In light of recent events, markets across the world have tanked and tanked very fast. Many investors, including myself, have been scanning for opportunities.

I generally steer clear of picking individual stocks and my portfolio allocation to publicly traded securities has always been quite low. I mainly stick to investing in private real estate & businesses.

However, I came across opportunities in Canadian REITs that were just too good to pass up.

For my readers that steer clear of public equities as well, REITs (or real estate investment trusts) are publicly traded companies that own and operate real estate. It’s a way for individuals to get exposure to various kinds of commercial real estate assets by purchasing units (shares).

Looking at a bunch of residential REITs lately, I feel like there’s an opportunity here.

— Jay Vasantharajah (@jayvasdigital) March 17, 2020

Since nearly everything has taking a hit dividend yields have become quite attractive now.

People are going to need a place to live, and if they can’t pay rent, there’s someone that will.

Why Canadian REITs?

Home court advantage

I chose to stick to Canadian REITs simply on the principle of familiarity, invest in what you know. Being Canadian, I have a good understanding of Canadian cities and neighbourhoods. The REITs I’ve been looking at own properties within my home country’s borders with a few exceptions (I’ll explain below).

Easy to analyze

I’ve found that REITs are fairly easy to analyze compared to many other publicly traded companies. It’s a pretty straight forward business, REITs acquire properties with a combination of debt and equity. They operate the properties, manage tenants, and then pay out the rental profits to unitholders as monthly distributions. There are standardized metrics that you can use to analyze virtually any type of REIT like FFO, NOI, implied cap rate, EV per door, and occupancy levels. Also, their buildings and tenants are often listed to the public for anyone to look at and analyze.

It’s especially easy to comprehend if you have rental properties and understand the underlying economics of landlording and real estate value. Compare this with trying to analyze a bank which has multiple divisions, utilize complex financial instruments and assets with opaque valuations.

Volatility as an advantage

The volatility of REITs ends up being a huge advantage here, and pretty much the sole reason for the current opportunity. Many REITs have plunged up to 50% in value within just a few weeks. Nothing in the private markets has moved this drastically, especially private real estate which usually lags several months behind.

The average Toronto home value, pre-COVID, was around $1m. Imagine if some homes dropped to $500k in a matter of a few weeks, with no material changes to the building or land. Investors would be all over it without thinking twice.

That’s the glaring value prop that many Canadian REITs offer right now.

Terminal Value

It’s been a while since I thought about terminal value, the concept is all but forgotten during an epic bull market.

It’s basically the value of a business in the “forever run”, after all the short/mid-term cash is earned, what is the value remaining in perpetuity.

REITs own land, and depending on where the land is located, it can have a very high terminal value. Well-located land is going to be worth a pretty penny unless the world comes to an end. This is important when considering an imminent economic downturn, and long-term value.

Reasonable Leverage

Debt is something that kills many companies in a downturn, and real estate operators are no exception. In private real estate, it’s common to see loan-to-value (LTV) ratios reach 80%-85%. The publicly-traded Canadian REITs I’ve been looking utilize a very reasonable amount of leverage, around 40-60% LTV. With strong balance sheets and better access to capital markets, publicly-traded REITs could better weather a storm.

Let’s take a look at some of the main REIT sectors.

Residential REITs

This is where I started my analysis back in early March. Simply put, there is inelastic demand for affordable housing. Even in a prolonged recession, people need to live somewhere. If renters cannot afford to pay rent, there will be someone else that can. People that owned a home may sell it and downgrade to renting.

