DISCLAIMER: One of my companies, PureFilters, is a Clearbanc customer. This blog post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Clearbanc has been absolutely crushing it lately, and it’s amazing to see a Canadian startup doing so well. As a fellow Canadian entrepreneur, I am very inspired by what Michele Romanow and Andrew D’Souza have accomplished thus far.

There’s been a lot of discussion about their financing model among the tech and eCommerce communities.

There also has been a lot of confusion on how it works and who it’s for.

So I decided to demystify Clearbanc and illustrate everything you need to know about this “new” form of financing they offer small businesses.

What exactly is Clearbanc

First off, what Clearbanc offers isn’t exactly new.

On a high level, they lend businesses money and get paid back based on sales the business generates, with a fee on top.

It’s called a “merchant cash advance” and several payment processors have been offering this for years.

Historically, the type of businesses that were eligible for merchant cash advances were brick-and-mortar establishments like restaurants, retail stores etc.

What’s different about Clearbanc is that they are offering merchant cash advances to digital businesses like eCommerce stores.

Their success to date has spawned competition, like Stripe Capital, and I believe this brilliant repurposing of merchant cash advances will further fuel growth in this industry.

So let’s take a closer look at exactly how it works.

The cost of Clearbanc’s money

Whether it’s debt or equity, all forms of money have a cost associated with it. You are going to be giving up a share of future profits, paying interest or a mixture of both.

Clearbanc takes a “fee”, which doesn’t have a specified time period for repayment, so it’s not exactly interest. That being said, you can still calculate the APR (annual percentage rate, or interest rate) of the Clearbanc fee based on either your historic data or revenue projections.

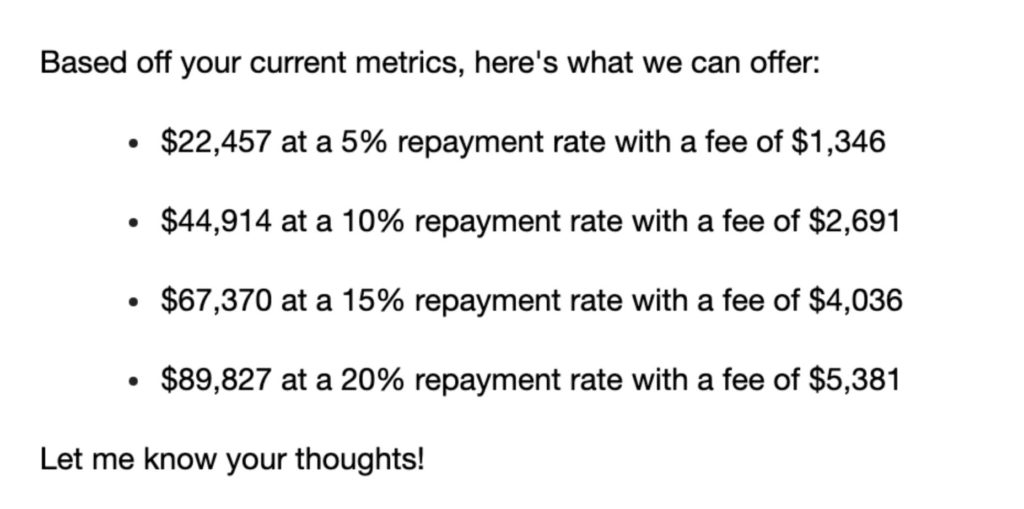

Here is a sample Clearbanc fee structure taken from Patrick Coddou’s Tweetstorm:

NOTE: the fee model has changed a bit. Clearbanc now charges a 12% fee but gives you rebates depending on what you spend their money on. Ad spend gives you roughly a 6% rebate, and everything else a 3% rebate. So the effective fee now can range between 6% to 9%, but for simplicity sake let’s assume 6%.

In all the examples, you pay back the principal + fee based on your revenue. The larger the offer you take, the larger percentage of your revenue Clearbanc takes until the principal + fee is paid back. But the fee, as a percentage of the principal, remains fixed at 6%.

So in order to calculate the “APR” you need to figure out how long it would take for you to pay Clearbanc back. The longer you take to pay them back, the lower the implied APR.

This might seem a bit confusing, so let’s model 3 different scenarios based on the offers above.

