Many governments incentivize their citizens to save and invest for retirement by giving them tax-advantaged investment account. The Canadian government does this, by giving all citizens a Tax-Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP).

Americans have equivalent tax-advantaged accounts like the 401k, IRA, etc. In this post, I am only going to focus on Canadian accounts, so to my friends south of the border, make of this what you will.

As an entrepreneur, I always prioritize investing in my businesses first since I can earn the highest after-tax return by doing so. If there aren’t opportunities available in my businesses, my second priority is real estate investing. But sometimes there just aren’t opportunities present in either my businesses or real estate. Rather than letting cash sit idle, I utilize the capital across my various tax-advantaged (and taxable) investment accounts.

Here’s how I optimize my tax-advantaged investment accounts to maximize gains and minimize taxes.

TFSA vs RRSP Overview

There is a ton of content on the internet about the differences between a TFSA and an RRSP, so I am not going to go into too much detail here. But here are the high-level points:

TFSA

- Contributions are NOT tax-deductible

- Contribution limit is determined by government mandate and prior-year contributions/withdrawals

- Investment gains are NOT taxable

- Withdrawals are NOT taxable

RRSP

- Contributions are tax-deductible

- Contribution limit is determined by your employment income and prior-year contributions

- Investment gains are NOT taxable

- Withdrawals are taxable

Both accounts can invest in anything that is considered TFSA/RRSP eligible. For most people that means stocks, bonds, ETFs, and other liquid/managed funds. There are complicated maneuvers to invest in other types of investments, but I’ll have to let someone else write about that.

How I Optimize My TFSA

I’ve talked about the importance of passive income in the past. Like any entrepreneur, income from my “day job” can be quite volatile. As a result, I allocate a portion of my total portfolio to Canadian income generators. I say “Canadian” because it’s disadvantageous to hold US income generators in a TFSA, since the IRS withholds 15% of the income (at the source) and you cannot get that money back.

Income generators are investments such as Canadian REITs, dividend-paying stocks, and bonds that provide a passive stream of income. Since I am holding these in my TFSA, I do not pay any tax on this passive stream of income.

Why not put income generators in an RRSP?

As mentioned, an entrepreneur’s income can be volatile, so easy access to passive income is ideal. The problem is, with an RRSP, you are not allowed to access any funds that you contribute to until you retire (65+). Compare that with a TFSA where you are able to withdraw at any time without penalty.

Why not put income generators in a taxable investment account?

Passive income (dividend, interest, distributions) is taxed at a very high rate in Canada. Therefore, it’s quite disadvantageous to hold these types of investments in a taxable account.

How I Optimize My RRSP

I have a fairly high tolerance for risk, and I am not afraid to make investments that could potentially lose money (or even go to zero). I allocate a small portion of my total portfolio to speculative investments that might turn out to be worth a lot, (or potentially nothing).

The most common form of speculative investment that I use my RRSP for, is stock options. There is a chance they expire worthless (value = $0) or are potentially worth a much larger amount than my original investment. By contributing the money I intend to buy stock options with to my RRSP, I can instantly deduct that amount against all forms of personal income.

(Note: holding US income generators in an RRSP is optimal as well, as you avoid the IRS 15% tax withholding).

Why not put speculative investments in an TFSA?

With the TFSA, on top of not being able to deduct the contributions, you cannot deduct any losses incurred either. Also, if you book a loss inside a TFSA, that contribution room is gone forever.

Why not put speculative investments in a taxable investment account?

The potential loss would be considered a capital loss, and can therefore only be deducted against realized capital gains in a taxable account. Putting speculative investments in a taxable investment account is great if you plan on having a lot of realized capital gains, but my investment strategy doesn’t plan for this (see next point). Contributing to your RRSP to make the speculative investment means being able to deduct this amount against all types of personal income, not just realized capital gains.

