I’ve been a math junkie for as long as I remember. I really enjoy discovering interesting math problems and paradoxes that defy intuitive logic.

One of my favourites is the Monty Hall Problem.

A probability puzzle named after Monty Hall, a game show host from the 60’s show called Let’s Make a Deal. The Monty Hall Problem is a paradox, with a solution so simple, but counterintuitive, that most people refuse to believe it’s true.

In this post, I share my thoughts on how The Monty Hall Problem applies to career decision making.

The Monty Hall Problem

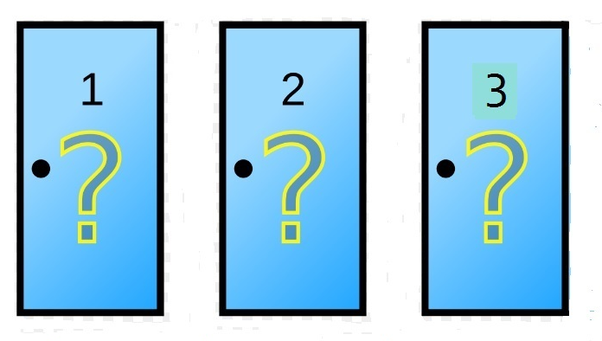

Let’s say you are a contestant on a game show, and you are presented with 3 doors. Behind 1 of the doors, there’s a prize, and behind the other 2 doors, there are goats (and no, nobody wants a goat). The game show host asks you to pick 1 door, so you pick Door #1.

After you pick Door #1, the game show host opens Door #3 to reveal a goat, and then asks:

Would you like to stick with Door #1, or switch to Door #2?

Do you stick with the original door or do you switch?

Though it may seem counterintuitive, the mathematically correct answer is: you switch.

Although you might think to yourself, it doesn’t matter whether you stick with the first door or switch, since there are two doors the chances are 50/50. But in reality, you increase your chances of selecting the prize if you switch doors.

Here is The Monty Hall Problem illustrated in the movie 21:

The reason behind why switching doors increases your odds is actually quite simple. When you picked the first door, you had a 33% chance of picking the prize, and a 66% chance of picking the goat. That means that you likely picked the goat, and therefore when the game show host reveals a goat behind another door…the remaining closed door has the prize. Switching doors increases your statistical odds.

An easier way to visualize this concept is by picturing 1 million doors and the game show host asks you to pick 1 door. After your selection, the game show host opens 999,998 doors, revealing they all have goats. Now it’s between the door you originally picked and 1 other remaining close door.

In this example, it’s quite obvious that you should switch.

How Does This Apply to Your Career?

Throughout your career, you will be forced to make decisions with incomplete information. Picking a career isn’t any different than picking a door in the aforementioned game show, except there are a lot more doors. Doors that open over time give you more information about your original selected door and other remaining doors.

The Monty Hall problem is predicated on the fact that your original choice was more likely incorrect (66%) than it was correct (33%). This same logic can be applied to your career, particularly early on. The chances that you picked the correct career, industry, niche, geography, on your first attempt is very low. And when I say “correct career” I don’t just mean one that’s the most financially rewarding. Picking the correct career also means one that maximizes your overall fulfillment and enjoyment too.

This brings me to my point: as more information comes to light, you might be statistically better off by switching careers.

Obviously, there is a bunch of nuances here and math never perfectly applies to the real world, as the real world is more than just numbers. But the overall logic holds true.

As someone who has switched careers a few times, here are some helpful lessons:

Humility

You need humility to be able to acknowledge that you may have chosen the wrong career choice. It’s not your fault, statistics is against you, don’t fight math. Life is too short to hold onto your ego. No shame in admitting you made the wrong choice, or have evolved/changed and you want to do something different.

Reassess in regular intervals

Reassess your current career path in regular intervals. The length of a “regular interval” is subjective and different for everyone, but for myself personally, I reassess about once a year.

