NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

I recently read the book, Capital Returns. It’s a collection of letters from Marathon Asset Management from 2002 to 2015. I thought it was a fantastic read and quite unique compared to the other investing books I’ve read. I wrote down some of my key takeaways and I’m sharing them with you below.

The book’s premise is that capital flows dictate a lot of what happens in an industry, and the economy at large. It’s good to zoom out and look at the bigger picture to help understand why businesses succeed and fail at generating sufficient investor returns.

When it comes to investment returns, capital flows can easily trump management, strategy, unit economics, and business model. Being on the right side of capital flows can generate sizeable returns. And being on the wrong side of capital flows can absolutely destroy your returns.

As an investor, having a sense of capital flows will allow you to understand which industries/businesses to pursue or avoid. It’s like understanding which casino tables have rules that are rigged in your favour before placing a bet.

On Capital Cycle

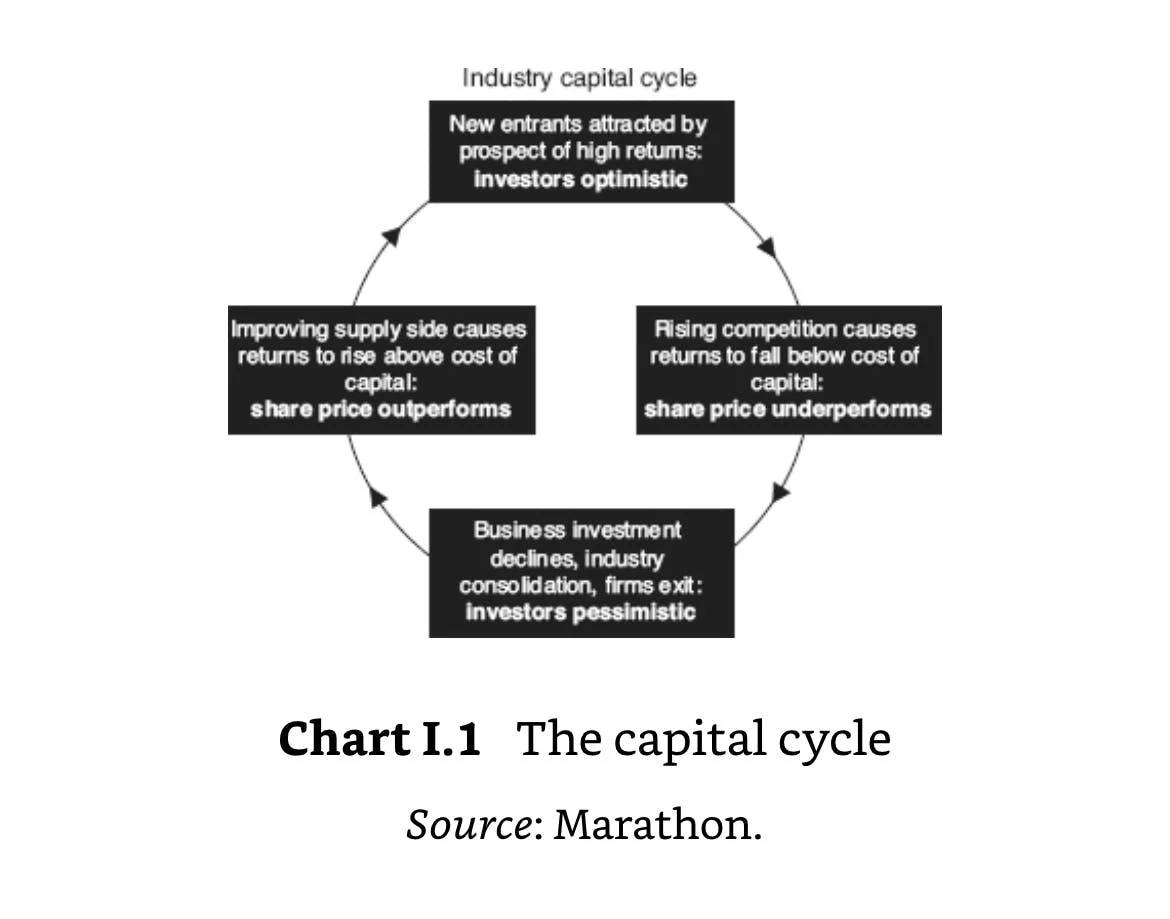

This diagram is basically the crux of the book, or what the author refers to as “Capital Cycle Theory”:

