The concept of borrowing to invest in stocks would send chills down the spines of financial gurus. Conventional wisdom dictates that debt is bad, and it would be risky to borrow money to invest in stocks.

But have these financial gurus actually ran the numbers?

Because here is an unpopular opinion:

Borrowing to invest in the stock market could be a smart strategy for the right type of borrower and credit.

I did the math and the results were quite interesting and very useful for anyone looking to grow their investment portfolio.

Key Assumptions

All financial models require key assumptions, here are the ones I used:

Long term investment horizon (15 years) – the investor has the ability to buy and hold without the need to sell and capture profit for a period of at least 15 years.

No panic selling – the investor is able to ride out volatilities in the market, unfazed by large short-term drawdowns.

Earning $100k income – the investor earns $100k per year for the foreseeable future and is a disciplined saver.

Has liquid assets – the investor has a sizeable amount of liquid assets to cover any unforeseen personal expense.

Great credit score – the investor has a great credit score which enables access to the best rates and credit terms.

Noncallable loans – the bank can’t demand payment in full out of the blue, no matter how much the asset value decreases.

Investing in a broad market index fund – something like the S&P 500, where you have fairly predictable returns over the long run. In this post, we will use the median 15-year return since 1970, which is 10.85%.

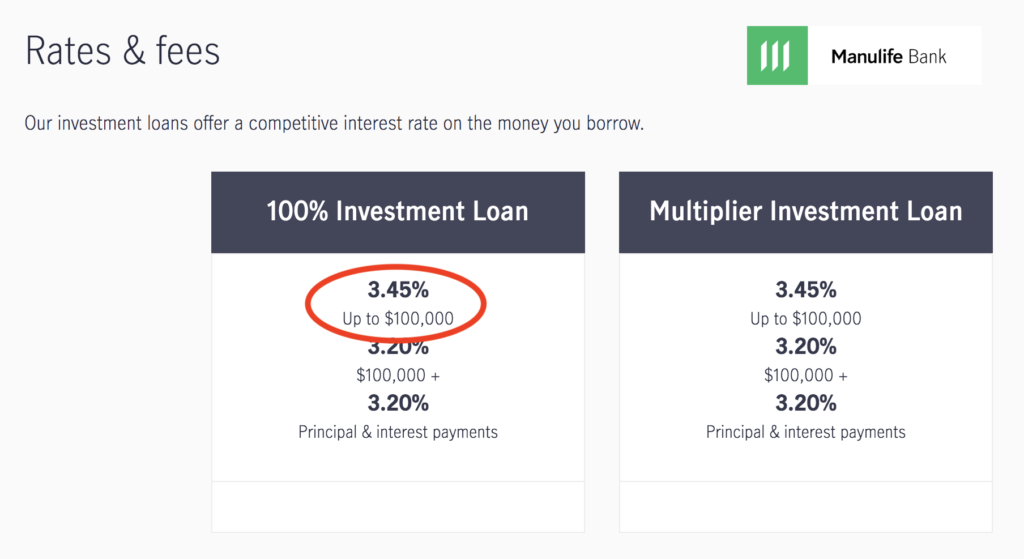

Interest rates are low – the investor takes advantage of the current low-interest-rate environment. In this post, we will use the Manulife Investment Loan starting rate of 3.45%.

Investing in Stocks Using Margin

This is the most common form of credit people use to invest in stocks. Margin loans basically use the stocks you buy as collateral. But margin loans are the worst type of credit.

Brokerages offer margin loans to anyone because they aren’t really taking on any credit risk.

Margin loans are designed to protect the brokerage from taking any loss. If your portfolio value drops, the brokerage will sell your positions locking in a permanent loss. This makes it unpredictable, near impossible to craft a long-term strategy, and very unfavourable for borrowers.

So let’s not waste any time discussing margin loans, and instead look at 2 credit offerings that are favourable for borrowers.

Investing in Stocks Using a Term Loan

Term loans function very similarly to a mortgage. There is a principal amount that is borrowed, and you pay it back over a fixed schedule at a fixed interest. Each payment you make is a blend of principal and interest.

