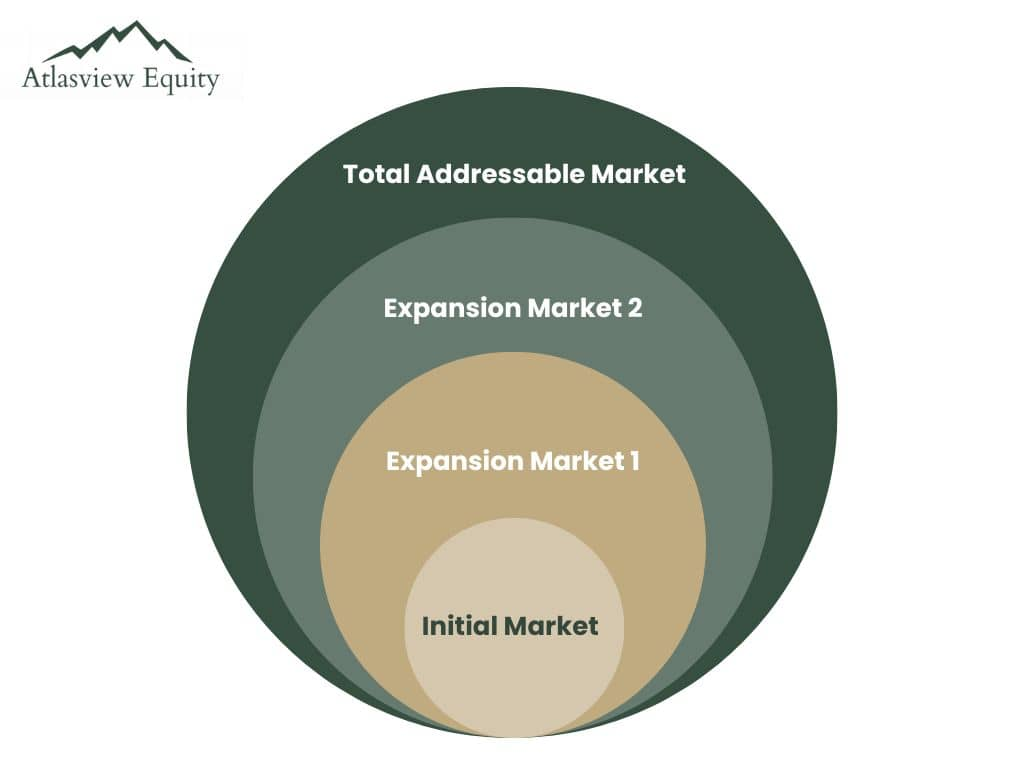

I read Peter Thiel’s Zero to One years ago but was too young and inexperienced to appreciate some of the key concepts articulated in the book. So I recently re-read parts of the book and wanted to share some important insights, particularly about monopolies. The book’s intended audience is startups, […]

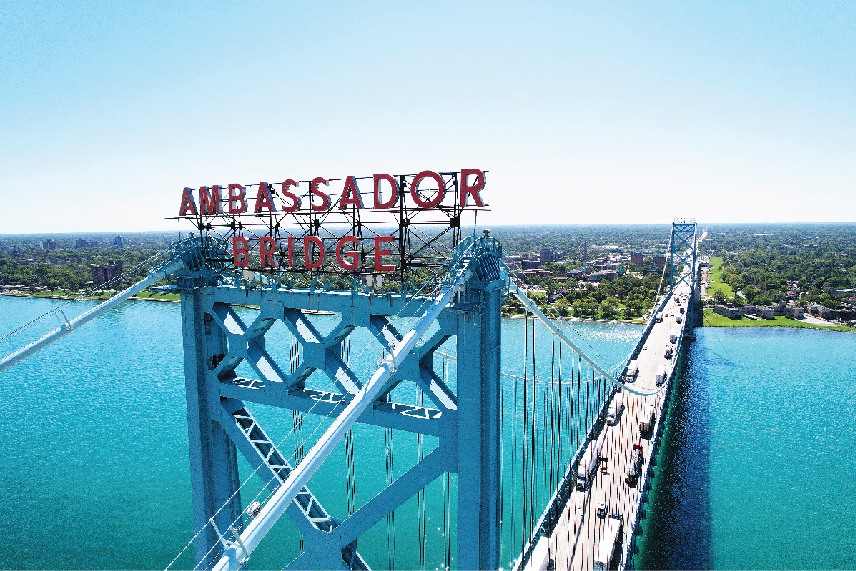

A little while ago, I shared a gem on the Detriot International Bridge Company with some discussion on Twitter. People asked for modern examples of this type of business, and some even concluded that these kinds of opportunities no longer exist. These businesses (and therefore investment opportunities) do in fact […]

One of my favourite investing books is Joel Greenblatt’s You Can Be a Stock Market Genius. Despite the cheesy title, the book has many great insights applicable to all types of investing. One key concept from the book is “forced sellers“. Greenblatt articulates how large institutional funds occasionally become forced sellers […]

Interested in Leading a PE-Backed Company? We are building a bench of talented individuals to lead our portfolio companies and create significant value in the businesses we acquire. Specifically, we are seeking exceptional candidates for CEO positions in PE-backed companies. Looking For A Lucrative Career Change? This is an excellent […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this investment pitch on Couche Tard at the 2024 Sohn Conference (12-minute video, click image below): This is a well-articulated and concise investment pitch. […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. There was an interesting story in the Financial Times this week about a dispute between a family and a private equity firm. The family sold their business, Save Mart […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this diagram which outlines Winterhalter Gastronom’s vertical specialization strategy: Winterhalter started by manufacturing dishwashing units for every vertical, but then they decided to specialize […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this framework for diversification by John Huber of Saber Capital: There are all sorts of frameworks for diversification out there, but this one is […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gems are the advertised acquisition criteria for Berkshire Hathaway and Constellation Software (note the commonality on offering price). Also, some discussion around price discovery. Two main […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this Twitter thread on Danaher, its history, and the Danaher Business System. Danaher’s life started with the acquisition of a publicly traded vehicle that had […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this snippet from a 1979 article where Buffett discusses smokestack companies and a peculiar interaction with an executive at one such company: Great lessons […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this book snippet where the former TransDigm CEO is asked about his recent stock sale by an investor: This is my favorite investor <> […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this podcast episode on Richard Rainwater. The Bass Family hired Rainwater in the 70s to help manage their investments (and diversify from their oil interests). […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this 2016 blog post snippet on Chipotle’s store economics and some discussion around organic reinvestment. Good businesses generate a high ROIC but great businesses […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is this Twitter thread on the Detroit International Bridge Company, which owns and operates the Ambassador Bridge. I love anomaly businesses like this, true gems. DIB […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. I recently read Morgan Housel’s new book Same As Ever. It was a fantastic read, I highly recommend it. He details a framework in the book “short-term pessimistic, […]

NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues. Today’s gem is a recap of my 10 favourite gems from 2023. But before we dive into it, I wanted to reflect a bit on this weekly […]