Scenario #1 – my business is steady

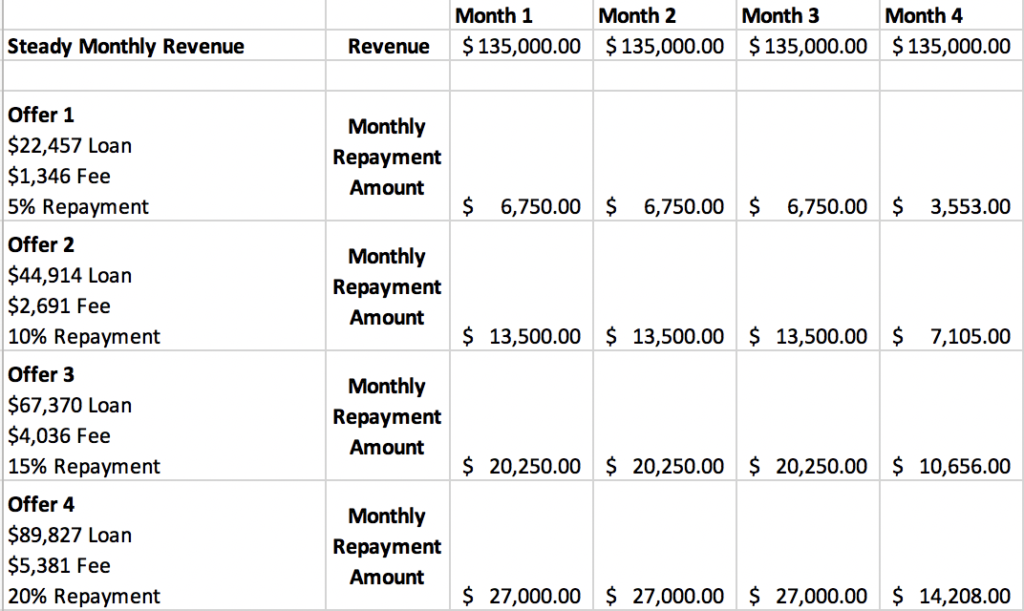

If your revenues aren’t growing or shrinking, but staying steady month over month, here is what the repayment schedule would look like:

In this scenario, you would pay the 6% Clearbanc fee in a period of around 3.5 months, or 1.7% per month (6% ÷ 3.5 months). You are looking at an annualized rate (1.7% x 12 months) of about 20%, roughly in line with most major credit card interest rates.

Scenario #2 – my business is shrinking

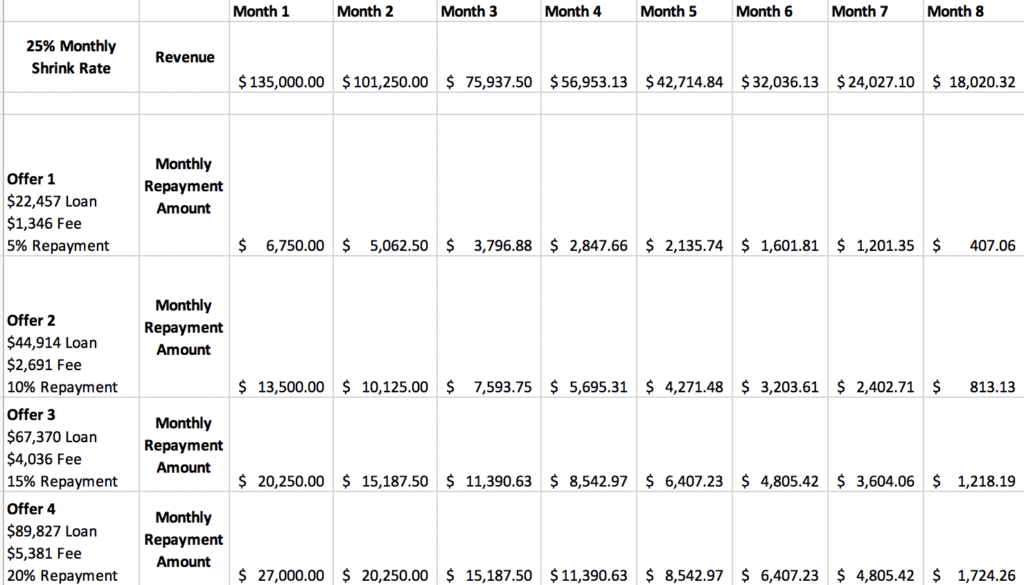

If your revenues are shrinking at a rate of 25% month over month, here is what the repayment schedule would look like:

In this scenario, you would pay the 6% Clearbanc fee in a period of around 7.5 months, or 1.7% per month (6% ÷ 7.5 months). You are looking at an annualized rate (0.8% x 12 months) of about 9.6%, which is really good for small business credit.

