NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

Today’s gem is this Twitter thread on Danaher, its history, and the Danaher Business System.

Danaher’s life started with the acquisition of a publicly traded vehicle that had ~$130m worth of tax losses in the 80s. The Rales Brothers used this vehicle to acquire profitable niche industrial businesses and utilize the tax losses. Focus on optimizing taxes appears to be a commonality amongst outsider CEOs!

The business has evolved drastically since the 80s through major pivotal acquisitions. Danaher pioneered the platform + add-on acquisition model, which is quite popular within private equity today (a strategy we pursue at Atlasview as well). It involves acquiring a larger business to serve as a platform to enter a new industry. Then, acquiring smaller add-on businesses to scale both product & distribution, to build a truly dominant market leader.

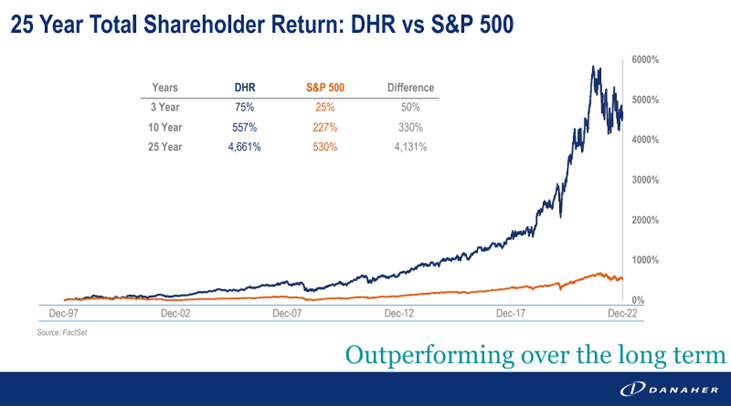

Today, Danaher has nearly a $200bn market cap and has compounded shareholder wealth at an outstanding rate since its inception.

Danaher had a dedicated chapter in the book Lessons From The Titans. I know I reference this book a lot, but it’s seriously such an important read. What’s interesting is that TerraVest has sort of a similar origin story. It was a busted income trust with big tax losses and has since been used as a public vehicle to acquire niche industrial businesses. I briefly discussed TerraVest in my post on serial acquirers, but Plural Investing recently did a great podcast on the business.