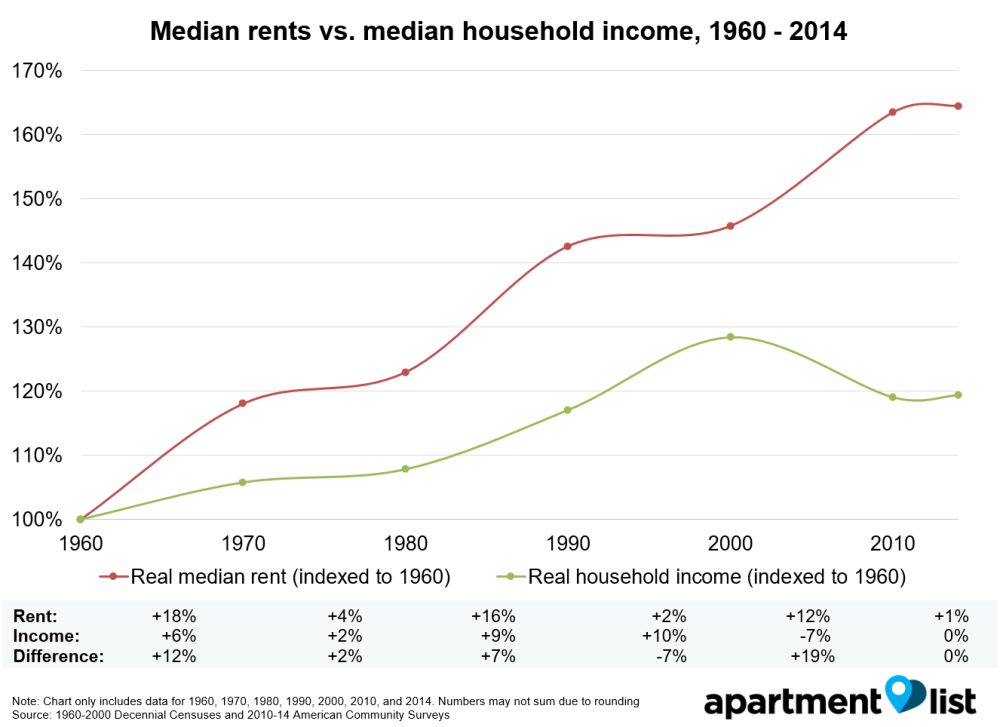

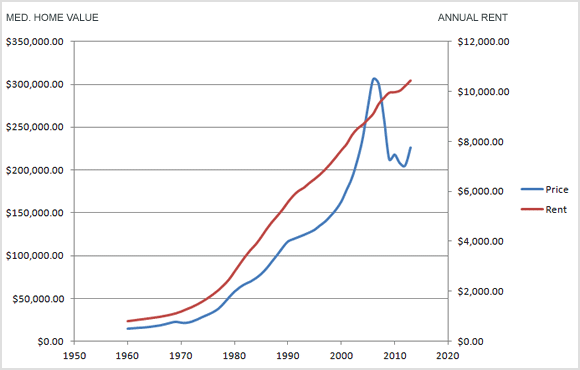

On-top of there being inelastic demand for affordable housing, residential rents typically stay intact during a downturn. What usually ends up happening is cap rates increase instead. This means that rental income, a residential REITs sole revenue source, should keep steady regardless of market conditions.

Take a look below.