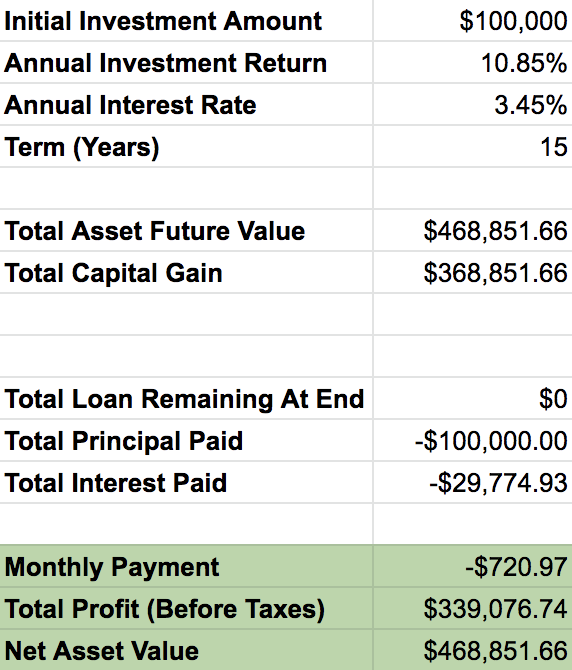

Let’s assume you take out a 15-year term loan of $100,000 and invested it immediately into the stock market. Since the interest rate is locked in with a term loan, the main variable here is the annualized return.

Here are what the results would look like:

Scenario #1 – 10.85% Annual Return

You end up with a profit of $339k and a net asset value of $469k after paying down the loan to $0. The monthly payment of $721 would be around 8.65% of your $100k/year salary.

If you took the 100% Investment Loan option, meaning you didn’t put any of your own money upfront, you would have created nearly half a million dollars by putting away less than a tenth of your salary each month for 15 years.

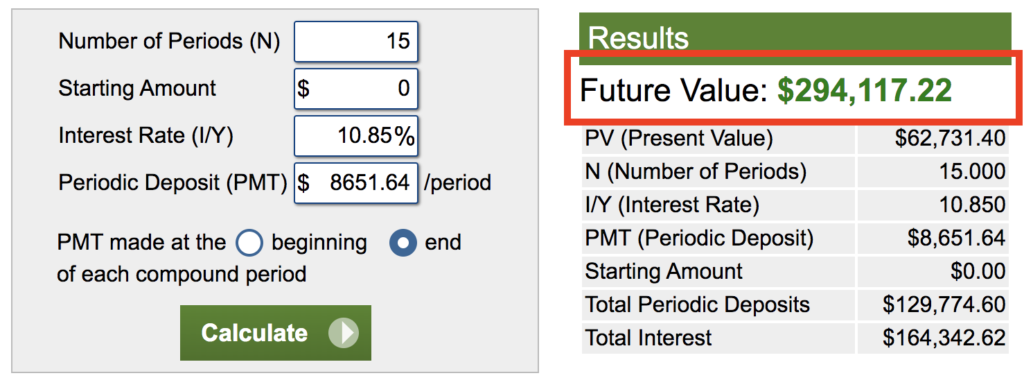

But what if you just invested $721/mo ($8652/year) for 15 years with your own money instead of taking a loan?

You end up with $294k, which is $174k less than you would have earned by taking the loan. The loan enables you to invest upfront, and thus take advantage of the power of compounding faster. This in turn increases your net asset value by nearly 60%, without any effective change in your cash contributions!

So in short, using the median 15-year return for the S&P 500 (10.85%), the results for borrowing to invest are quite amazing.

But what happens if returns fall short? Let’s take a look.

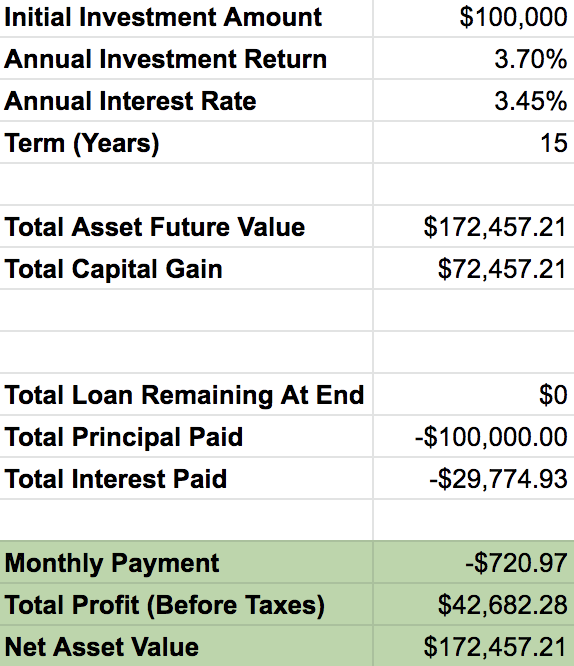

Scenario #2 – 3.7% Annual Return

I chose 3.7% annualized return here because that is the worst 15-year annualized return the S&P 500 has had since the 70s. So even if the S&P 500 matched its worst 15-year performance, you would still walk away with $43k net profit.

