It might seem unusual for me to write about a stock that recently hit an all-time high. But despite the meteoric rise in stock price, Mainstreet Equity still flies under the radar and I feel it needs a bit more spotlight.

Here’s why I believe Mainstreet Equity is an underrated compounder.

Under The Radar Compounder

If the name sounds familiar to you, you might have first seen it mentioned in my Canadian REITs blog post a little while ago (note: MEQ is a REOC, not a REIT). I first invested in MEQ back in 2012, held for a few years before selling (doh!). But I was lucky enough to have the opportunity to buy back in during the COVID dip at an incredibly attractive price and vow not to sell early this time!

It’s easy for Mainstreet Equity to be overlooked. It’s a relatively small company, with a $1.1bn market cap and ~$2.6bn AUM. As a result, it’s often underestimated and undervalued, presenting a great investment opportunity.

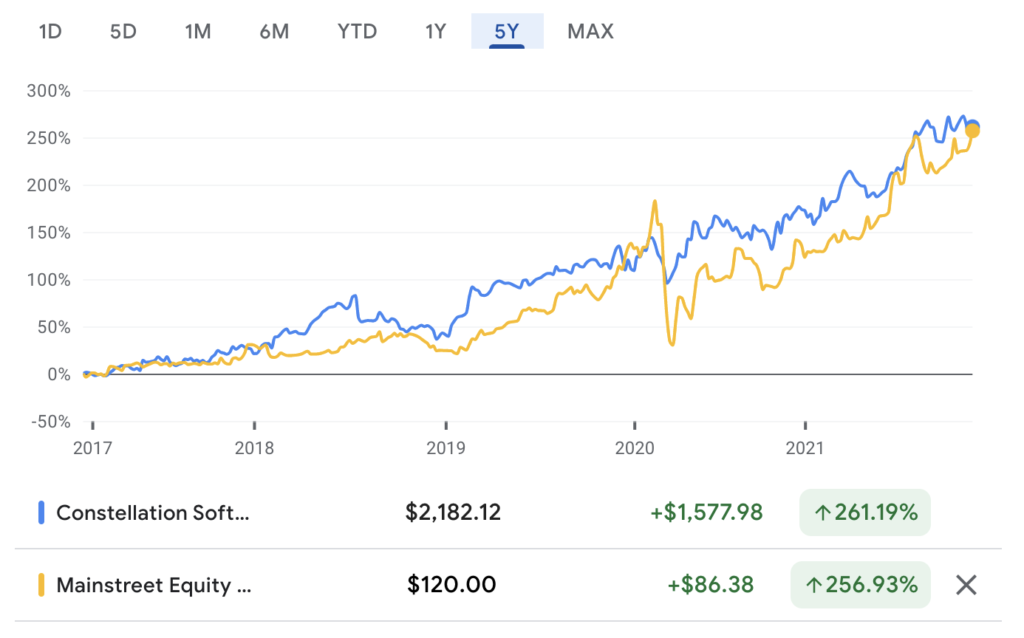

The 5-year performance for MEQ is now neck-in-neck with the TSX darling compounder stock, Constellation Software (CSU), yet MEQ gets a fraction of airtime compared to CSU.