Retail REITs

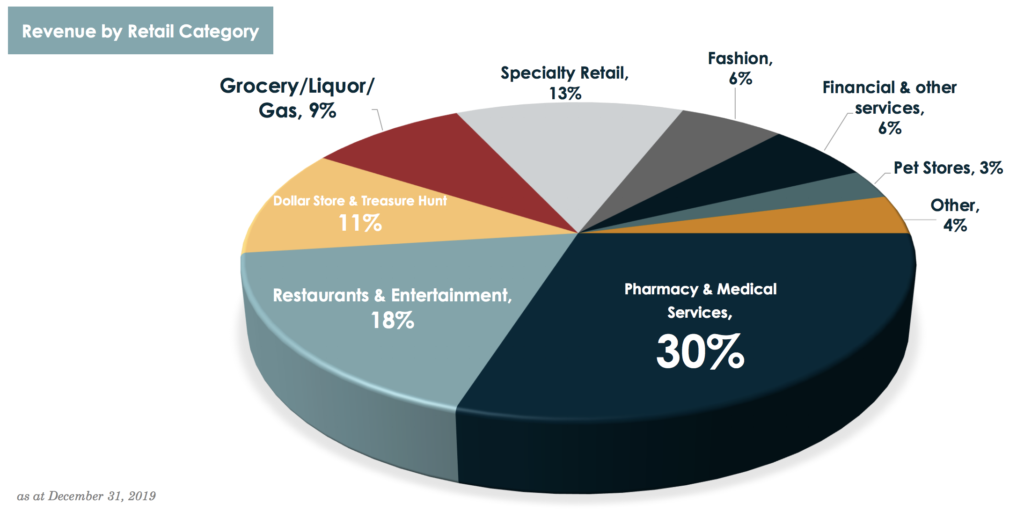

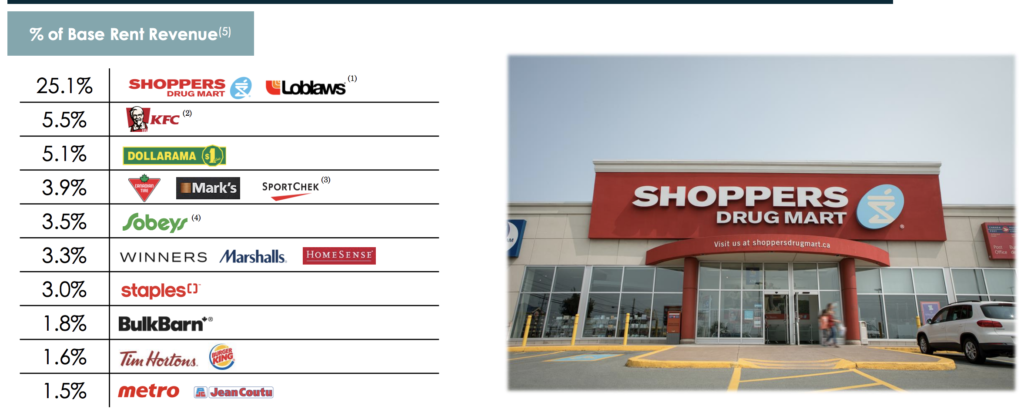

Retail REITs, especially in light of the COVID lockdown, definitely have more fragile rental income compared to residential REITs. Even though many of them have a tenant base consisting of large essential businesses (like national grocery chains, pharmacies, dollar stores, etc.) they also tend to have small/local business tenants as well.

To give you an idea, here is a sample tenant mix from a larger retail REIT:

So, short-term, retail rental income might be a bit shakey, however, this is where terminal value comes into play. Many retail REITs own land in key urban and suburban areas. They can repurpose the buildings on the land to dynamically meet market needs.

What’s important is the fact that they own land in key areas (location, location, location) and that’s the terminal value right there. The general population will eventually desire use for that land.

Another factor to consider is liquidity. Retail REITs that have strong balance sheets that can weather a storm are great opportunities. Things like healthy leverage metrics, cash on hand, lines of credit and staggered loan maturity dates will ensure they survive a downturn.