When an industry experiences growth, it will attract excess capital from investors (mostly due to investors over-extrapolating growth). Two main things happen when too much capital flows into an industry:

- Supply increases: the excess capital attracts new competitors to start up

- Capex overspend: businesses spend too much on assets (or even worse, opex)

The result is that investor returns worsen subsequent to excess capital flows. Conversely, when capital is sucked out of an industry – investor returns will, generally, subsequently improve.

As mentioned in my previous issue on Thomson Newspapers, there is no such thing as a “secular growth” industry. Every industry is cyclical, it’s just some cycles are longer than others. Before making an investment into a business, it’s important to understand where it stands in the capital cycle.

On Prisoner’s Dilemma

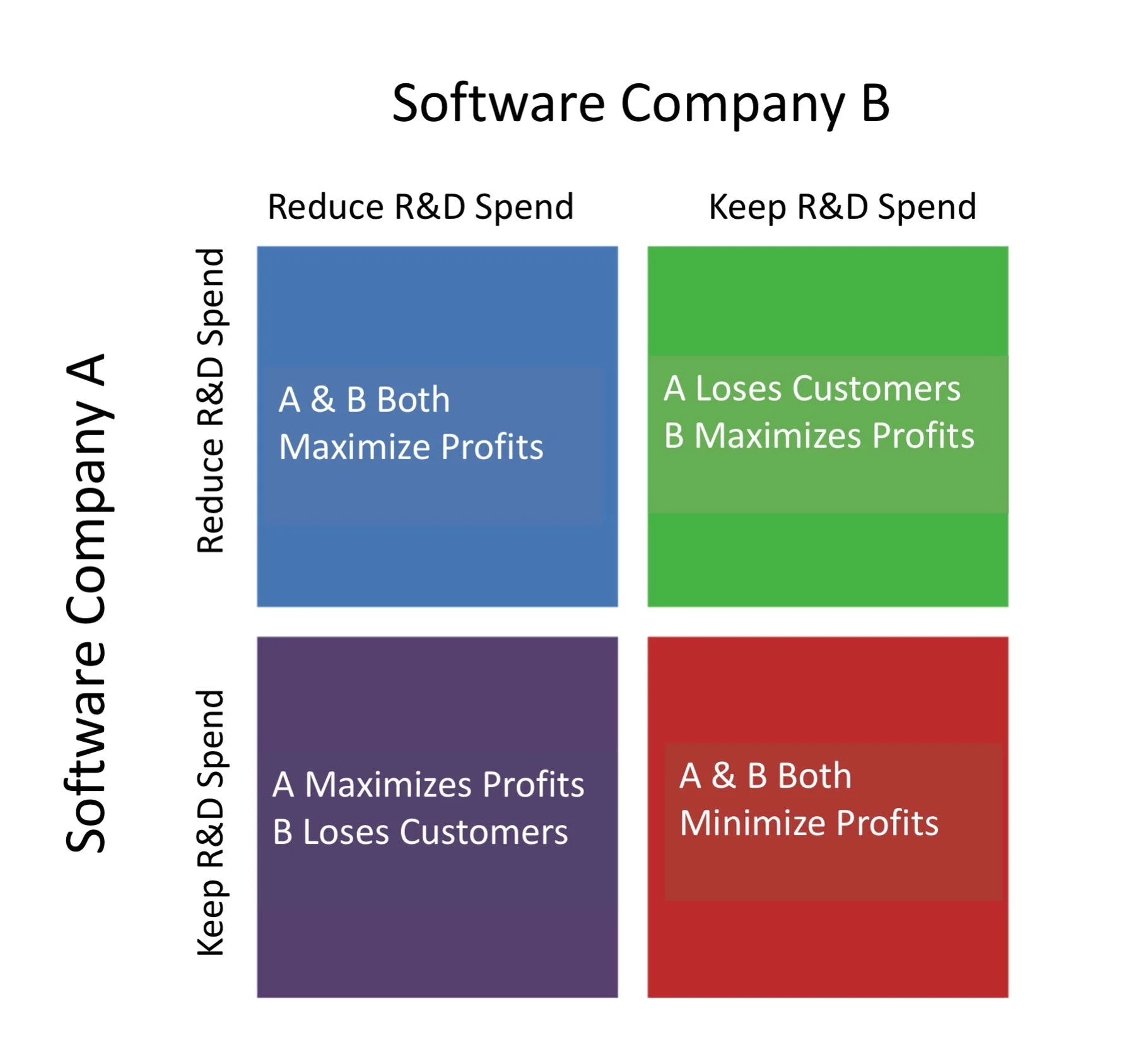

When too much capital flows into an industry, a prisoner’s dilemma scenario ensues with incumbents. It becomes an arms race on who can spend the most on capital expenditures. The businesses become overbuilt and need to maintain that high level of capex in order to be competitive.

What’s interesting is that I’ve actually witnessed this exact scenario play out in software businesses firsthand. I wrote about capex in software a little while ago, and I specifically referenced the prisoner’s dilemma as you can see below:

On Consolidation vs Fragmentation

Is an industry consolidating or fragmenting?

If an industry is consolidating, that means supply is decreasing and it’s a telltale sign of capital flowing out. Consolidation occurs when dominant players start to acquire or merge with other players. Or even when the dominant players remain strong while other players go out of business (and new ones aren’t popping up). As the number of firms in an industry starts decreasing, investor returns generally increase. One of the best examples of this is Copart.

If an industry is fragmenting, that means supply is increasing and a telltale sign of capital flowing in. This happens when new entrants start up or divestitures and spinoffs of existing businesses occur. As the number of firms in an industry starts increasing, investor returns generally decrease.