That’s not a bad worst-case scenario.

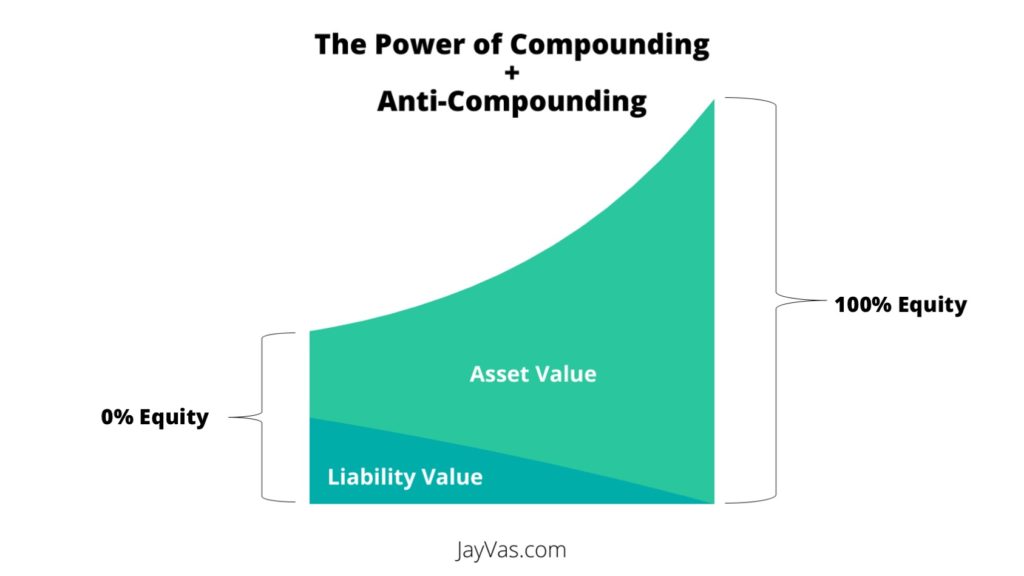

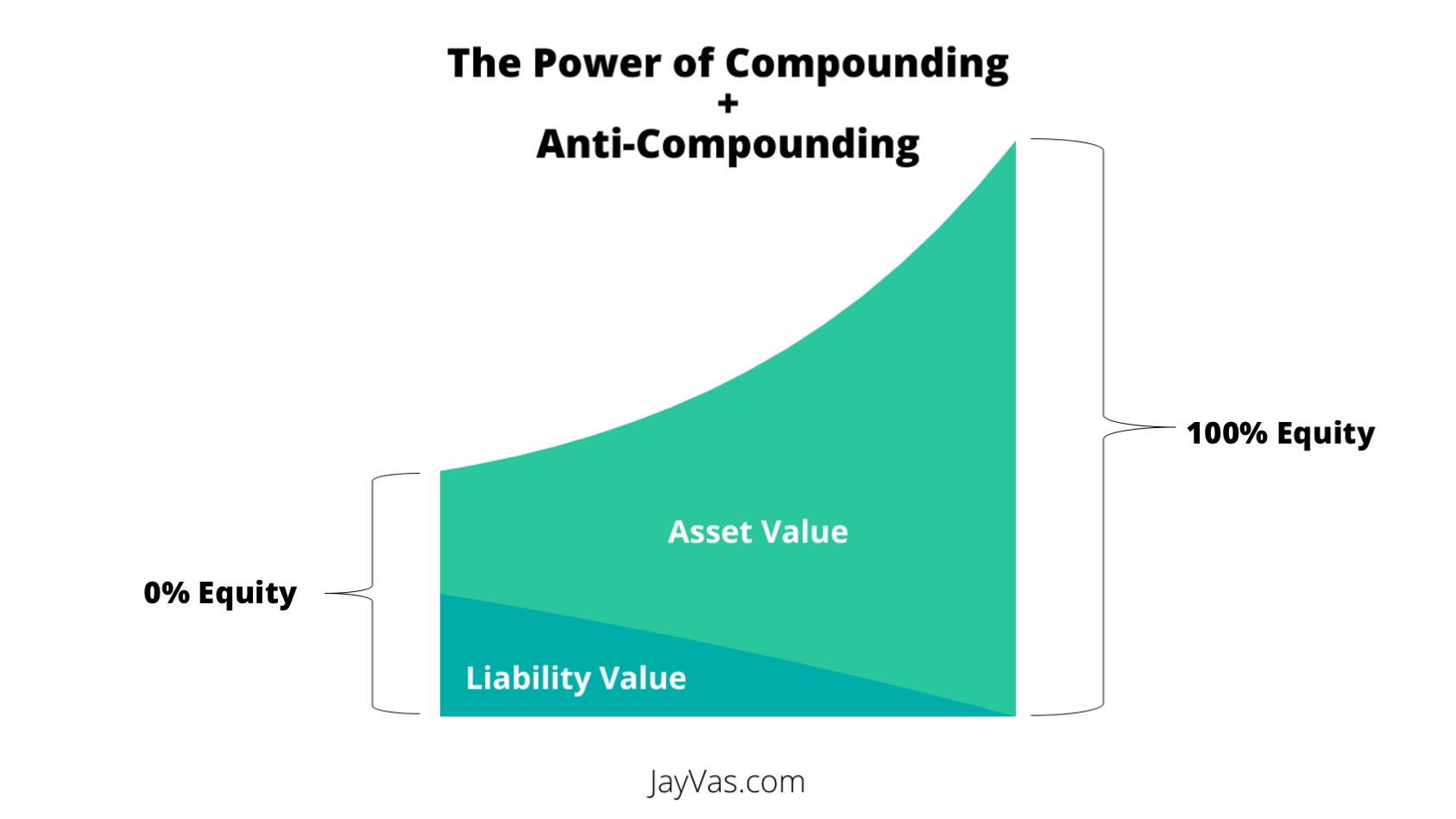

What’s happening here is the power of compounding and anti-compounding.

Even at a low annualized return like 3.7%, over a long period of time, the asset still grows quite substantially. And by making regular loan payments, your interest cost continually shrinks. Both happening concurrently widens your profit margin over time.

Investing in Stocks Using A Line of Credit

Another common form of credit is a line of credit. They are usually interest-only payments, no set term for payback, and have revolving use. Meaning, you only have to pay interest on the amount that you use. Anytime you pay down your loan that amount becomes available to borrow again.

