Many entrepreneurs overlook the importance of capital allocation despite how critical it is. Capital allocation is the process of allocating financial resources to different areas of a business to maximize returns.

Entrepreneurs who understand how to strategically allocate capital are able to effectively operate a business, optimize its intrinsic value, and ultimately their net worth.

In this post, I will highlight various capital allocation options available to entrepreneurs and analyze the impacts of each.

Capital allocation

As an entrepreneur, it’s easy to lose yourself to the day-to-day grind of running your business. For this reason, entrepreneurs often forget what their main function is, it isn’t just running their business, managing employees, or serving customers – it’s allocating capital. Though it may not seem obvious, many operational decisions are in fact capital allocation decisions.

Here are some examples of operational decisions that are actually capital allocation decisions:

- Increasing your advertising spend

- Paying yourself more

- Outsourcing your development team

- Purchasing new equipment

- Hiring an admin assistant

When you start looking at your business from the perspective of capital allocation, you start to see more opportunities to earn a return on your money.

Capital allocation for most business falls into 4 broad options, which include:

- Reinvesting back in the business

- Paying down debt

- Paying out dividends

- Acquiring competing or complementary businesses

Let’s take a closer look at each one of these capital allocation options.

1. Reinvesting back in the business

This is by far the most common capital allocation option chosen by most entrepreneurs. It’s what you know best and the easiest to access.

Reinvesting back into the business may include hiring more sales and marketing employees, developing a new product or service line, purchasing new equipment or technology, or leasing a larger office space. Anything that you feel might increase revenue, decrease costs, and ultimately increase profits in the long run.

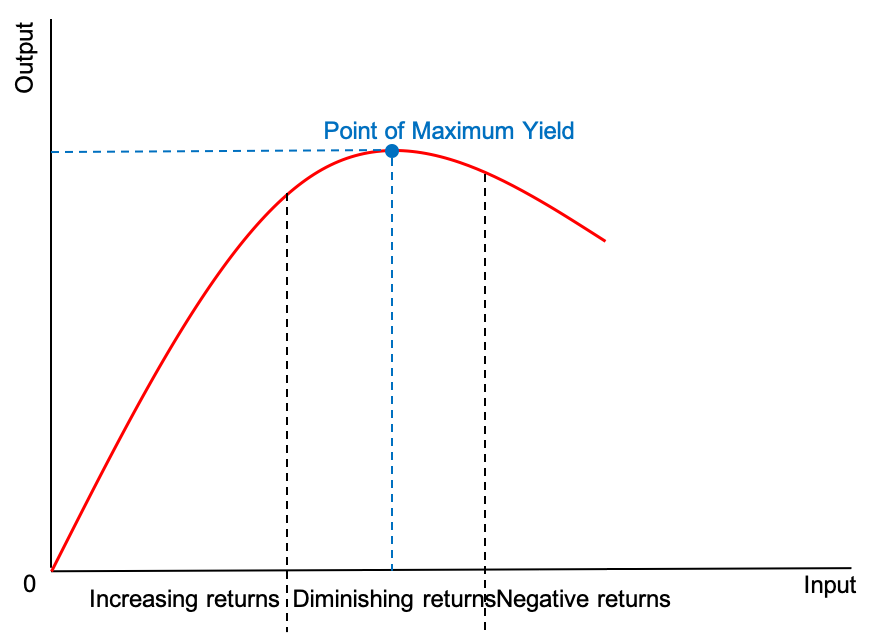

It makes sense for entrepreneurs to prioritize reinvesting back in the business, it has the highest return potential. The problem is that returns are diminishing, and entrepreneurs often overestimate where the ‘point of maximum yield’ (the blue dot in the chart below) is located in the businesses they run.

Where your business is on this curve depends on a number of variables. These variables include the age of your business, saturation of your industry, total addressable market, market positioning, competitive advantage, and your company culture.

So how do you calculate the return on reinvesting in your business? Well, it’s subjective, but it can be done using a series of projections and assumptions.

