NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

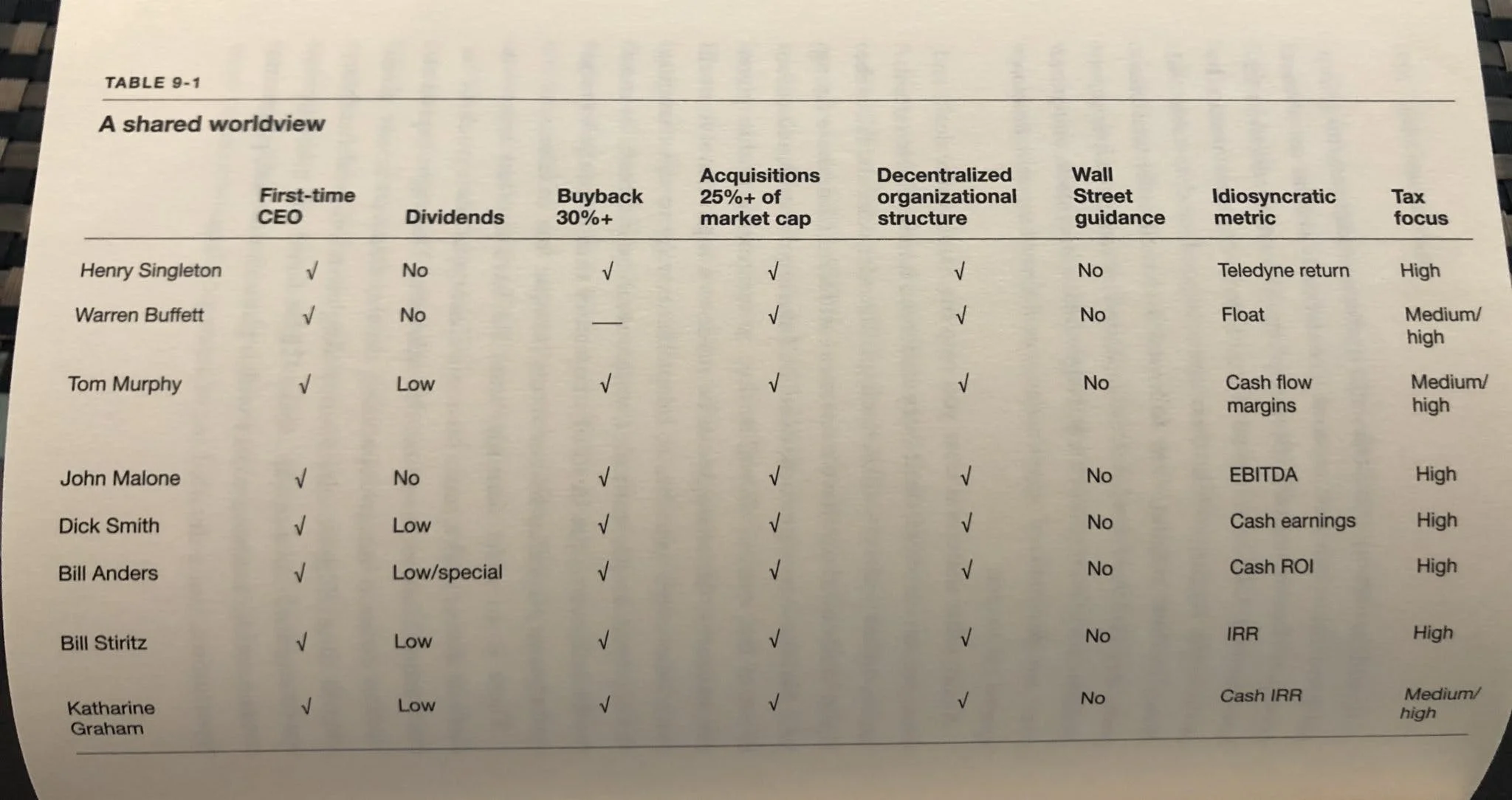

Today’s gem is a table that compares the commonalities among the 8 “Outsider” CEOs, and some discussion around one of the commonalities that stood out to me.

Let’s dive in, but first, a quick note from our sponsor:

Looking To Grow Your Biz Through M&A?

Could you double your business if you acquired a competitor? How about a supplier or an adjacent business?

Atlasview Equity is a flexible capital partner that can help you scale your business rapidly through M&A. Take some chips off the table today, and have the capital to take your business to the next level.

This chart was taken from the book, The Outsiders, one of my favourite reads of all time. What stood out to me was the column on the far right, “Tax focus“.

I was at the AGM of a $24bn asset manager called Dream Unlimited (TSX:DRM) a few weeks ago. Their main business revolves around standard real estate categories like residential, office, and industrial. However, they also own a ski hill called Arapahoe Basin. A shareholder asked the CEO, Michael Cooper (who happens to own 45% of DRM), why they don’t sell that orphaned asset and redeploy the cash in one of their core categories.

The CEO’s response intrigued me. He said that Arapahoe Basin is comfortably generating a 12% IRR. If he sold the asset (and paid taxes), he would have to buy a new asset that would generate at least 19% IRR to make up for the taxes paid.

So the CEOs options for the asset are (besides doing nothing):

- Sell an asset you KNOW is generating 12% IRR and hope to find an asset that MIGHT generate 19%+ IRR

- Hold the 12% IRR asset, refinance out a lesser amount, incur ~5%+ annual debt costs, and hope to redeploy at a higher IRR

Which is the better option?

You have to consider both risk/returns on reinvestment and the amount of reinvestment. The answer is not clear or obvious it’s never black/white. Capital allocation is hard, especially if you manage $24bn. The CEO has opted for option #2, and as a (recent) DRM shareholder, I hope this is the right call!

The CEO had also mentioned he spends a solid 70% of his time on taxes, which again, also intrigued me. I’ve gone back and forth on the topic of tax focus vs investment focus a few times. On one hand, you shouldn’t let the tail wag the dog (overfocus on taxes, overlook the investment). On the other hand, optimizing taxes is part of great capital allocation, taxes are potential cash outflow after all.

Warren Buffett has gone on record to say they’ve made investments specifically for the tax benefits (just google “Berkshire solar credits”, spoiler alert: it didn’t end well). As well, avoiding taxes may have been one of the reasons why Buffett has held onto Coke for all these years, despite the underperformance.

3 thoughts on “Issue #59: Outsider CEO Commonalities”