Scenario #3 – my business is growing

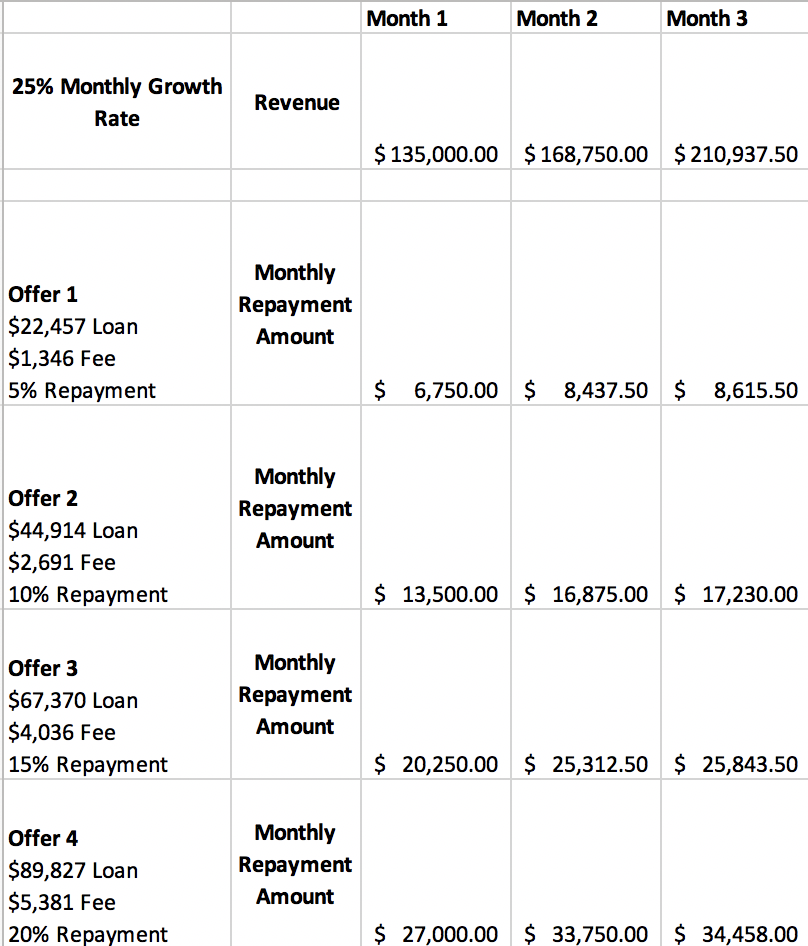

If your revenues are growing at a rate of 25% month over month, here is what the repayment schedule would look like:

In this scenario, you would pay the 6% Clearbanc fee in a period of around 3 months, or 2% per month (6% ÷ 3 months). You are looking at an annualized rate (2% x 12 months) of about 24%, which is definitely on the higher side of interest rates.

So if you have a business that’s growing, you end up paying a pretty high APR . Is it really worth it?

Well, it depends how you look at it.

At 24% interest rates, the immediate questions is…

Is Clearbanc taking advantage of small businesses? Is this predatory?

Interest rates should match the risk profile of borrowers, that’s why high risk lenders charge high interest rates. It has to cover the high default rates of high risk borrowers.

Lending to small businesses is extremely risky, they have a very high rate of failure which translates to a high default rate. Lending to eCommerce businesses is a new frontier, there is no real historical data of default rates. This makes it an extremely risky endeavour.