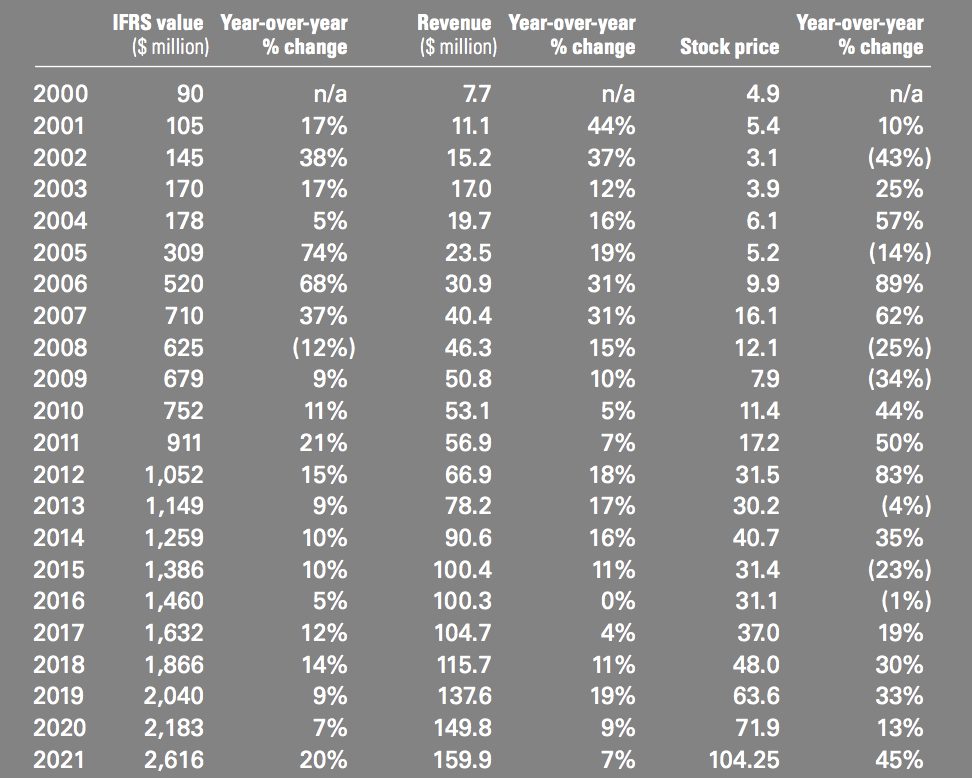

Mainstreet’s stock has compounded by nearly 20% for over 22 years now. Had you invested $100k in MEQ when it went public, it would be worth over $4.7m today. And keep in mind, this is a REAL ESTATE business we are talking about here.

The Business

If you’ve been following me for a while, you’d know I love easy-to-understand, straightforward business models. Mainstreet’s business is the epitome of this; they buy mid-sized apartment buildings, renovate them, increase rents, refinance the debt, and repeat. It’s commonly known as The BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat) amongst real estate investors.

A lot of real estate investors do thing exact same thing, so what makes Mainstreet so unique?

Here are some of the main reasons why Mainstreet stands out as a remarkable business:

Hyperniche

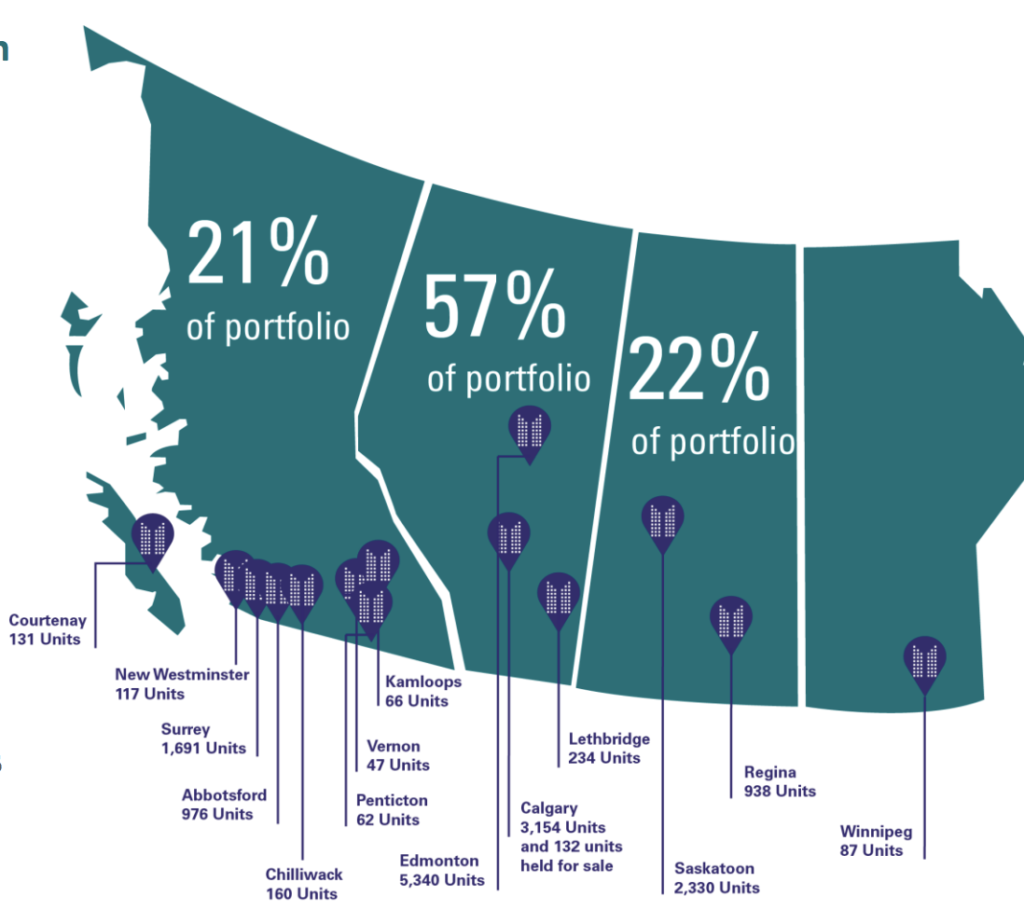

Let’s start with geography first. Mainstreet only acquires assets in Western Canada, specifically in 4 provinces and a handful of cities.

They only acquire mid-sized apartment buildings. A market that is often deemed too small for large REITs, but too large for mom-and-pop operators. They face limited competition here as a result.

It’s rare to find a real estate operator that stays so disciplined with their niche. Oftentimes, as real estate businesses grow, they expand into other geographies, pursue larger deals and diversify into other real estate asset classes. Mainstreet has refused to do any of this, despite being in business for over 22 years and growing to over a billion-dollar market cap. They do the exact same thing they’ve always done – value-add mid-sized apartments in Western Canada.

Disciplined Acquisitions and Operations

Their disciplined approach to their niche allows them to take a disciplined approach to acquisitions. Many of the apartments they buy are well below replacement costs, many of them even distressed.

Since they operate in such a tight niche, they’ve been able to successfully internalize much of the value-add operations. Concentrating on the same niche for over 22 years results in compounded competency and expertise. They’ve got the model down to a science, there is no guesswork in any deal they do.

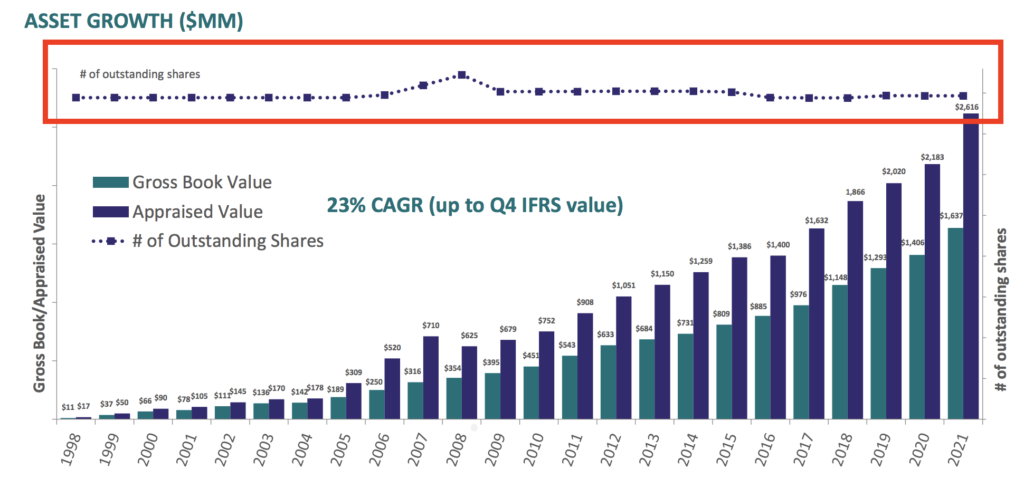

No Stock Issuance

Since Mainstreet went public, the number of shares outstanding has NOT grown. In fact, they have a history of opportunistically buying back shares when it makes sense to do so (like when the stock price is well below their net asset value). This is in stark contrast to many REITs that have a habit of issuing equity and diluting unitholders.