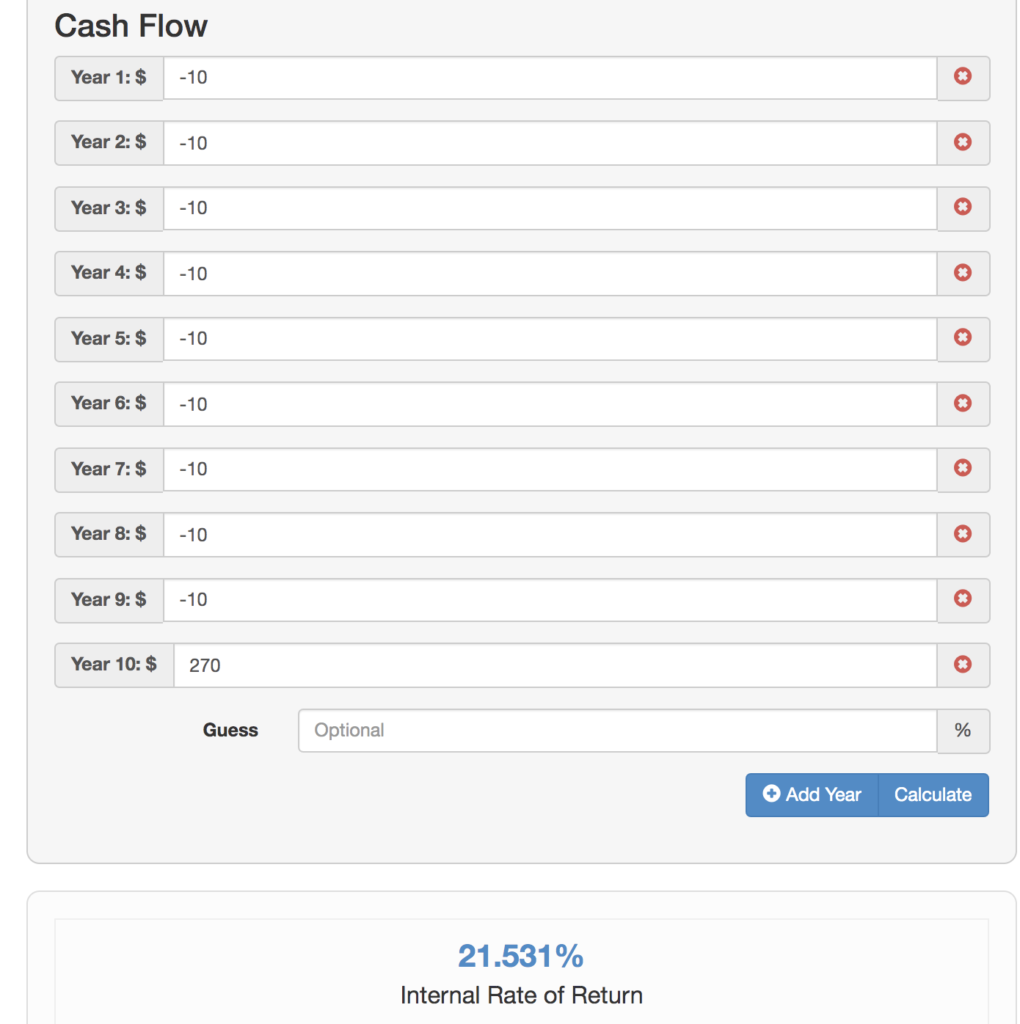

Let’s take the example of hiring a new salesperson. Assume this new hire costs you $100k/year all in, including commissions and benefits. Now assume your business generates a net profit margin of 15%, and comparable businesses sell for 3 times net profit.

If the salesperson brings in $600k worth of new sales per year, it translates into $90k in net profits, or a $10k per year net investment. By putting the 3 times multiple on the net profit, you can assume that the valuation of your business increases by $270k when you sell it.

If you assume a 10 year window, and plug into an IRR calculator, you get 21.531% (fantastic return!).

It’s obviously never this easy to calculate, but it’s not impossible. The main takeaway here is the importance of doing similar exercises to get a sense of return on reinvesting in your company. And not only compare multiple business reinvestment decisions against each other but also compare them against the capital allocation options listed below.

There are also a ton of other reasons to reinvest into your business beyond strictly return on capital. Reasons like hiring to free up your time and generating more cash flow now (instead of a bigger payday later) to help pay bills.

2. Paying down debt

Most modern entrepreneurs are running asset-light businesses, and therefore don’t have a lot of debt. If this is your case this option doesn’t apply.