Lines of credits are either unsecured (no assets pledged as collateral) or secured (by your home or some other hard asset).

Lines of credits usually have a variable interest rate, meaning it could increase/decrease at any time. So let’s test out a few scenarios assuming you were only making the interest payments.

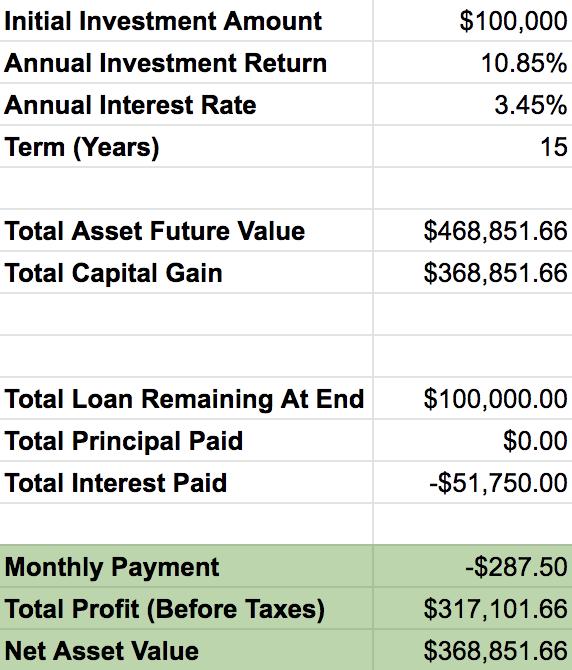

Scenario #1 – 10.85% Annual Return, 3.45% Interest Rate

A little bit less profit compared to the first term loan scenario, and your net asset value is obviously lower as you still have the $100k line of credit outstanding.

