There is a wide range of metrics, formulas, and calculations that can be used to measure the quality of a software or SaaS business. While many of these metrics are important overall, I believe that the most important metric is net dollar retention.

Let’s take a look at why net dollar retention is so important for software/SaaS investors.

What is Net Dollar Retention?

Also referred to as net revenue retention, it is the measure of how much of your recurring revenue you keep each year (or month, depending on the time frame of measurement).

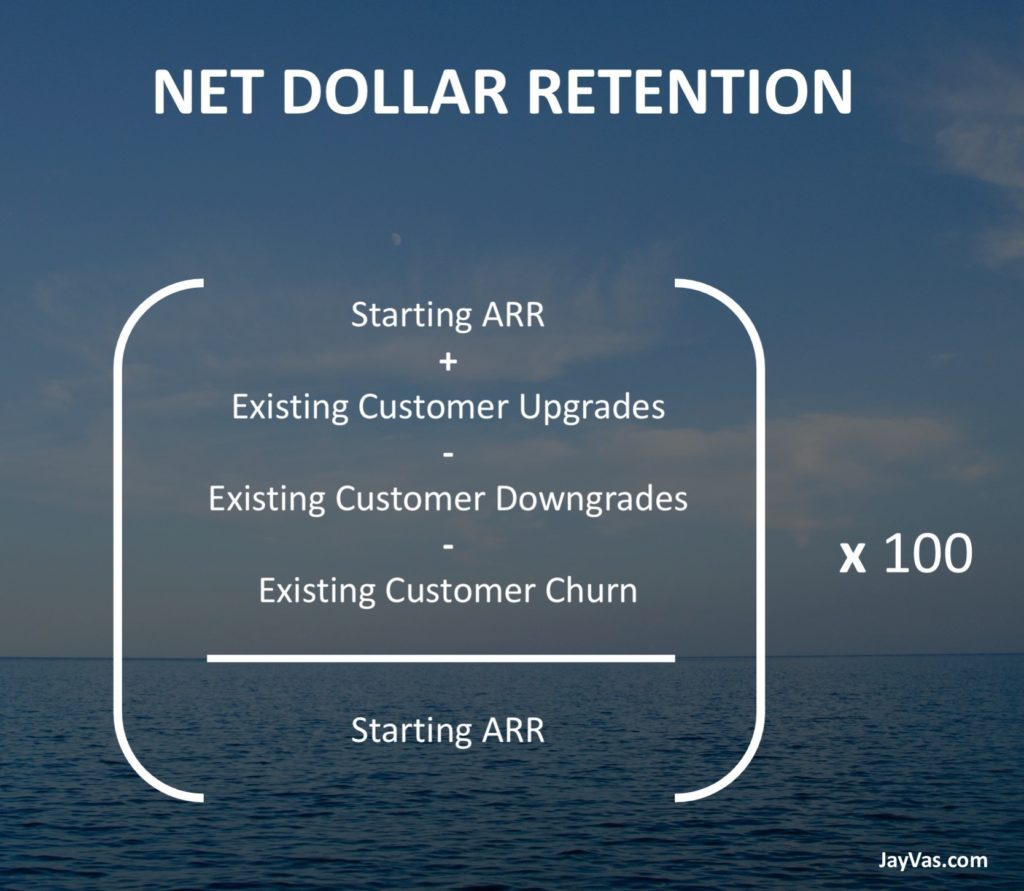

The formula is as follows:

For example: let’s say that you started the year in January with $3m in ARR representing 150 customers. By December:

- 20 customers upgraded to a higher package represneting an additional $300k ARR

- 15 customers downgraded to a lower package representing a loss of $150k ARR

- 20 customers cancelled their account completely representing a loss of $200k ARR

Plugging these numbers into the formula above and you get net dollar retention of 98.3%. This means that you keep $0.98 of every $1 in recurring revenue each year.

Net Dollar Retention vs. Logo Retention

Logo retention is another popular metric, it’s a measure of the number of clients that are retained within a year. So in the above example, you started with 150 customers and retained 130 of them by year-end, giving you a logo retention of 86.7% (130 / 150).

Though logo retention is an important measure, it falls shorts when there are different cohorts of customers. The classic example is a SaaS business that has both enterprise and SMB customers. SMB customers are prone to high churn, and enterprise customers rarely churn and, in fact, usually expand/upgrade (and have larger contracts). SMB customers unfairly punish the logo retention metric, which may make a SaaS business’s retention look worse than it actually is.

In the above example, imagine if all 20 of the customers that canceled were SMB customers and all 20 of the customers that upgraded were enterprise customers. Logo retention (86.7%) wouldn’t capture this dynamic, but net dollar retention (98.3%) would.

Why Is Net Dollar Retention The Most Important Metric?

As a private equity buyer, I look at mature SaaS businesses. Unlike VCs that invest based mostly on future potential, PE buyers invest based on what’s already been built.

SaaS businesses are built on intangible assets consisting of their actual software and their customers that use it. Net dollar retention can perfectly measure the quality of these two intangible assets. It measures a SaaS business’s upside (reinvestment moat + growth) and downside protection (business moat + resilience).

Let’s take a look at some of these factors.

Stickiness of software

Net dollar retention is a fantastic measure of how sticky a software is. The more a customer relies on the software, the more likely they will retain (and expand). Mission-critical software that has high switching costs often has a very high net dollar retention. The combination of high cost to switch to a competitor and the software powering the customer’s business creates a very large moat around existing revenues.

NDR is a measure of how strong a software business’s moat is – the most important thing to consider as an investor.