Make it easy to switch

Beyond just mentally preparing, you can financially prepare as well. Set aside some assets, generate some passive income (maybe even a side hustle), and keep your expenses low. You don’t want your lifestyle and current spending habits to keep you prisoner to your current career.

Keep your identity small

Don’t tie yourself to your profession or career. There is no need to associate your identity with what you are currently doing. Similar to the above point, it may keep in prisoner to your current career.

Be opportunistic and open to new things

This is a recurring theme that I have noticed in many successful entrepreneurs is their ability to be opportunistic. This was one of my key takeaways from Kirk Kerkorian’s career, as he successfully switched industries multiple times.

Develop transferable skills

Spend your time acquiring and honing skills that can transfer to any profession, niche or industry. Skills such as sales, digital marketing, analyzing a P&L, and writing code. You don’t want to invest too heavily in a skill that is specialized only for your current role.

Build a network

Having a network is an incredible career safety net. I’ve found that people are generally supportive of career changes, and help out where they can. Networking using Twitter has proven to be incredibly effective for me in more ways than I could’ve imagined.

My Own Career Switches

I’ve switched my careers multiple times. I’ve went from being an accountant, to an entrepreneur and digital marketer to a real estate and software investor. Here is an overview of my career switches.

Started out in the corporate world

I started my career out at Deloitte as a consultant. Here I received some in-depth training in how to build financial models, read financial statements, and interpret accounting standards. But in my spare time, I would learn digital marketing, real estate investing, and drive cabs.

After a couple of years in, I reassessed my current career path and decided it wasn’t for me. More information revealed itself, both about the corporate world and myself, and I decided I wanted to be an entrepreneur. Quitting my full-time job to start my own business was incredibly difficult. I remember being embarrassed to tell my Deloitte colleagues at the time. But looking back, it was the best decision I had ever made.

Switched into entrepreneurship

I saw an opportunity in the market to launch my first business, a digital marketing agency that focused on pay-per-click advertising. My agency, ClientFlo, managed campaigns and built tools for over 300 clients including InMode ($448m IPO in 2019 NASDAQ: INMD) and Cynosure (acquired by Hologic for $1.8bn in 2017). ClientFlo was awarded Top PPC Agency by Clutch in 2017, 2018, and 2019.

Running an agency was not only financially rewarding, but it was also a great learning experience. It’s where I learned critical skills like cold calling to sell our services, managing clients, hiring and training employees and delegating effectively.

But I didn’t tie my identity to digital marketing. As I was running ClientFlo, I was still building my personal investment portfolio using cash flows generated from my business. I started with real estate investing, eventually moved into stocks and then private businesses.

Reassessing regularly, almost exactly on the 5th anniversary of ClientFlo, I decided to switch again. I really enjoyed investing and wanted to give up running my agency to move into investing full-time. By this time, I had built a large enough portfolio of assets that it was fairly easy for me to make the decision (financially). Emotionally, it was a tough decision to let my agency go. But looking back, I am very happy I made this decision.

Switched to investing full time

This brings me to the current day, where I am 100% focused on investing. I continue to acquire real estate (see my latest real estate deal) and build my portfolio. But I have expanded into acquiring software businesses as well through my firm, Bloom Venture Partners (see our latest deal, Viostream, an enterprise video software business). I see an incredible opportunity to acquire and operate mature software businesses and I am focusing the majority of my time here.

I am still actively expanding my network on Twitter, keeping an open eye for opportunities, and developing transferrable skills. In fact, many of the skills I acquired through real estate acquisitions have transferred smoothly to software acquisitions.

Final Thoughts

The Monty Hall Problem, though a simple math problem, provides a powerful framework for decision making. Though this post is focused on career decision-making, you can apply the same principles to any kind of decision-making.

Keep The Monty Hall Problem in mind the next time you face a “stick or switch” decision.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

2 thoughts on “How The Monty Hall Problem Applies To Career Decisions”