But the monthly payments of $287.50 make up a measly 3.45% of your $100k/year income. You probably wouldn’t even notice it coming off your paycheque, and the end result could be a net asset value of $369k after 15 years. Not too bad.

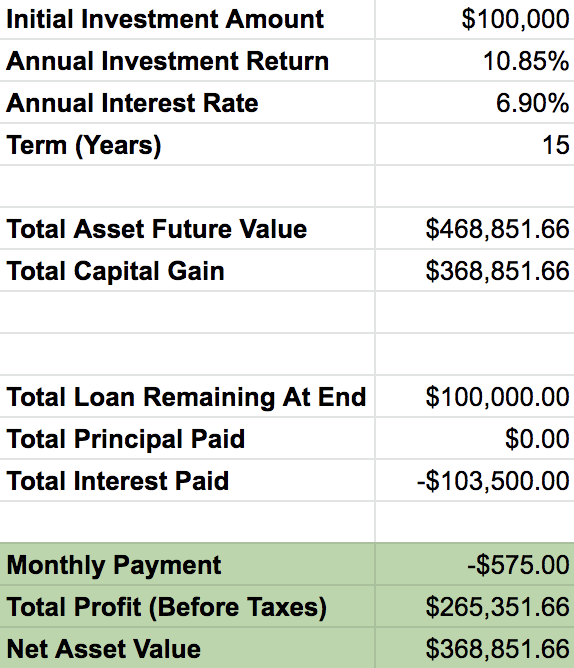

Scenario #2 – 10.85% Annual Return, 6.9% Interest Rate

If the interest rate on the line of credit doubles, you still end up making a $265k profit.

Your monthly payments would also double, but still only accounting for 6.9% of your $100k/year salary. So even if the interest rate increases by 2x in 15 years, you still end up with a decent outcome.

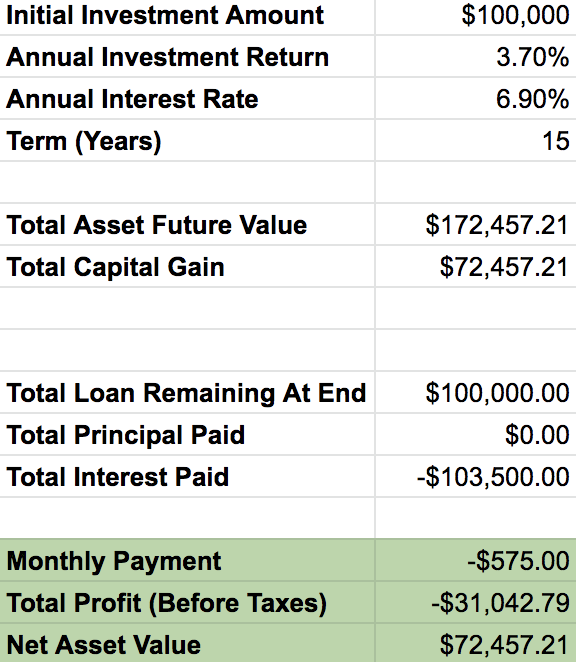

Scenario #3 – 3.7% Annual Return, 6.9% Interest Rate

This is pretty much your nightmare scenario, interest rates double and S&P 500 matches its worst 15-year performance at 3.7% annualized return.

As you can see, in this scenario you’d lose $31k. However, your stock asset value ($172.5k) is still enough to cover your outstanding loan($100k).

Even though this scenario is highly unlikely to happen, there are things you can do to mitigate this.

You could pay down the principal as the interest rate rises. Interest rates don’t shoot up overnight, they gradually increase, giving you plenty of time to start paying down the principal.

You could also hold on longer than 15 years. Returns could improve and your stocks would continue to compound. The worst 20-year annualized return for the S&P 500 was 6.4%.

Feel free to play around with the model in Google Sheets (File > Make a copy).

Main Benefits of Borrowing to Invest in Stocks

Boost Returns

The main benefit of borrowing to invest is obviously boosting your investment returns and growing your portfolio using other people’s money.

Increase Liquidity

You also have more liquidity since you are only putting away less than 10% of your salary. You could use the rest of your salary to form an emergency fund or invest in other asset classes. Or you could amplify your returns by putting more of your salary into the stock market.

