As an investor, there’s one key thing that I look for when deciding whether to invest in a business – pricing power. Let me break down why I’m obsessed with it and how to assess if a business has it.

What is Pricing Power

The textbook definition of pricing power is a business’s ability to increase prices without losing customers or market share. But it’s a lot more nuanced than just that. Here’s why:

Levels

Pricing power isn’t black and white, there are levels to it. Two different businesses can both have pricing power, but one could have more power than the other. This is measured by how much and how consistently the business can increase prices, without losing many or even any customers.

Inflation

The level of pricing power needs to at least exceed inflation. If a business is only able to increase its prices at the prevailing rate of inflation, it does not have pricing power.

Supplier Value Leakage

If a business’s suppliers are able to increase their prices at the same (or higher) rate as the business’s price increases, it does not have pricing power. Wholesale transfer pricing occurs when a supplier is able to take all of the value generated by price increases, robbing the business of true pricing power. Google’s auction-based bidding platform is a fantastic example of this.

Will or Force

Broadly speaking, companies either have pricing power over their customers by customer will, or by force.

- By will: customers deem a company’s product/service so unique and desirable that they consider any substitute as vastly inferior, therefore consciously willing to pay more. This is usually achieved with a strong brand positioning.

- Example: LVMH is able to increase the price of their handbags every year, and customers willingly pay more, despite the ability of more affordable luxury handbags being available in the market.

- By force: customers either don’t have any substitute options or it’s simply too risky or costly to switch. Customers are therefore forced to pay whatever the company charges. This is usually achieved by the company controlling the supply of a product/service with inelastic demand (duopoly, monopoly) or having a product/service that’s gets deeply entrenched within its customers.

- Example: many enterprise software businesses have their customers deeply entrenched in their product, making it risky and costly to switch to a competitor

I don’t have an opinion on which type of pricing power is better, but both types will result in significant benefits for owners.

Why Pricing Power is So Important

Pricing power is basically the measure of a business’s moat. Even if the business doesn’t increase prices year over year, the mere ability to do so indicates the strength of its moat. And the stronger a business’s moat, the more durable the business is, which ultimately results in higher returns on invested capital for its owners.

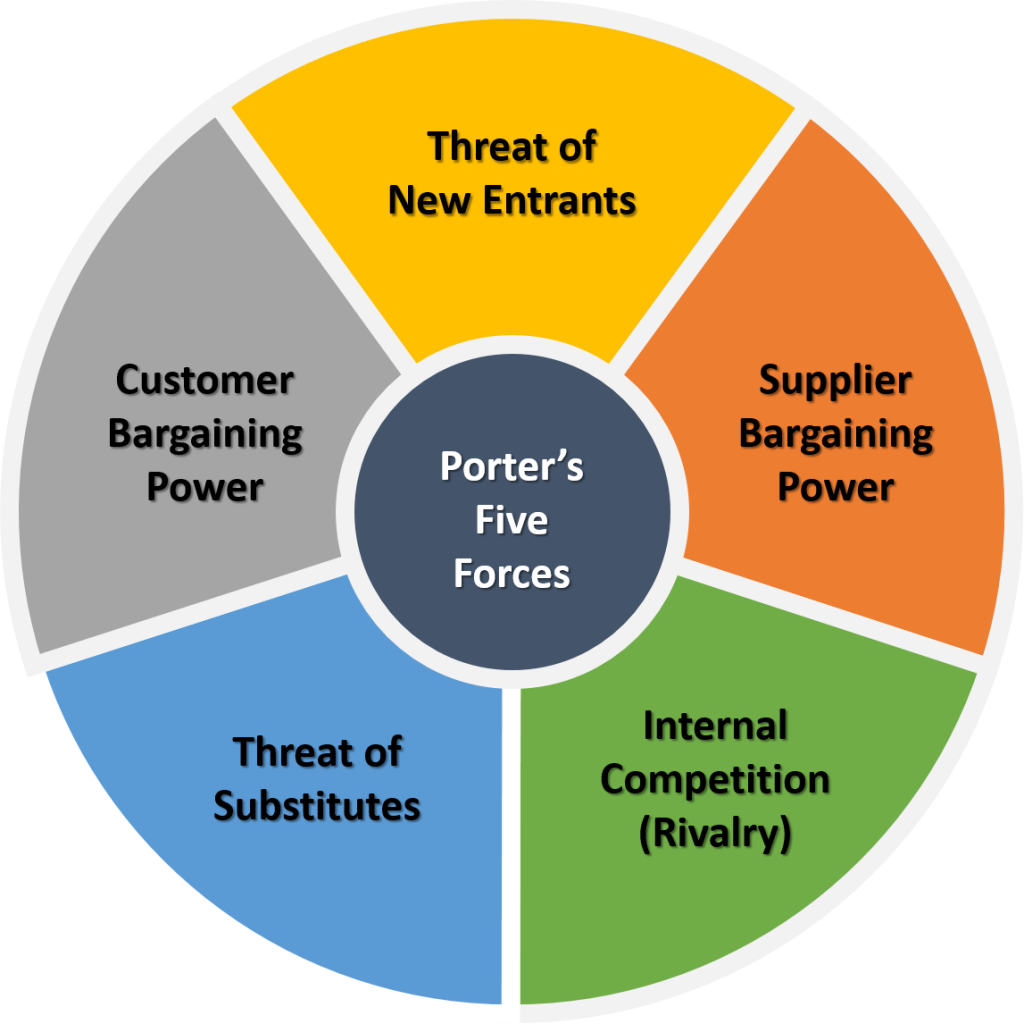

I know it’s a bit cliche, and every MBA is going to roll their eyes…but the best way to illustrate this is with Porter’s 5 Forces Model. This framework is a fantastic way to quickly assess any business’s defensibility.