Their stable/decreasing outstanding shares and the amount they purchase back each year are stats they proudly market.

Incentive Alignment

I have an affinity for small-cap, founder-led businesses where the original founders have a lot of skin in the game. Bob Dhillon, the CEO of Mainstreet, owns nearly 50% of the company. That level of skin in the game is incredible.

Another important, but often overlooked characteristic, is the fact there are no fees with Mainstreet Equity. This is a problem with investment opportunities offered by many real estate asset managers, from large-scale ones like Blackstone and Brookfield to small private real estate syndicators. These fees misalign incentives, as fee-driven asset managers are encouraged to buy larger assets and focus on quantity of deals over quality. This ultimately shifts focus to AUM growth instead of absolute returns/profits for investors. As well-intentioned as they might be, like Munger says, show me the incentives and I’ll show you the outcome. And to make matters worse, over time, these fees eat away at a ton of the value created in real estate which muzzles the effects of compounding.

But with Mainstreet there are no management fees, acquisitions fees, disposition fees, refinances fees, or carried interest charged by the operator. This is also part of the reason why they’ve been able to stay disciplined in their acquisition process and not get distracted by larger and or less-quality deals.

Mainstreet (47x multiple on cash since inception) is a fantastic case study of what real estate compounding looks like without any fee interruption and superb incentive alignment. With 50% ownership and 0% fees, you can rest assured that Mainstreet and Bob only win, when you (as the shareholder) do too.

Shrewd Capital Allocator

Bob Dhillon has demonstrated, year after year, his ability to effectively allocate capital. Unlike other real estate companies (and REITs), Mainstreet has never declared a dividend. Instead, Bob has always found opportunities to reinvest in organic growth, acquiring well and creating tremendous value. It’s also important to note that the legal structure of Mainstreet (a corporation, not a trust or a limited partnership) enables easy retention of cash/profits and reinvestment.

As well, he’s opportunistically refinanced Mainstreet’s debt to lower their cost of capital and bought back shares when the stock price was well below NAV.

Bob is a textbook shrewd capital allocator, doubling as an entrepreneur.

(p.s. there are a number of interviews with Bob online, I’d encourage you to watch them. He has an inspiring rags-to-riches story as a new immigrant to Canada.)

Summary

Any one of these points alone may not make Mainstreet special. It’s the fact that Mainstreet offers ALL of them combined and in a consistent fashion. I challenge you to show me any passive real estate opportunity, public or private, that offers all the above.

On top of the core business model being straightforward, it’s amazing that what makes Mainstreet unique is also very easy to understand. It’s one thing to know all the above factors, and it’s another to actually execute on it. And boy has Mainstreet executed…

The Numbers

When a company regularly publishes its 20+ year track record, it means 2 things:

