I didn’t know much about Kirk Kerkorian until very recently. I think that’s by design since Kirk was very secretive about every aspect of his life.

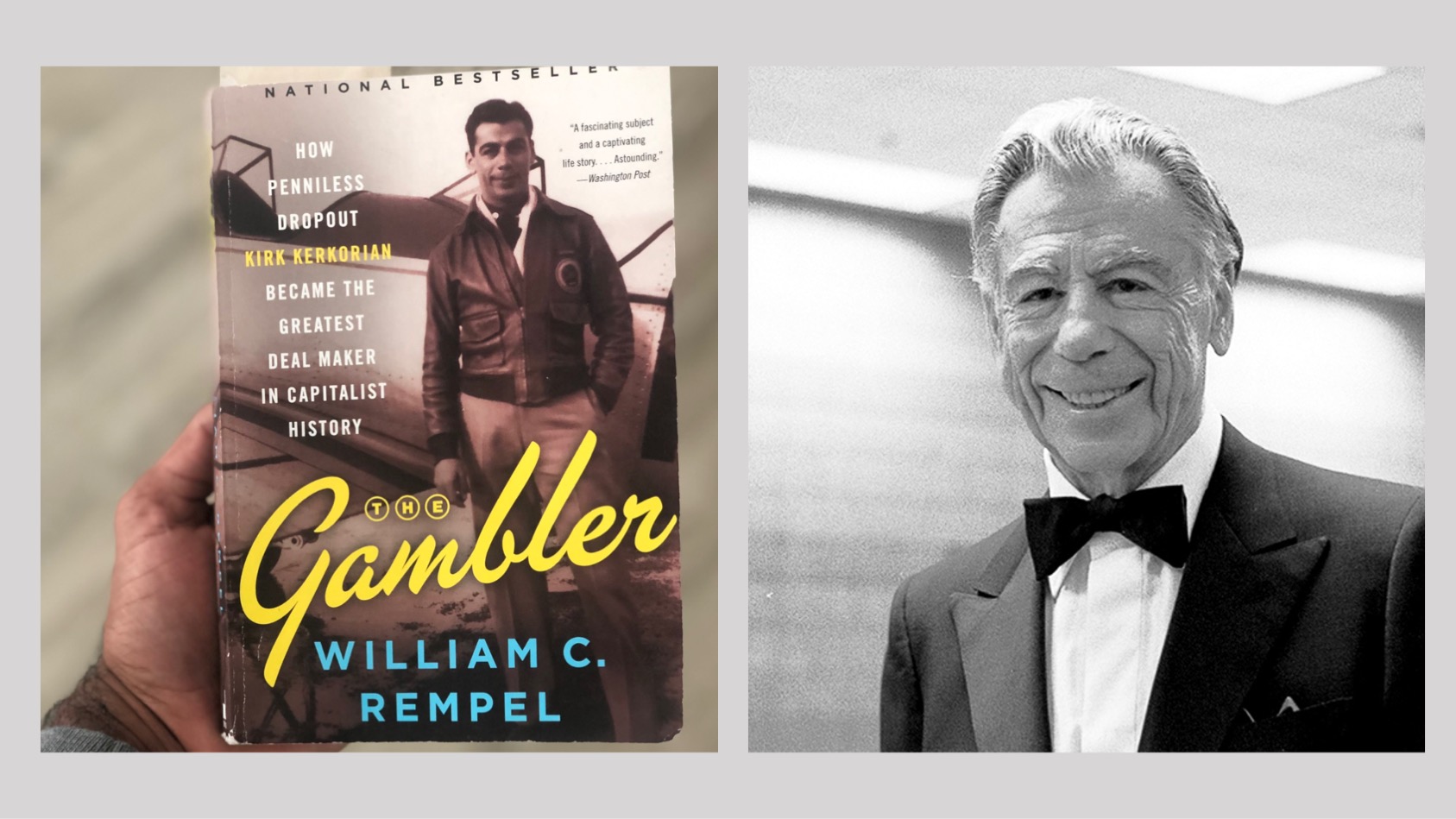

The book, The Gambler, details his life and bold business ventures. Piecing together the journey of a self-made billionaire, who built a multi-billion dollar empire from nothing. Here is what I learned from Kirk Kerkorian, the least known and greatest deal maker in the history of capitalism.

Make highly concentrated bets

The title of the book says it all, Kirk was no stranger to making big bets, he was a gambler by nature. Kirk’s view was, if you see a unique opportunity to make money, you lose more by betting small.

