DISCLAIMER: One of my companies, PureFilters, is a Lending Loop borrower and my holding company is a Lending Loop lender. This blog post is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

A few months ago I wrote a blog post detailing exactly how Clearbanc works and received a lot of positive feedback. Clearbanc’s success is a testament to how many small business owners are looking for alternative financing options.

Like Clearbanc, Lending Loop is another rising star in small business financing and I love seeing fellow Canadian entrepreneurs build something so inspiring.

Let’s take a closer look at Lending Loop.

What is Lending Loop?

Lending Loop is a P2P (Peer-to-Peer) lending platform based out of Toronto, Canada. P2P lending simply means that borrowers can “crowdsource” a loan from several individual lenders, hence peer-to-peer.

Therefore P2P lenders, like Lending Loop, aren’t lenders at all. They are simply an intermediary between borrowers and lenders. It’s a two-sided marketplace that allows Canadians to lend and or borrow.

This is a stark contrast to traditional banks or other alternative lenders, who lend to borrowers using their own money. P2P lenders do not hold any loans on their books.

There are several established players in the P2P lending space globally, such as Funding Circle in the UK and Lending Club in the US. Canada was a bit slow to adjust the regulations to allow for P2P lending, but since the appropriate legislation was passed – Lending Loop has become the #1 P2P lending platform in Canada.

First, let’s look at how Canadian small business owners can obtain credit using Lending Loop.

Lending Loop For Borrowers

My company PureFilters is an active borrower on Lending Loop, so I have first-hand experience in how the process works. The first step is application.

Eligibility and Application Process

Lending Loop offers loans for up to $500k with payback terms up to 5 years. During the application process, you will need to specify the amount you are applying for as well as the payback term.

All you need to quality is $100k in revenue, at least 1-year business history, and a 600+ personal credit score. The larger the loan and longer the payback period, the stronger your financials and history need to be.

The approval process doesn’t take long and can be started right from their website. They request standard documents that any other bank or alternative lender would ask for, such as:

- Company financial statements

- Company tax returns

- Personal tax returns

- Government-issued identification

Specific due diligence documents will be requested on a case by case basis.

From there your company will either be denied the loan or sent a loan offer containing the interest rate and other important details.

NOTE: Lending Loop takes a personal guarantee on your loan. If your business cannot make the payments, Lending Loop will come after you personally to collect the remaining principal.

Interest Rates and Fees

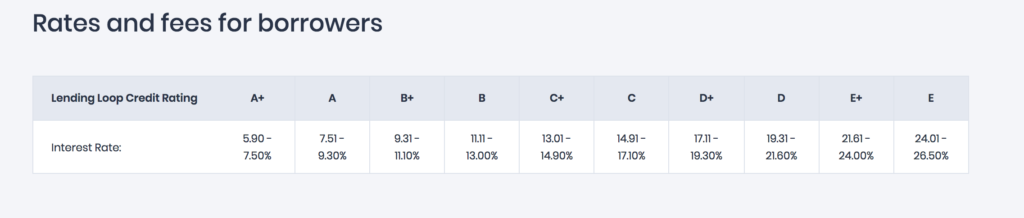

Lending Loop has an internal rating system in which they grade your company’s creditworthiness from A+ (best) to E (worst).

The interest rate for each rating is as follows:

Once you accept the offer, it usually doesn’t take more than a couple of days to get funded. Remember, when you take a loan from Lending Loop, several individual lenders have to pool their money to fund your loan. These individual lenders are the ones who are risking their money and subsequently earning interest from lending to you.

Another important thing to consider is that there is no pre-payment penalty or fees. Unlike loans from traditional lenders, you can pay off your entire loan early, and not be charged any sort of penalty or fee. I’ve even seen some lenders make borrowers pay the entire amount of interest that would have been paid over the remaining loan as the pre-payment penalty (ouch).

Lending Loop does none of that.

How does Lending Loop make money on borrowers?

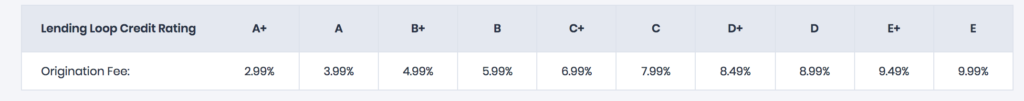

Simple – they charge a one-time origination fee, which is taken from the loan. So if you borrow $100k and the origination fee is 6%, they will wire you $94k once the loan is approved and closed.

The origination fee is quite steep compared to what a bank or an alternative lender would charge.

Here is a breakdown:

As you can see, this origination fee can have a material effect on the cost of borrowing using Lending Loop.

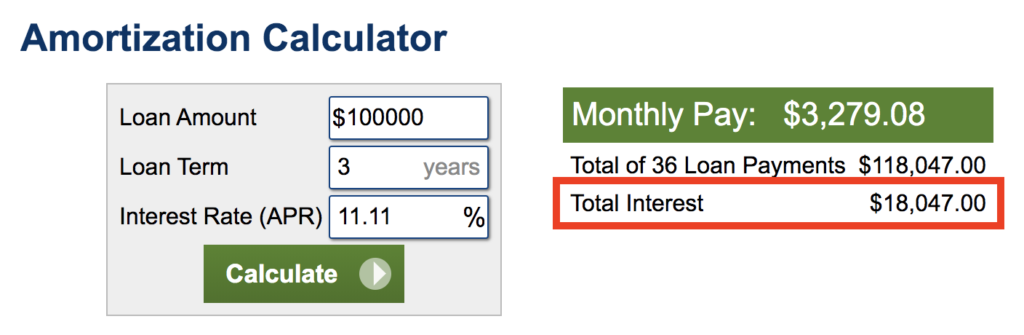

For example, let’s say you borrowed $100k with a 3-year payback and your business had a B credit rating, assuming an 11.11% interest rate. The interest you would pay over the 3 years would be $18,047:

Now add the 5.99% origination fee ($5,990) to this interest and your total cost of borrowing increases to $24,037, representing a 33.2% increase.