- They are long-term focused

- They are proud of how far they’ve come

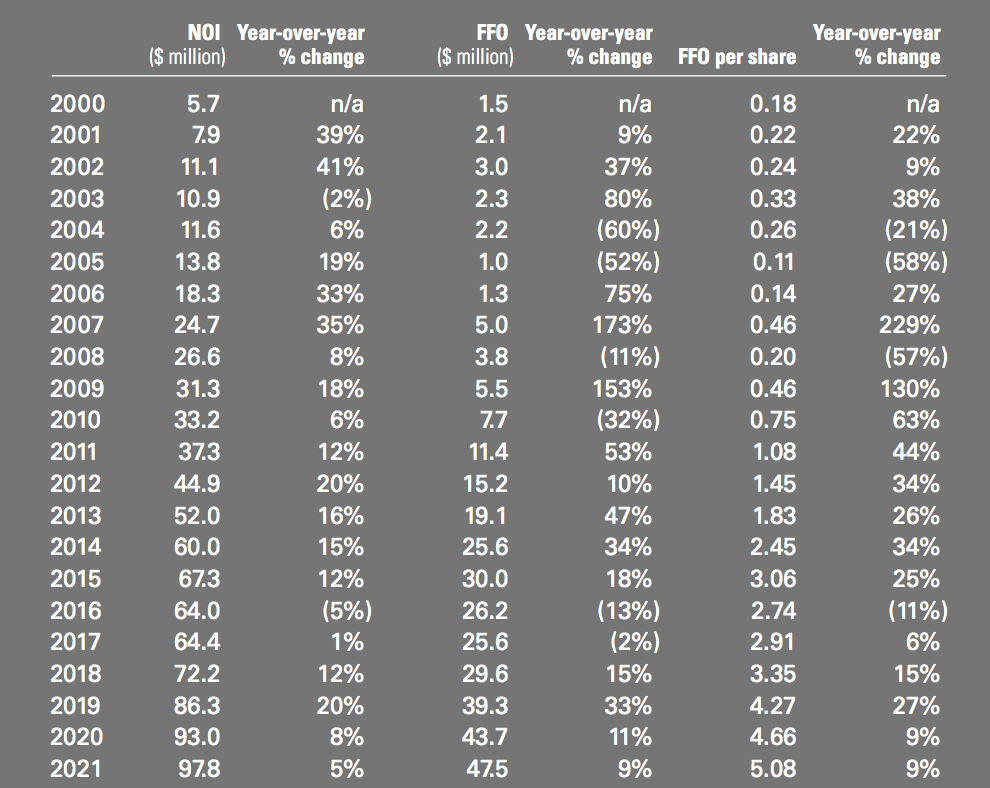

Here is their latest published 20+ year track record:

The numbers speak for themselves. Their P&L is fairly standard for a multifamily operation, sporting a 39% expense ratio in the latest fiscal year.

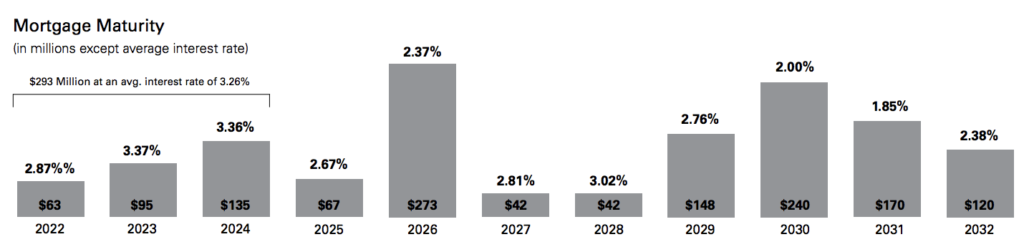

The company is reasonably leveraged, with roughly $1.36bn in mortgages secured on real estate assets worth $2.62bn. This gets them a loan-to-value (LTV) ratio of 52%, very reasonable considering that many private residential real estate investments can easily reach 80% LTV. The long-term and favourable debt MEQ has to offer can be a huge benefit during inflationary periods.

They currently have around $223m in liquidity, and their debt service coverage ratio is roughly 1.49, giving them plenty of safety in my opinion. They have also done a great job of staggering their mortgage maturity dates in order to manage liquidity.

If you are wondering how their interest rates are so low…1) welcome to Canada, and 2) they utilize CMHC, a government entity that provides loans, and also insures loans to enable very favorable debt.