Throughout his entire career, Kirk made mega-bets in various businesses and investments, often putting a large majority of his net worth on the line. The first bet he made was a local airline company that shuttled gamblers back and forth between LA and Las Vegas. He purchased the business for $60k, which consumed every penny he had saved. Going all in continued throughout his life, as at the ripe age of 87 he bet $7.6bn and purchased the Mandalay Bay Casino, still an icon today in the Vegas strip.

Kirk’s investment philosophy was simple, if he was going to invest, he was going to do so in a very big way…and it paid off for him.

Use leverage

This goes hand in hand with the previous point. Kirk used leverage to obtain and control larger assets, enabling him to keep making larger and larger bets.

Kirk built a 70-year relationship with Bank of America who played a pivotal role in many of his deals. He took his first loan in his early 30’s to buy the aircraft business, and continually borrowed from Bank of America until the very end. Having a strong relationship with a bank was crucial to accomplishing all that Kirk did. And as this relationship compounded over the years, so did Kirk’s ability to borrow more, every time with even more favourable loan terms.

Of course, leverage is a double-edged sword, and becoming over-leveraged can lead to disastrous consequences. But Kirk seemed to have a good handle on managing his risks and never defaulted on a loan his entire career.

Take controlling stakes

Kirk’s first foray into the casino business was a passive investment of $50k for 1% of the Dunes Casino in Vegas. The casino was poorly managed and he lost his investment but learned an important lesson – to never invest in a business that he didn’t run.

Kirk was completely fine owning less than 100% of an asset as long as he had undue influence on the operations. He often installed a team member to company boards and in some instances, he would even become involved operationally.

Kirk often had new ideas and strategies that drove investment returns. When he took stakes in publicly traded companies, he would do so with the intention of taking an activist role.

Always reinvest profits

No matter how big Kirk’s wins were he always reinvested his profits into his next deal. Profits he earned from his airline wins were reinvested into Casinos. Profits from casinos were reinvested into movie studios, and those profits reinvested into auto manufacturing.

The point is, Kirk stayed invested at all time. He never kept cash on the sideline or waited to invest. By continuously reinvesting, Kirk maximized his time in the market, which compounded his investment gains and rewarded him handsomely.

Trade up or down

Kirk couldn’t sit still, he was always on the hunt for his next deal. While most of the times he traded up, selling an asset he owned to buy a larger one, there were times he traded down as well. Kirk even bought back several assets he had sold previously for pennies on the dollar.

For example, he sold MGM to Ted Turner for $1.5bn only to buy it back from him for $300m because Ted was experiencing financial issues. Kirk later re-sold MGM to an Italian magnate for $1.3bn. He mismanaged the company, and Kirk bought it back once again for $870m. MGM went on to be worth north of $7bn and made up a large part of Kirk’s estate.

Kirk did this exact same thing in other industries as well, the key lesson being – your next deal might be in your rearview mirror.

Explore different industries, be opportunistic

Kirk was the ultimate opportunist. He traded up, down, sideways and was always open to making deals. But what amazed me was Kirk’s ability to switch to different industries throughout his career. His dealmaking was never confined to a single industry, and he didn’t let his core competencies pigeonhole him. Kirk found success in the airline industry, real estate development, casinos and hotels, movie studios, and auto manufacturers.

This was my biggest takeaway from the book. Much like Kirk, I aspire to navigate multiple industries and firmly believe in not tying your identity to a specific industry (or a company). A life lesson best described by Paul Graham, “keep your identity small”. Plus, being open to new opportunities not only leads to personal growth but also helps you pivot and embrace the challenges life throws at you.

Kirk never tied his identity to a single industry, he was simply just a dealmaker. If he saw an opportunity that intrigued him, he was ready to take a gamble.

Final thoughts

I really enjoyed reading The Gambler and found Kirk Kerkorian’s life story and bold approach to investing inspiring.

In addition to being a great investor, Kirk is described as an all-around great guy. A fair man that often gave concessions, had reasonable demands and was cordial with everyone he dealt with. Kerkorian was also an active philanthropist and the founder of the Lincy Foundation (named after his two daughters Linda and Tracy) which he established to help his home country of Armenia after a devastating earthquake.

I highly recommend this biography to anyone looking to be inspired and learn from one of the greatest deal makers of all time. I learned a lot, and can’t wait to apply the lessons learned in future investment opportunities.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

3 thoughts on “Dealmaking Lessons From The Gambler, The Kirk Kerkorian Story”