NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

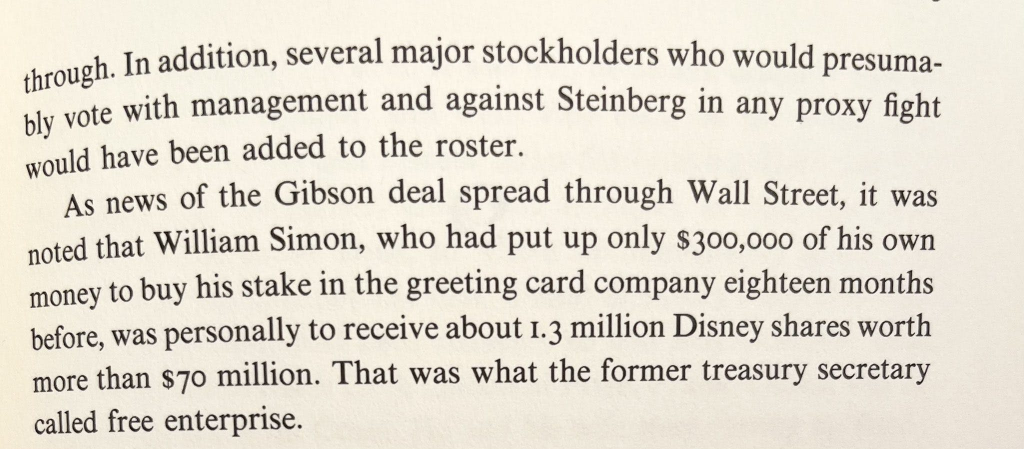

Today’s gem is this book excerpt which highlights profits from the leveraged buyout of Gibson, a greeting cards company:

To provide more context: Wesray Capital (pioneer in LBOs) acquired Gibson for $80m for which they put up $1m of equity($300k of that was Simon’s) and borrowed $79m. 18 months later, they sold Gibson for $290m, the net proceeds back to Wesray was $210m.

A cool 14,000% IRR!

Take a moment to marvel at how insane this is but realize, much of this was simply being at the right place at the right time. Simon and Wesray didn’t know the first thing about the greetings cards business. This was the 80s, a unique period in history, and for every one Simon, there are many Macklowes & Reichmanns…highly leveraged bets that ended in catastrophe.

Good risk management means purposely leaving money on the table, no matter how tempting it looks on paper. This is especially true with leverage. The more leverage you use, the more EVERYTHING needs to go right (including timing, which is hard to predict).

Our approach to leverage at Atlasview Equity is quite conservative. We aim to utilize debt for all of our businesses, but prefer there be a large enough margin of safety with ample equity. The beauty of software/technology businesses is that they have significant operating leverage and don’t require as much financial leverage to drive great returns for equity holders.

The excerpt is from the book Storming The Magic Kingdom. It’s the story of Disney battling corporate raiders during the 80s. Like all stories from Wall Street in the 80s, its a mind-blowing one. Highly recommend it.

Also, if you want to read more about Wesray, check out this NYT article from 1983. Disney failed to acquire Gibson, but Gibson went public and Wesray received roughly the same proceeds.