Customer acquisition profitability

Most software customers are acquired through digital channels, and it is no secret that ad costs are steadily rising each year. This is due to the algorithmic nature of ad pricing and is completely out of our control. What can be controlled however is the lifetime value of each customer. Net dollar retention drives LTV, the higher your NDR the higher your LTV will be.

What’s important to consider here is that a high LTV makes customer acquisition more profitable, since the return on each CAC dollar invested is higher. This creates a reinvestment moat allowing you to keep spending on marketing and sales and squeezing out competitors with low LTV levels.

NDR is not only a measure of the moat around a software’s existing customers – but also a measure of a software business’s potential reinvestment moat to acquire new customers.

Uncovering negative churn

When a software business has an NDR higher than 100%, they effectively have negative churn. This is a beautiful thing because this means the software can grow revenue year-over-year without adding a single new customer.

Many publicly traded SaaS companies have an NDR exceeding 100%, like Twillio (~140%) and Okta (~120%). If Twillio wanted to grow revenues 50% in a year, it only needs to find ~10% of it from new customers. Negative churn makes growth far more predictable and easier to obtain.

A business with an NDR exceeding 100% means it has negative churn, a sign of a very high-quality software business with predictable and super-charged growth.

Not at the mercy of the markets

This one is a continuation of the previous point. If you have negative churn, that means you will generate more cash each year without needing outside capital.

Right now, this may not seem like a big deal as the capital markets are flooded with cash. But this could easily reverse, and the capital could dry up. Having negative churn means the ability to generate more cash internally from your existing customers, and not being at the mercy of the markets. This makes a business far more resilient in the wake of any downturn.

NDR (especially negative churn) is a great measure of downside protection in a SaaS business.

How To Improve NDR and Achieve Negative Churn

There are several ways to improve your net dollar retention and achieve a negative churn rate for your software business. Below are a few ideas:

Investing in customer service & success

Acquiring a new customer is far more exciting than retaining an existing one. This is why many businesses, especially growth-focused ones, are obsessed with new customer acquisition. This often leads to under-investing in customer service & success.

The ROI for a dollar invested into retaining an existing customer can be far higher than a dollar invited to acquiring a new one. This is critical to consider as an entrepreneur approaching capital allocation with your business. Investing in customer service/success should lead to improving your NDR and LTV. As mentioned earlier, a higher NDR/LTV will only make your new customer acquisition efforts more profitable.

Implement usage-based pricing

There are several ways to price software, and this could be an entire blog post on its own. Usage-based pricing means that the customer’s price depends on how much they actually use the software. The more they use it, the higher the price they pay. This type of pricing is fantastic as the customers that derive the most value from the software (those who use it the most) are usually willing. to pay more for it anyways.

My portfolio company, Viostream – enterprise video software, is priced for usage (bandwidth + storage of videos). The more videos a customer stores and streams using Viostream, the higher the price they pay.

Understand how your customers use your software, especially the heavy users. Implementing a pricing strategy that scales with usage means existing customers upgrading each year which can drastically improve your net dollar retention.

Increase prices regularly

Many software business owners are afraid to increase prices on their customers, fearing they might churn. But the reality is, software is often such a small line item on a customer’s P&L – they would barely even notice a price increase. Not to mention, if your software is critical to your customer’s business, they are unlikely to churn anyway – it’s far too costly and risky for them.

If you get into a habit of regularly increasing your software prices on your existing customers each year, this will certainly improve your net dollar retention (prices increases are technically upgrades). Not to mention, increasing your prices is a great way to protect against inflation.

Cross-sell complementary products

Launching new features and products is a way for existing customers to spend more money with you. This goes hand-in-hand with investing in customer service & success. This department can be responsible for and measured by how effectively they cross-sell your products. You can also automate cross-selling within your software and by educational emailing marketing to your existing customers.

Existing customers spending more money with you means higher net dollar retention.

Focus acquisition efforts on heavy users

Figure out who your most loyal customers are, the customers that use your software the most, and derive the most value from it. Some internal research can easily uncover this. Focus all or the majority of your customer acquisition efforts on this type of customer. A high NDR/LTV makes customer acquisition that much more profitable.

By concentrating your S&M dollars high NDR/LTV customers, you’ll improve your NDR (and achieve a better ROI).

Understand why people churn

Customers don’t just wake up one day and decide to cancel – they cancel for a reason. Sometimes these reasons are out of your control, but most of the time they’re addressable.

This is where your customer success team comes in. Their role is to go beyond customer service (a reactive approach) to proactively identify, address and solve customer problems. Being proactive is key, and this can be done by using simple tactics like customer interviews/surveys every three months to ensure customers are getting value from their product. And hold your customer success team accountable to proactive check-ins. They may uncover some dissatisfaction that wasn’t bad enough for the customer to leave right away but can get bigger and lead to churn over time.

It’s important that you not only reduce churn by improving your product but also by identifying reasons for churn and proactively addressing them. Churn reduction is a sure-fire way to improve your net dollar retention.

Final Thoughts

I hope this post has convinced you of why net dollar retention is the most important for software/SaaS investing. Of course, there are a bunch of other metrics you should track & measure. But NDR reigns king in my opinion.

It is a measure of both upside & downside for a software business. A high NDR is a telltale sign of a high-quality software business, one that you’d want to be an investor in!

Hi there! I’m Jay Vasantharajah, a Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences and passion for investing, entrepreneurship, personal financial management, and traveling the world.

Subscribe below, to get a couple of emails a month with free, valuable, and actionable content.

3 thoughts on “The Most Important Metric in Software/SaaS Investing”