The Industry

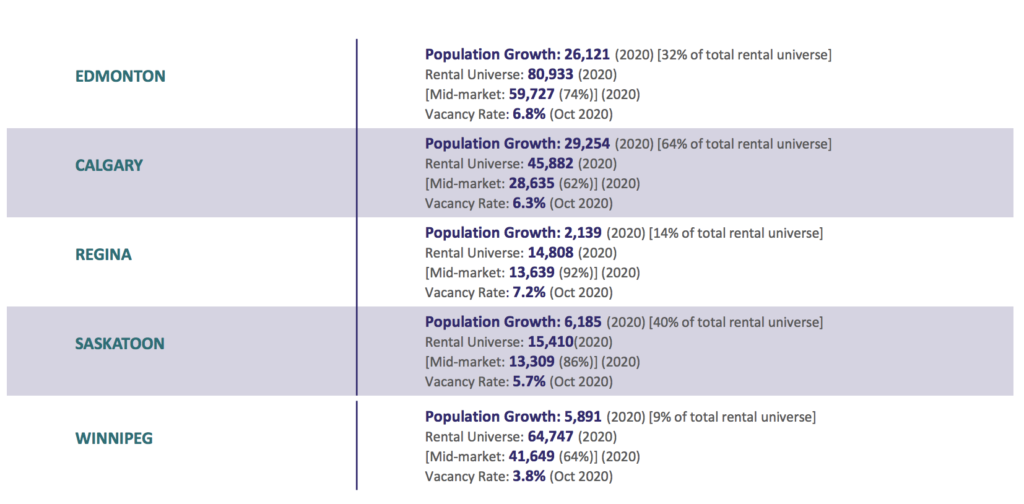

You might have been inundated with headlines talking about how expensive Canadian real estate has become. Though this may be true, there is a bit of nuance here. The VAST majority of the “expensive” real estate is concentrated in basically 2 cities: Toronto and Vancouver (neither cities Mainstreet operates in).

Western Canada (excluding Vancouver) has actually faced some headwinds in the past 20 years. They certainly haven’t experienced anywhere near the same population growth as Toronto/Vancouver. As well, Western Canada’s major industry is oil, which has had some incredible boom and busts over the past 2 decades.

The point I am making here is, I don’t want you to chalk up Mainstreet’s success to “real estate has been booming everywhere in Canada”. They’ve managed to consistently acquire well and grow NOI in their niche geography, despite comparatively lower population growth, oil commodity cycles, the Global Financial Crisis, and the recent pandemic.

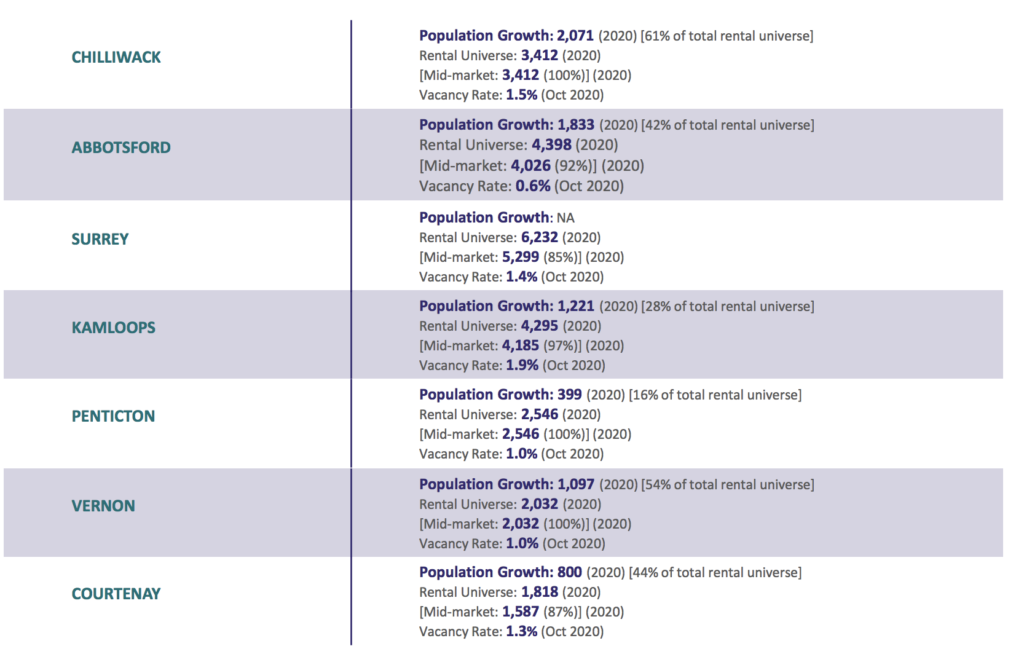

The Runway

Though the niche may appear small, Mainstreet still has a long runway in Western Canada. For example, they own 3154 units in Calgary, and the CMHC estimates the rental universe for mid-market apartments in Calgary is 28,635 units. Similar runways exist across all the cities they operate in.

Also, not to get too speculative here, there have been several recent reports and studies predicting population growth to accelerate in Western Canada. Many of the fastest-growing cities, according to Stats Can, are located in Western Canada. Though I am hesitant to accept this at face value (explained further below), still worth bringing up.

