NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

Today’s gem is this snippet from a 1979 article where Buffett discusses smokestack companies and a peculiar interaction with an executive at one such company:

Great lessons in this snippet. A couple of thoughts…

1) Capital-intensive businesses

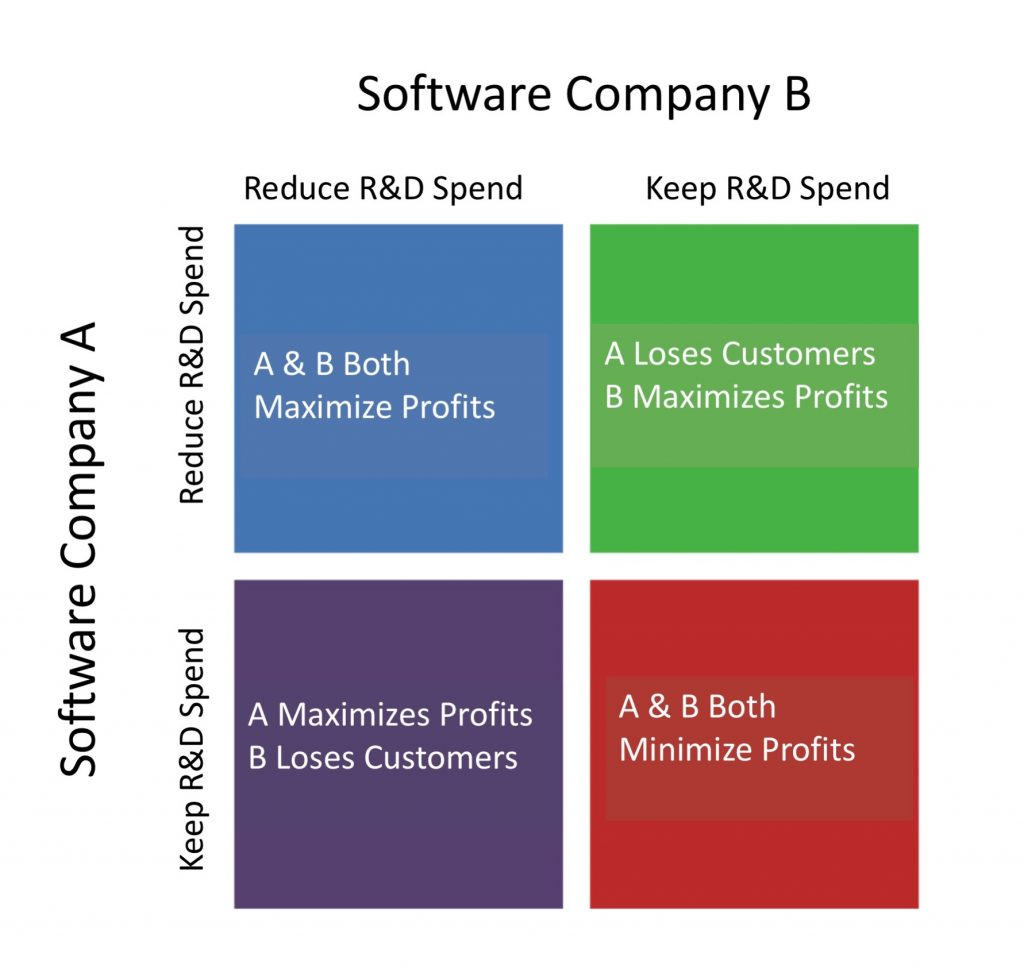

Software businesses can be smokestack companies too. One of the biggest myths of all time is that all software businesses are “asset-light”. Software businesses can very much be capital-intensive with their assets requiring frequent replacement/upgrades.

Buffett’s remarks about retaining capital to build more capacity, just to meet competition, have been echoed in the book Capital Returns. This applies to software companies as well, it puts them in a prisoner’s dilemma situation like this (ending up in the red box):

I wrote more about capex in software businesses here, and how we avoid this lose-lose situation in our software investments at Atlasview.

2) Management returning capital

Management is seldom incentivized to return capital back to shareholders. It’s rare to see management teams that are skilled in capital allocation (there are exceptions, like Autozone). As the executive in the snippet remarks “that’s not what they’re there to do”.

Management always benefits from running a bigger business. Bigger business means bigger salaries, bonuses, perks, bragging rights, etc. Faced with the option of returning capital or spending it on questionable projects that have even the slimmest chance to grow the business, they are incentivized to choose the latter. Even if reinvesting into growth destroys shareholder value, management will always try to rationalize it to avoid giving the money back.

This is one of the reasons I prefer control investing – I get to decide how the capital is allocated.