Interest Deductibility

Another key benefit is that the interest is tax-deductible. If you are earning $100k/year on salary, you are probably in a high tax bracket, paying a lot of taxes. So borrowing to invest would reduce your taxes.

Inflation Benefit

This concept is a bit more abstract. If you agree that the inflation rate is around 2%, it basically pays for a large part of the 3.45% interest cost. That makes the borrowing cost quite low (almost free).

Compounding

Time is your best friend when it comes to investing. By investing more money upfront, as opposed to gradually over time, you benefit from the power of compounding faster.

Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

-Albert Einstein

Conventional Wisdom and Final Thoughts

The risk of borrowing to invest in stocks is more of a perceived risk than reality. The volatile nature of stocks and instant stock price updates dominates headlines, making people believe stocks are risky.

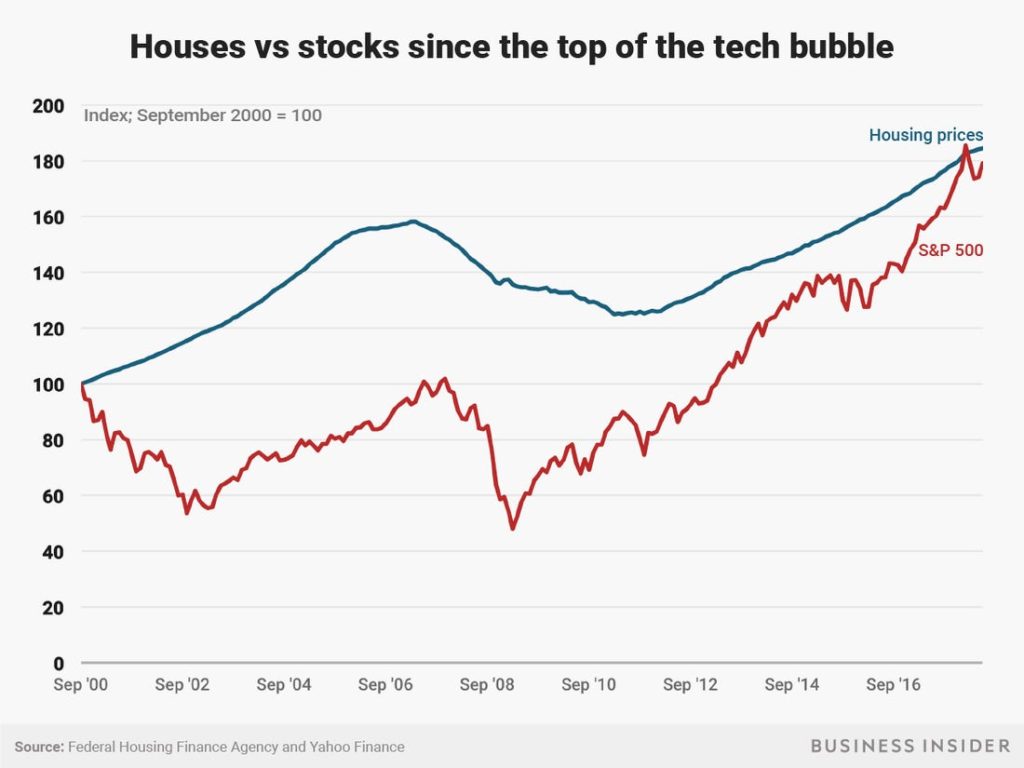

But people have no problem borrowing to invest in real estate because “real estate always goes up“. This is true, in the long run, real estate values generally do increase in developed nations like Canada and the US. But so does the stock market.

Since the real estate market doesn’t have instant price updates, most people have no idea how volatile the is. This makes borrowing to invest in real estate appear safer.

Both real estate and stocks are derivatives of the overall economy. If the economy grows over time, so do both asset classes.

People often take out loans for assets that don’t always go up in value with the economy, like a small business (check out my article on Lending Loop).

Borrowing to invest in stocks could be a way to harness the power of compounding and anti-compounding. Especially now as you are able to lock in record-low interest rates.

You obviously need to obtain the right type of credit and be the right type of borrower. But if done correctly, it could be a wise decision, despite conventional wisdom telling you otherwise.

DISCLAIMER: This blog post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

5 thoughts on “The Math Behind Borrowing to Invest in Stocks”