If a business could consistently increase its prices year over year, none of the above 5 forces should pose a significant threat. I’ll go into further detail below, under “How To Assess Pricing Power”. But the bottom line is that a business’s ability to increase prices will accurately tell you a lot about its competitive positioning with direct and indirect competitors, suppliers, new entrants, and customers.

The Economics of Pricing Power

Now that we understand why pricing power is so important, let’s discuss what it can do for the economics of a business.

When it comes to organic growth, there are a few levers you can pull to increase earnings. You could invest in opex or capex in an effort to grow revenue and earnings. Both efforts can lead to unpredictable results, will consume capital, and may not deliver a return above your business’s cost of capital. You could cut costs, or squeeze more out of your existing infrastructure. You can only do this basically once (or at least a very limited amount of times), and you run the risk of destroying company culture/morale and increasing company fragility.

The other lever you could pull, assuming you have pricing power, is simply increasing prices. This is by far the most riskless way to increase earnings, as the extra money as a result of increasing prices falls right to the bottom line and into the pockets of the owner. This is especially true if the business has low ongoing capex, and stable opex. The financial term for this is operational leverage – revenue goes up, costs stay the same.

Let’s look at Berkshire Hathaway’s See’s Candies as an example. The confectionary industry is stagnant with growth barely keeping up with inflation. But Buffett noticed the diehard loyalty of See’s customers and knew the business had pricing power. After acquiring See’s Candies for $25m, Buffett began hiking prices each year by 10%, well-outpacing inflation. Since the business didn’t require much capex investment, virtually all of the extra cash deriving from the price increase fell into the bottom line, year after year.

Annual net profits grew from $2m at acquisition to $12m within a decade. This means See’s was generating 50% of the money that Berkshire put up to acquire it in the first place, every single year! Berkshire still owns See’s Candies today and Buffett mentioned that since 1972, the company generated Berkshire well over $2B in net income. Not only is that a return of more than 80x on Berkshire’s original investment, but they’ve effectively reallocating that capital to acquire other businesses, and compound further.

Many niche vertical software businesses have very similar dynamics to See’s Candies. Pricing power (or triple-digit net dollar retention) multiplied by low ongoing capex and stable opex equals phenomenal returns on invested capital. Bottom line is, exercising pricing power in the right business can lead to phenomenal return on investment.

How To Assess Pricing Power

One of the easiest ways to tell if a business has pricing power is simple, ask this question:

Has the business been increasing prices year over year, without losing customers?

High customer retention amidst steady price increases was one of the things that stood out when my team discovered Atlasview Equity’s portfolio company, Soutron Global. Soutron is an enterprise software business that provides integrated library systems to power libraries around the world. to power libraries around the world. For the past several years, the company has successfully increased prices well above inflation without experiencing any churn. This was a telltale sign of pricing power and a testament to how sticky the software is.

But there are many businesses that don’t consistently increase prices, even if they have the potential to do so. So if the answer to the above question is “no“, the next logical question is:

In order to accurately answer this question, we need to go back to Porter’s 5 Forces model. What happens to each of the forces if you were to raise prices?

- Threat of New Entrants: could new entrants easily emerge, undercut the business and then effectively take its customers?

- Supplier Bargaining Power: could suppliers increase their prices at the same, or higher, rate to transfer value?

- Internal Competition: could customers easily, and willingly, switch to existing incumbents that have identical offerings?

- Threat of Substitutes: is there an adjacent product/service that is cheaper, and which customers would settle for?

- Customer Bargaining Power: do customers have the ability to simply reject the price increase?

Depending on the answers to these questions, the business may have untapped pricing power. At Atlasview Equity, we come across businesses with untapped pricing potential all the time. Business owners often don’t realize the pricing power they possess, are too afraid to increase their prices, or simply prefer to maintain the status quo for pricing because that’s how they’ve always done things.

One of Atlasviews’ major post-acquisition value-add strategies is implementing a sound pricing strategy. This is the beauty of private equity investing with a control position; we’re able to influence management to tap the untapped pricing power. As per the See’s Candies example above, this can unlock significant value for owners.

There are actually people out there who don’t price everything as high as the market will easily stand. And once you figure that out, it’s like finding money in the street.

Charlie Munger

Assessing pricing power isn’t easy, but getting really good at it will make you a better investor. If you feel like your business has pricing power, feel free to reach out. I’d love to chat with you and learn more about your business.

Final Thoughts

Understanding pricing power is key. It is the ultimate measure of a business moat and can lead to an outstanding (and often untapped) ability to yield high returns on invested capital.

If you’re interested in learning more about this topic, check out this podcast I did with Michael Girdley.

Hi there! I’m Jay Vasantharajah, a Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences managing my portfolio of real estate, stocks, and private companies. I write extensively about allocating capital and building businesses.

Subscribe below, to get a couple of emails a month with free, valuable, and actionable content.

5 thoughts on “Why I Am Obsessed With Pricing Power”