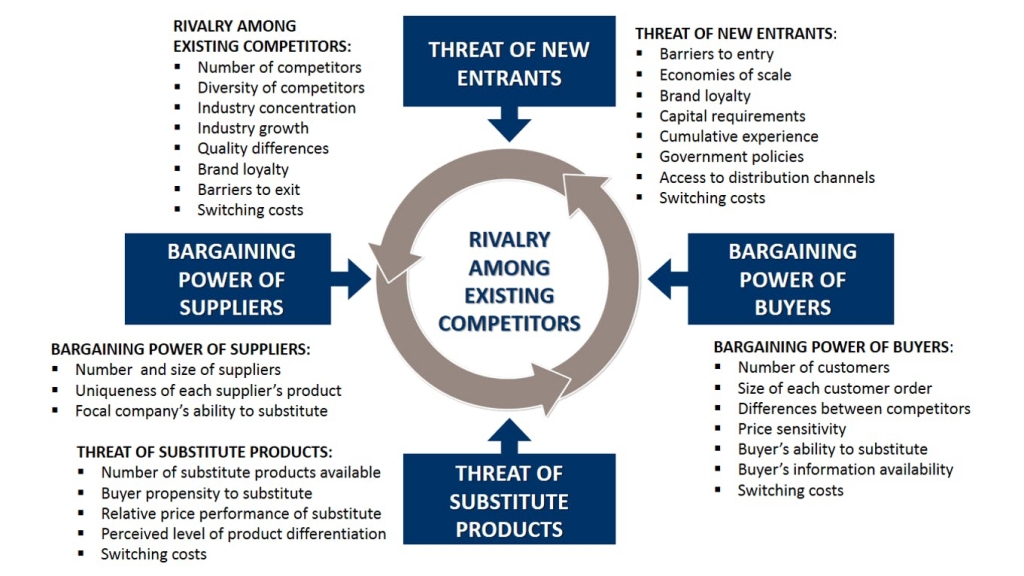

Today’s gem is a framework to assess a business’s competitiveness called the Porter’s Five Forces Analysis.

If you went to business school, you’ve seen this before and it might seem cliche…but I honestly believe it’s an effective way to quickly (and objectively) assess a business.

In fact, at Atlasview, we incorporate many pieces from Porter’s Five Forces in our initial questioning when we receive a deal. We often have to make a decision quickly on whether to pursue or not, and this framework helps us fast-track our understanding of the business and the opportunity.

Here is a quick breakdown of how we approach each of the five forces:

Rivalry Among Existing Competitors

We want to know how powerful the competitors are. Some industries have a winner-take-all dynamic (often the case with horizontal software), and, unless we are looking at the winner, it’s best to avoid.

Some Qs we might ask are:

- Why isn’t a competitor acquiring this business?

- How much capital have competitors raised?

- How fragmented is the market? Is there an active consolidator?

Threat of New Entrants

We want to know how difficult it is for a new upstart to launch and take market share. Large TAMs inevitably attract new entrants because the end prize is worth the pain of starting up.

Some Qs we might ask are:

- Is there interest from venture capitalists in this industry? Have there been newly funded upstarts?

- How difficult/long is the sales process? Is distribution typically direct or indirect & gated?

- How tailored is the software/service to the niche (if any)?

Bargaining Power of Suppliers

Suppliers for the types of businesses we look at are usually hosting providers and or platforms. Platforms are ecosystems like Salesforce or Microsoft that the software (or service) could be built on top of. We want to know the strength of the partnership, and whether the business is at the complete mercy of the platform.

Some Qs we might ask are:

- How much of a cut is the platform taking and when is the last time they increased it?

- Could you serve your customers directly, without the platform? Could you partner with other competitive platforms?

- Is the platform investing in its partner ecosystem?

Thread of Substitute Products

We want to know what the alternatives are to using the business’s software and or service.

Some Qs we might ask are:

- Is the product/service a need-to-have or nice-to-have? Is “non-use” an option for its customers?

- Would it make sense for customers to build their own tailored version of this software in-house?

Bargaining Power of Buyers

We want a business that has many customers, as the more spread out the revenue is among them, the less power customers have over the business. Some businesses have indirect relationships with their customers via channel partners, so we need to understand what level of risk and influence the channel partner(s) pose.

Some Qs we might ask are:

- How much revenue does the top 5 customers represent?

- What are the switching costs and risks to customers?

- When was the last time you increased your prices? What happened?

—

You can score each section out of 10 or something to get a (somewhat) objective measure of the opportunity at hand. But even just using this as a general guide will help you streamline your discovery process when presented with a business that you’re unfamiliar with.

2 thoughts on “Issue #51: Porters 5 Forces”