How I Optimize My Taxable Investment Accounts

The power of compounding over a long period of time can be truly incredible, and no investment portfolio is complete without a significant allocation to compounding assets. For myself, these are broad-index ETFs and individual stocks that will experience compound growth over a long period of time.

Since I plan to hold these assets for a long time (maybe even forever), I won’t experience a realized capital gain on them. No realized capital gains mean no taxes. This is exactly how Warren Buffett deferred $61bn in taxes.

Why not put compound investments in an TFSA?

Since I won’t have any realized gains to pay taxes on, I won’t save any taxes by holding compound investments in a TFSA.

Why not put compound investments in an RRSP?

Same logic as above, no tax advantage to holding compound investments in an RRSP, if you plan to hold them forever.

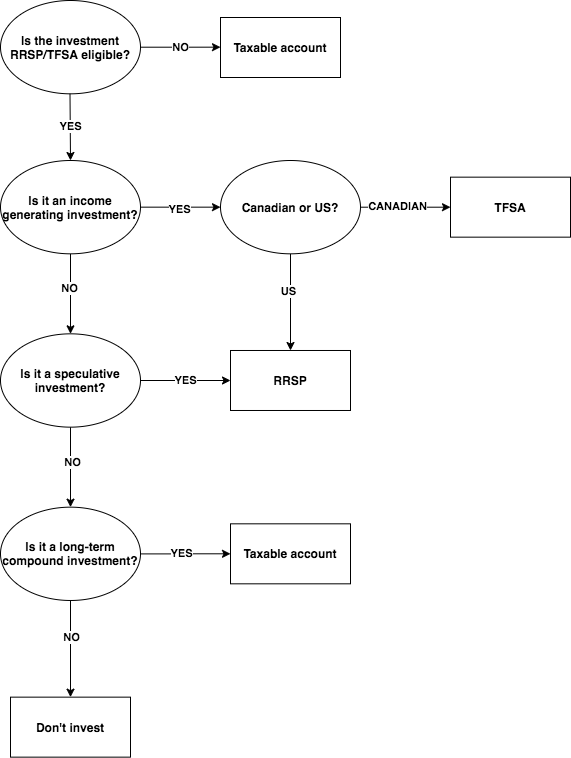

Here is a quick decision-making flowchart on how I allocate an investment to each account (assuming I have contribution room in my TFSA/RRSP):

Other Considerations

Beyond optimizing for tax purposes, there are several other considerations you should review as well.

Liquidity – TFSAs provide far better liquidity than RRSP. On top of being able to cash out without tax consequences, banks offer investment-secured lines of credit against a TFSA. You are not allowed to do this with an RRSP (the CRA will penalize you for the entire amount of your RRSP). So if you feel you might need the cash in the near-term, think twice about contributing to an RRSP account.

Asset protection – RRSPs are protected from creditors/bankruptcies whereas TFSAs are not. This is an important consideration for entrepreneurs operating risky businesses.

Income planning – you should contribute to your RRSP whenever you have a year with high personal income, as you will be in a higher tax bracket and can save more money by contributing that year. This might happen when you have an unexpected large personal expense and have to pay yourself a large amount in a given year.

Investment thesis – you should also invest in whatever you feel will generate you the best returns after taxes. Perhaps you may feel income-generating investments produce far inferior after-tax returns compared to compounding investments. Or you might not believe in investing in stocks or bonds in general and prefer to invest in assets that cannot be held within a TFSA/RRSP (real estate, small businesses, angel investments, etc). Whatever the case may be, optimize your tax-advantaged accounts after you have come up with an investment strategy that you feel will provide you with the greatest after-tax returns.

Final Thoughts

An effective tax-strategy can make a world of a difference when growing your wealth. All Canadian citizens have access to a TFSA and an RRSP which can be optimized for investment gains and tax minimization.

The strategy laid out above has aided me in growing my personal investment portfolio and perhaps it could help you with yours.

DISCLAIMER: This blog post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.