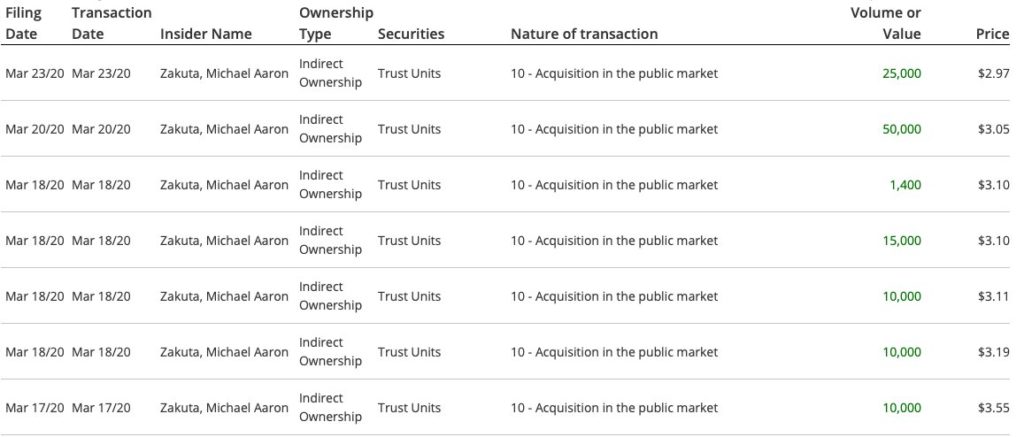

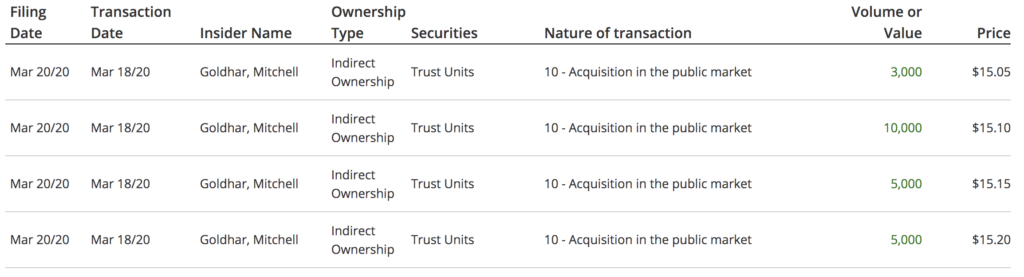

Oh, and also there’s a lot of insider buying going on in retail:

Insiders might sell their shares for any number of reasons, but they buy them for only one.

Peter Lynch

Industrial REITs

Industrial REITs are definitely the most foreign to me (literally and figuratively). The Canadian industrial REITs I have scanned actually have significant properties globally, rather than concentrated in Canada. Unlike residential REITs and retail REITs, I haven’t invested in any yet.

What I do like about industrial REITs is that they are fairly uncorrelated with retail and residential. Many of their tenants are warehouses and distributors, both of which will receive nice tailwinds with the increase of eCommerce.

I will continue researching some industrial REITs in the next couple of weeks and form a decision.

Conclusion

Even though I typically stick to investing in private businesses/real estate, I couldn’t pass up on this opportunity. The volatility of publicly-traded REITs presents a fantastic way to get exposure to high quality commercial real estate at huge discounts.

The upside is the valuations bouncing back ~50%+ to pre-COVID levels, with monthly rental income distributions along the way.

The downside is whatever the terminal value of the land is.

It seems like a no-brainer to load up on Canadian REITs while you can.

Have you seen similar opportunities in public markets? Let me know in the comments!

DISCLAIMER: This blog post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

4 thoughts on “Opportunities in Canadian REITs”

Investing in reits might be profitable to you, but the 1000s of tenants whose lives are upended every year by these insidious neoliberal cesspools are human beings being treated like economic double A batteries to fund people like yourselves material desires. I would urge you to take a moment and ask yourself is it worth letting this need for money to trade up your morality ad a Canadian or even a human being ? Reits flip ppl out on their butts regularly to increase rent. They inflate cosmetic upgrade costs, implement any new scam on tenants to charge for anything to increase your retirement savings. It’s shameful and it’s been the inspiration behind so many scholarly articles in 2 decades I’m be genuinely surprised anyone who reads doesn’t know their investment comes at the cost of others dignity and safety. Whether capreit or centurion the name of the game is by any means necessary screw over the average person because they don’t deserve anything. It’s happened globally from Amsterdam to Miami to small towns like Cambridge ontario. Shame on any of you and I hope the day comes when it’s exposed as the disgusting inhuman financialization of housing it is. Then your assets won’t help you when the mob of evicted and mistreated sue every one of you for knowingly contributing to this despicable industry.