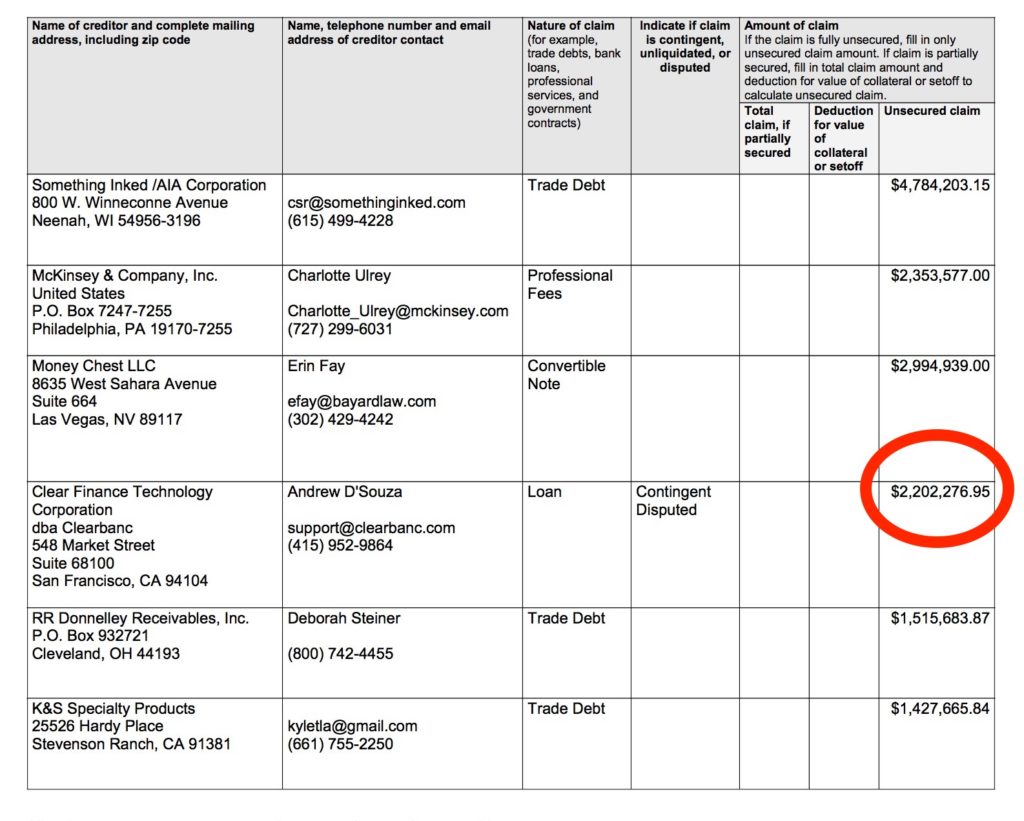

I did a bit of digging and found Loot Crate’s recent bankruptcy filing, where Clearbanc is listed as a large unsecured creditor:

Clearbanc took a $2.2m loss on this customer, I can predict there will be more of these to come – reiterating my point that Clearbanc is taking on an unknown and potentially high risk.

Sure the APR may appear high, but it could very well be justified given the inherent risks that Clearbanc is taking. Remember, they aren’t asking for any sort of collateral or guarantees, which further increases their risk.

Looking beyond APR

In Canada it is near impossible to get any sort of small business credit. Banking is heavily regulated and our banks won’t even touch most small businesses beyond a credit card with a measly limit (and requesting a personal guarantee at that).

Even government-funded lenders, like BDC, ask for a personal guarantee on their small business loans.

When you sign a personal guarantee, the business debt shows up on your personal credit report. With this kind of business debt under your personal profile, it would be impossible to get a mortgage.

And if you already have a home, good luck protecting it with a personal guarantee on your business debts.

Clearbanc removes these shackles and gives entrepreneurs access to financing to help grow their businesses, without putting their entire personal life at risk.

This is especially important if you have a family or dependants. Clearbanc is literally one of the only companies in Canada that won’t ask you to put their well-being on the line.

For many Canadians, this is worth way more than paying a few extra percentage points of financing costs.

More use cases for Clearbanc

Another clever way to utilize Clearbanc or any merchant cash advances is through savvy forecasting. Clearbanc offers eCommerce merchants money based on their trailing 6 months’ worth of sales. Time the Clearbanc loan right before you predict a large drop in sales. For example:

- Right after a massive sale (boxing week, Black Friday, etc)

- Right after your busy season (assuming there is seasonality in your sales)

By doing this, you get more money from Clearbanc due to the sales spike or busy season and you pay it back slower, as sales should slow down after you take the money. This emulates Scenario #2 above (my business is shrinking) and will ultimately reduce your APR which may result in a reasonable cost of capital.

A new form of financing for a new form of entrepreneur

If you have a rapidly growing business, paying a high interest short-term loan is still a lot “cheaper” than giving up equity to investors. Growth brings in more cash organically, and will make the interest loan a smaller line item on your P&L. Also, as your business grows, eventually your business can refinance with another creditor at lower rates.

And if your business is shrinking, you may end up paying a reasonable implied APR on Clearbanc’s money, but you have far bigger problems at hand.

As I mentioned earlier, I believe that repurposing merchant cash advances for online businesses is a brilliant move. Traditionally, most online businesses that needed financing either had to either give up equity or take on rigid debt.

Clearbanc gives entrepreneurs another form of financing, and more options are always better.

But as with anything new, only time will tell whether this will work out well for both entrepreneurs and Clearbanc.

In the meantime, I am rooting for Clearbanc, it’s incredible to see a Canadian company changing the game for small business financing.

Have you ever used Clearbanc financing? How did it work out? Leave your comments below!

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

6 thoughts on “Everything You Need To Know About Clearbanc”

Jay, do you know what Clearbanc raised their debt fund at (what % return they committed to LP’s)?

When you consider that cost to LP’s + their overhead (staff is 30+, rent, etc) this helps give you an idea of the spread they have to generate when they loan out to companies relative to what Clearbanc has to pay back to its lenders.

If they only make 9.6% (your scenario 2 above), do you think Clearbanc loses money on that loan? Same question at 20% or 24%.

I’ve spoken with entrepreneurs who tell me the 6% is typically on a 2 month term for an effective APR of 36% (which explains why Clearbanc is raking in money – which comes from you; the entrepreneur).

Hi Nathan,

Thanks for your reply. I have no idea what Clearbanc raised their debt fund at, but I know they have a sizeable credit facility so it probably came from a major bank.

I think the largest variable is probably the default rate, which is largely unknown right now. Overhead costs are problem immaterial compared to loan defaults in the long run. It’s really hard to say whether 9.6% adequately reflects total loan risk, my knee-jerk reaction says NO.