The overall shift towards renting instead of homeownership for younger generations will likely also play a factor. Millennials/Gen-Z have a different perception of renting; they value flexibility, convenience, and experiences over homeownership. In a fast-paced society, this will continue to be a contributing factor to increased rental housing demands.

The Valuation

There are a few ways to value a real estate business like this, including a multiple of FFO (Funds From Operations), an implied capitalization rate (Cap Rate = Net Operating Income / Enterprise Value), and discount/premium to NAV (Net Asset Value). They all basically arrive at the same outcome, but for simplicity’s sake, let’s focus on FFO multiple.

I know the immediate question you might have is: is the stock still undervalued?

And my immediate answer to that is: well, it depends on your hold period.

Of course, as I first mentioned, MEQ is trading at all-time highs. Their last reported FFO was $47.5m ($5.08 per share) and at ~$120 per share that is almost 24x trailing FFO. Not exactly “cheap” by this measure.

But the beautiful thing about a simple business is that they are fairly predictable. As per above, they’ve historically grown FFO at an average of around 17% a year. Let’s say that drops to 15% FFO growth going forward, and markets compress the FFO multiple from 24x down to 15x. After 25 years, the FFO will have grown to $1.56bn ($167 per share). Put a 15x FFO multiple on that, and you are looking at a stock price of $2,502. That represents a 20x+ upside from today’s stock price of $120.

I have no idea where the stock might be next year, or even in 5-years. But even using conservative assumptions here, I am absolutely confident over the long run, it will continue to compound at least mid to high teens.

The Risks

There are a lot of risks in real estate related to credit, interest rates, and liquidity. But Mainstreet’s expertise and track record address most of these general risks, so let’s focus on potential risks that are specific to Mainstreet.

Key-man

Bob is obviously a talented capital allocator, and fairly core to this thesis. Even after a bit of digging, I still don’t know exactly how much of a key-man risk Bob Dhillon represents. Sometimes, these things are not well known until, unfortunately, it’s too late. It comes down to how decentralized the acquisition process is at Mainstreet, and whether Bob is deeply involved in the deals on a regular basis.

Keep in mind Bob is only mid 50, and based on what I’ve gathered from interviews, he has no intention of slowing down any time soon. That said, I think if Bob were to leave or step down as CEO, I would revisit this thesis.

Western Canada

Western Canada (again, outside of Vancouver) still has somewhat of a stigma in the real estate world. No pun intended, but it feels like the boom/bust nature of oil has stained this region. Real estate prices in the cities that Mainstreet operates in, trade for lower than in other parts of Canada, and they may continue to stay depressed.

Western Canada is less of an attractive choice for new immigrants coming to Canada compared to the Greater Toronto or Vancouver Area for a variety of reasons. And considering Canada plans to welcome 400,000 new immigrants per year, this population influx will likely continue to fuel rental growth in cities like Toronto and Vancouver, instead of markets that Mainstreet operates in.

Inflation

A value-add operation requires heavy amounts of capital expenditure. Inflation will increase capex costs, and rent prices may not be able to keep up especially given Mainstreet’s target demographic are lower-income households. This may be offset by the devaluing of their mortgages as a result of inflation. It’s difficult to precisely estimate the net effect of inflation, but it’s a potential risk worth considering.

Low Float

I hate to even mention this one, but I have to keep in mind investors all have different definitions of risk. If volatility is a big deal for you, MEQ has a very low float and can experience violent price movements. As well, liquidity is very low, so you can’t be in a rush to enter/exit this stock. This means that investors in MEQ, much like Bob Dhillon and Mainstreet, need to be long-term oriented!

Final Thoughts

Mainstreet is a truly remarkable business that has flown under the radar for far too long. I am impressed with how straightforward their business model is, their level of discipline, and how aligned management is with shareholders.

I hope this blog post puts a spotlight on this great Canadian compounder.

DISCLAIMER: This blog post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Full disclosure, I own Mainstreet Equity stock.

Hi there! I’m Jay Vasantharajah, a Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences and passion for investing, entrepreneurship, personal financial management, and traveling the world.

Subscribe below, to get a couple of emails a month with free, valuable, and actionable content.

4 thoughts on “Mainstreet Equity (TSX: MEQ): Canada’s Under The Radar Compounder”