NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

I recently read Morgan Housel’s new book Same As Ever. It was a fantastic read, I highly recommend it.

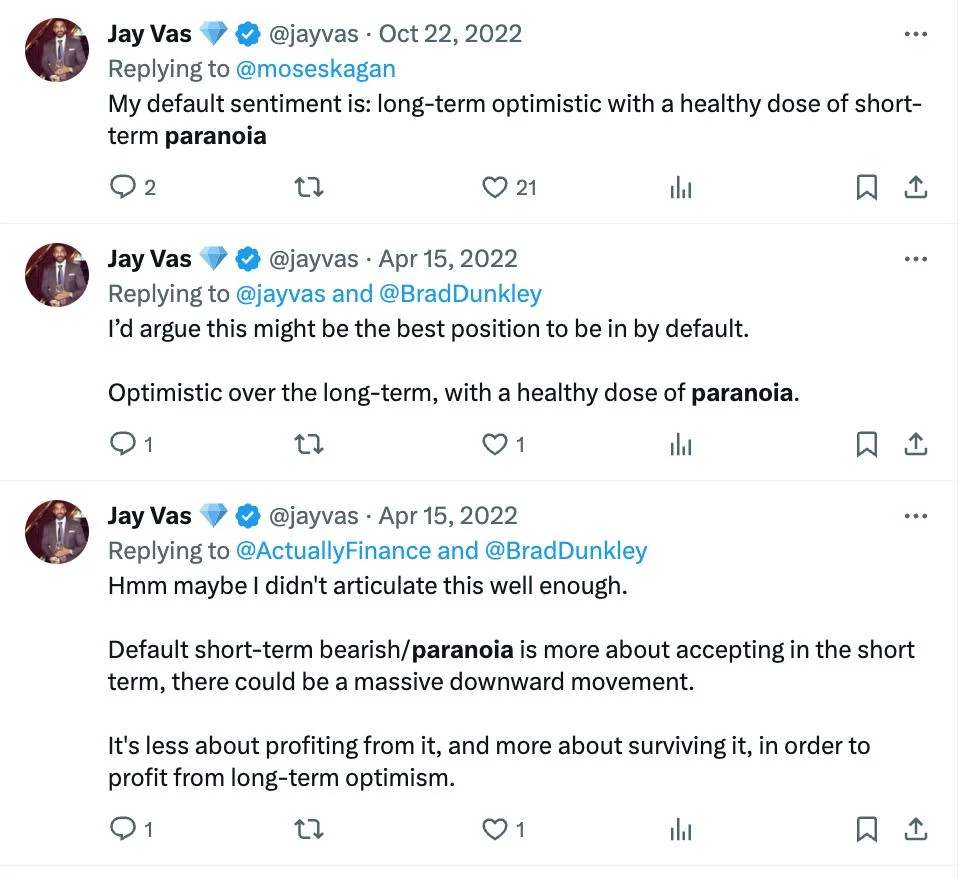

He details a framework in the book “short-term pessimistic, long-term optimistic” which is not only a great framework, but something that I’d already believed in before reading the book. Here are some time-stamped receipts for proof:

This is an important concept to internalize for all investors, so let’s take a look at what it means.

Long-term optimistic

Compound returns are made over the long run, so you need to be long-term optimistic if you want to make a lot of money – it’s as simple as that. You need to believe that, over the long run, the businesses you invest in will perform well along with the economy and society at large.

This shouldn’t be groundbreaking insight for most investors. It’s the second half of the framework that’s trickier.

Short-term pessimistic

To benefit from the long run, you need to make it there – this means surviving all of the short runs in between. The short run is inherently unpredictable. The probability of any one adverse event (pandemic, record rate hikes, recession, war, etc.) occurring in a given year might be small. But add them all together and the cumulative probability of any adverse event occurring is high.

Short-term pessimism means underoptimization to withstand temporary adversity. Forgoing maximizing returns in the short term for the sake of survival. Less leverage, more liquidity, avoiding hype, sacrificing some growth for cash flow, etc. Beyond practical preparedness, it also means being mentally/emotionally prepared as well. It’s a balancing act to be short-term bearish but long-term bullish.

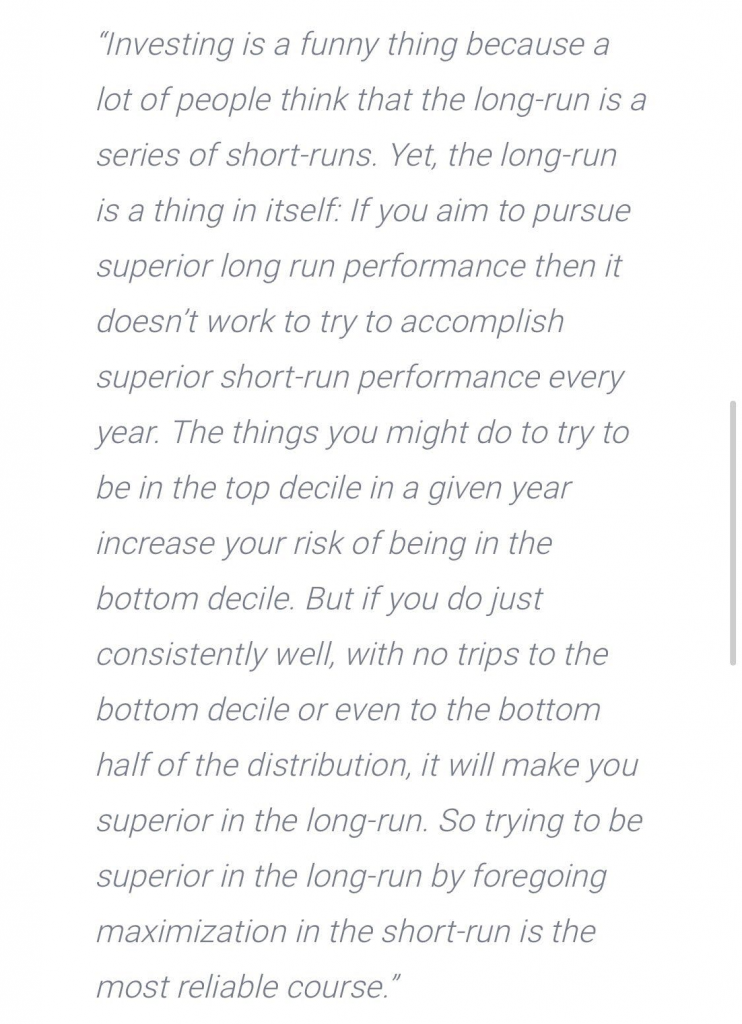

One of the best ways I’ve seen this articulated is this Howard Marks anecdote:

I featured this anecdote in a prior email last year. I always refer to this anecdote whenever I feel FOMO seeing another investor’s spectacular 1-year return (because this is all that’s ever shared on social media). Missing out on a 1-yr upswing? Not a big deal. Getting wiped out on a 1-yr downswing? Big deal.

Anyways, check out Housel’s new book, lots of great lessons in it.