Analyzing the nature of and the number of incumbents in an industry is a core part of Porter’s 5 Forces framework. This is critical to understand before investing in a business.

On Supply vs Demand

Focus on supply instead of demand. Demand is hard to predict and can change rapidly for a multitude of (often illogical) reasons. Supply only reacts to demand or to capital flows, and usually lags behind, making it much easier to forecast.

Too many investors get awestruck by rapidly increasing demand or how quickly an industry is growing. But if there is nothing to ensure a supply/demand imbalance, the businesses will not generate outsized profits (and investors will not generate outsized returns).

In my previous issue on my favourite compounders, I noticed that all of these organizations focused more on supply (and capturing it) instead of demand (and chasing it). A business that is the benefactor of a supply/demand imbalance deserves to trade at a higher valuation.

On Investment Bankers

Though the author was critical of investment bankers – he did acknowledge that they serve a key function in our economy and possess valuable information. Investment bankers grease the wheels of capitalism, they make deal activity happen and capital flows smoother and more efficiently.

Investment bankers, being in the business of M&A, know exactly which industries are consolidating and which industries are fragmenting. As well, being in the business of raising capital, they know which industries capital is flowing into.

When speaking with investment bankers, ask about their recent mandates & successful deals!

On Generalists vs Specialists

Specialists (investors who only focus on a single industry) are handicapped when it comes to capital flows. Having only an “inside view”, they would miss the fact that their entire industry might be set up to generate subpar returns. They are prone to confirmation bias, seeking positive reasons to stay focused on their industry.

Only generalists are capable of making investment decisions based on capital flows as they can move into or avoid industries of their liking. As mentioned at the beginning, capital flows can trump all other aspects of a business & industry. Having the “outside view” when assessing opportunities can be a significant advantage.

5 thoughts on “Issue #58: Lessons From Capital Returns”