But if you have long-term debt, paying it down faster may be a valid option. Calculating the return on capital for this option is far easier than the option above – it’s simply the interest you’d be saving.

With low-interest rates and high inflation in today’s economic environment, this option is likely the worst return on capital. By using the same example noted earlier, it’s unlikely that you’re paying an interest rate higher than 21.531%. But if the interest rate is higher, then obviously paying down debt would be the optimal capital allocation option.

Of course, there are other reasons to pay down debt beyond strictly return on capital. Reasons like overall risk management and peace of mind from not having debt.

3. Paying out dividends

This is option is often overlooked by many entrepreneurs. Paying out dividends doesn’t just mean more money for yourself so you can buy a bigger house or a nicer car. Paying out a dividend means that you could allocate the capital elsewhere, like stocks, real estate, or other passive investments.

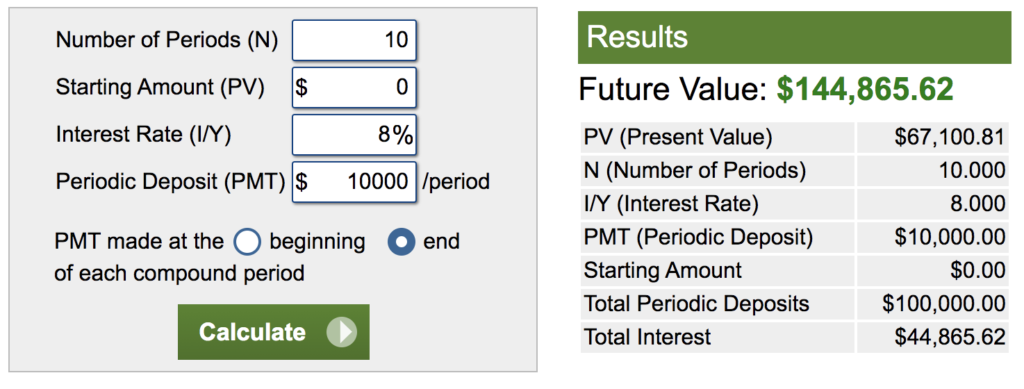

Let’s consider that the S&P 500 has returned about 8% per year over the long run. In the above example, the return on hiring a salesperson obviously vastly exceeds the 8% S&P 500 return. But what if the salesperson brought in half the amount of new sales? Or profit margins on your product/service worsened? There are so many variables here that could easily sink the return on hiring the salesperson below 8%.

The point here is, investing in elsewhere outside of your business should always be used as a benchmark to compare against. To help you visualize the baseline S&P 500 return, here’s what investing that extra net $10k per year would look like after 10 years.

$145k is obviously less than the $270k increase in business valuation (from the prior example). But it helps you visualize a hurdle rate when evaluating capital allocation decisions for your business.

There are also other reasons to pay out dividends and invest elsewhere. Reasons like diversifying your personal net worth and setting up passive income.

4. Acquiring competing or complementary businesses

This option is by far the most complex and hardest to execute. It requires a little bit of expertise around M&A, great acquisition opportunities to be available, and significant time investment. All of which makes this option quite risky, but the payoff can be massive.

This option is also quite capital intensive. The $100k per year for the salesperson is probably not enough capital to acquire a competitor or a complementary business. But if you do happen to have the excess cash on your balance sheet, this can be a very lucrative capital allocation option.

Doing a build vs buy analysis often suggests that it can be cheaper to buy an existing complementary or competing business because it gives you access to an existing customer base, or geography that would take up too much time and capital to build from scratch.

The return calculations on acquiring another business are very complex and deserve a separate blog post. But on a very high level, acquiring a competing or an adjacent business can improve margins, unlock new sales, and overall make your business larger. The speed in business growth that you can achieve with this option often exceed option 1. The larger the business, the higher the multiple it will sell for.

All this can translate into a fantastic return on investment, far exceeding capital allocation options 1 to 3.

Final thoughts

I hope this post inspires you to take a step back from day-to-day operations and look at your business through the lens of a capital allocator. Making the right capital allocations is critical to the growth and success of any company and can have a significant impact on your overall net worth.

So let’s all take a step back from ‘doing’ and be more strategic with how capital is allocated in order to reap the benefits it can bring.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

7 thoughts on “How to Approach Capital Allocation as an Entrepreneur”