NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

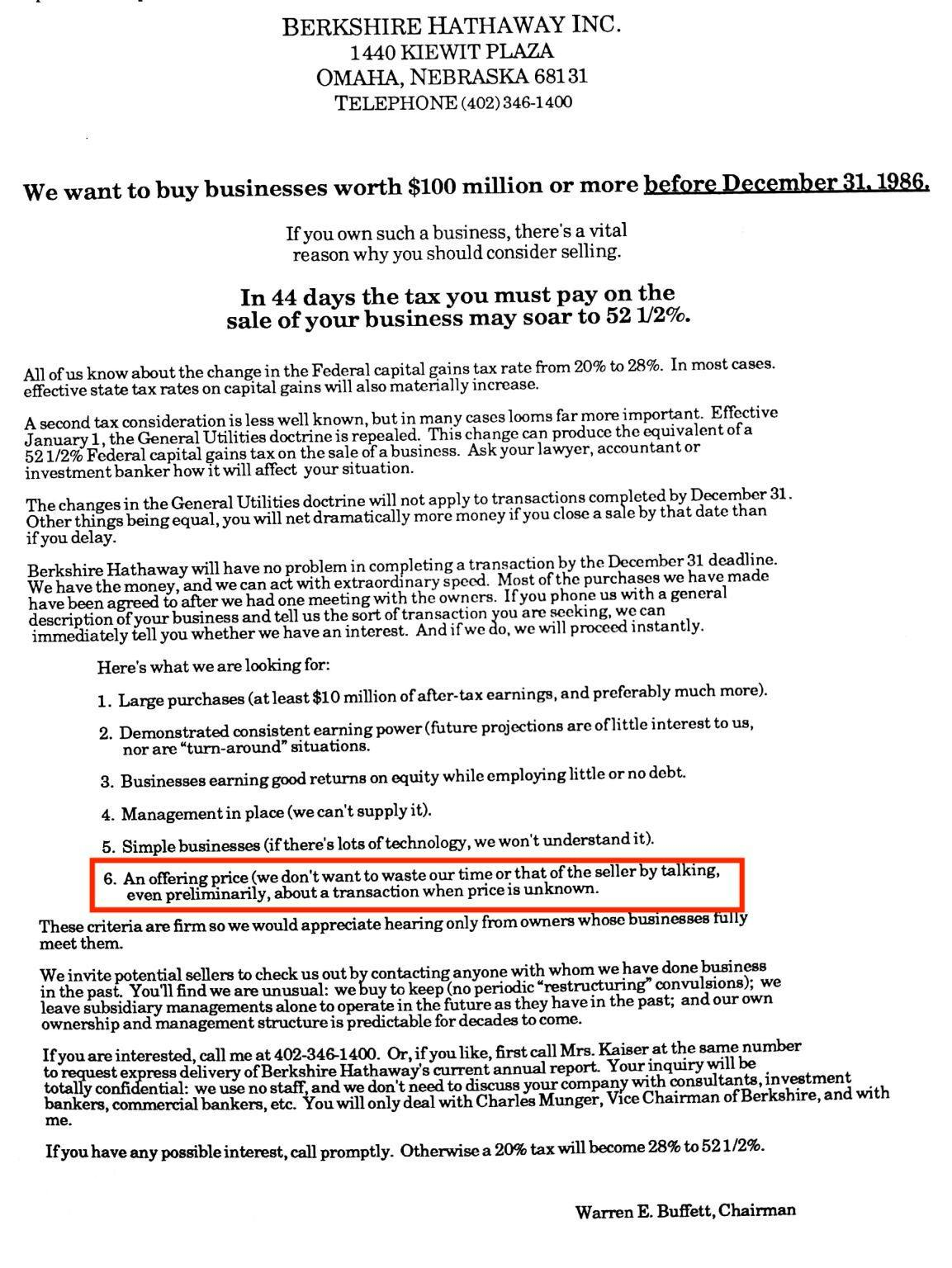

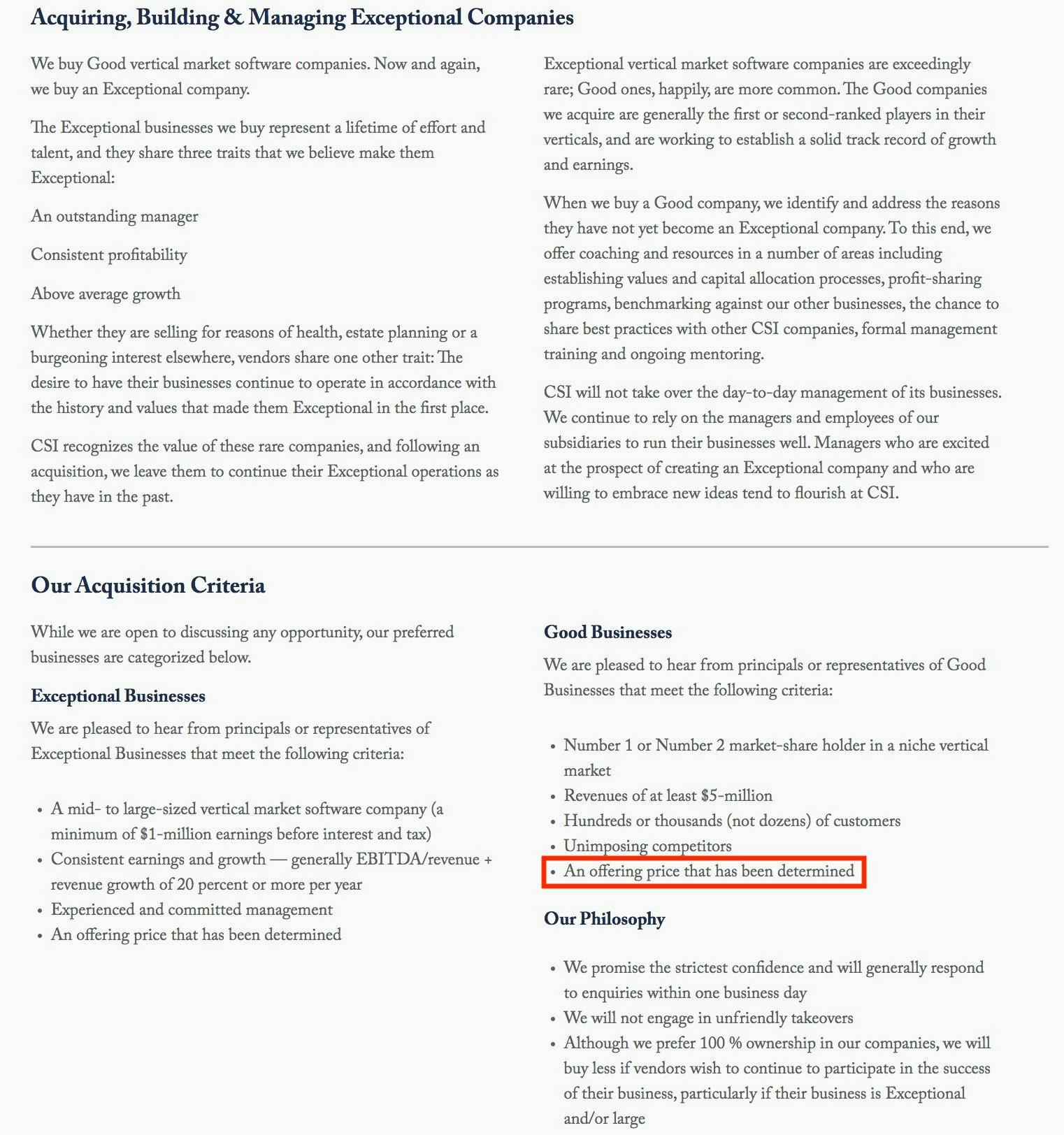

Today’s gems are the advertised acquisition criteria for Berkshire Hathaway and Constellation Software (note the commonality on offering price). Also, some discussion around price discovery.

Two main components of any great value investment: quality business + attractive price. Both are important, and I’ve gone into discussion on this in a previous post. Let’s discuss the “attractive price” component in this post.

When you’re looking at a publicly traded stock, the price is visible to everyone – so you know what the ask is as soon as you see an opportunity. But in private markets (specifically buying businesses), the asking price is generally unknown, even when the business is listed for sale by a banker/broker. In most sale processes, buyers are simply asked to put in their bids, and sellers pick the best one.

You can spend an immense amount of time learning about the business, assessing its quality, creating all sorts of financial models, and researching the industry before having any idea what the asking price is. Time is your most valuable asset as an investor, so there is a massive opportunity cost to doing this. This is why Constellation and Berkshire don’t entertain anything without knowing what the price is upfront.

Atlasview isn’t Berkshire or Constellation so we can’t simply demand the price or walk. Unfortunately, we need to play the price discovery game, but here are some ways we manage this process.

1) Relationships – Every seller has a number in their head, which is the bare minimum amount they will sell their business for. The stronger the trust between you and the seller (or their broker/banker), the more likely you’ll be able to get that number from them. Cultivating relationships with sellers and brokers/bankers increases the probability that when the business is put up for sale, we might get that number right away.

2) Systemize valuation – we have an internal scorecard that we use to arrive at a valuation based on key aspects of a business. We’re able to do this since we look at the same types of businesses (mostly software) that are all roughly the same size, which makes the intrinsic value of these businesses similar. We bake in our margin of safety to arrive at a price we’d be comfortable with.

3) Speed in offer – when a business is for sale we complete our scorecard and arrive at our valuation to present to sellers as quickly as possible. Only once we know that the valuation is acceptable (and therefore attractive to us) do we dig deeper into the quality of the business.