The overall cost of borrowing could still be lower than other alternative lenders, and the process is much smoother than Big 5 Banks.

The reason why Lending Loop’s origination fee is so high is because this fee is what drives the majority of their revenue. Since they don’t earn interest on the money lent out, the origination fee has to cover their overhead and generate a profit.

Now let’s take a look at how it works from the lender’s side.

Lending Loop For Lenders

Lending Loop enables individuals to lend to businesses across Canada and earn interest.

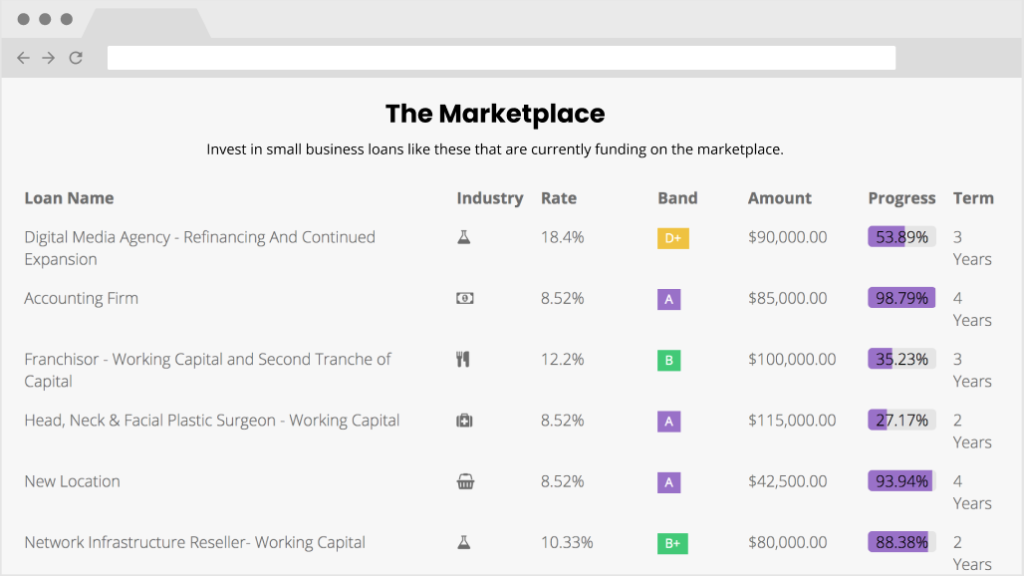

You can lend as low as $25 per loan and choose any business you prefer. They have a marketplace in which you can browse and hand-pick who you want to lend to and for how much.

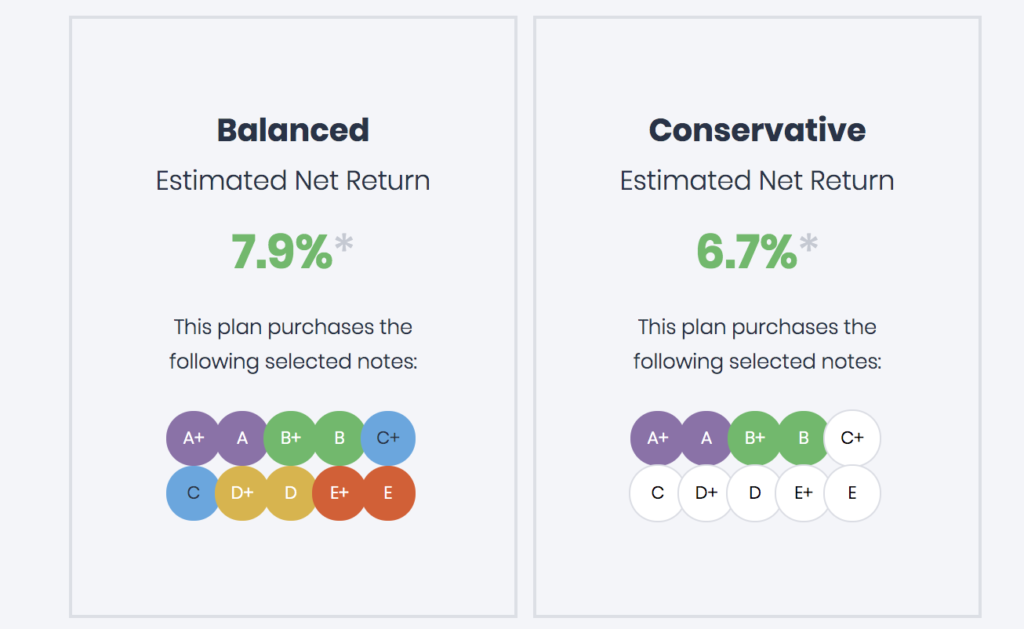

They also have an auto-invest feature where Lending Loop selects the loans for you based on your goals. You can see a couple of the options here:

You can even set credit rating allocations of your choice, in a “build your own” plan.

For example, you can set up the auto-invest to put $100 into every A and A+ loan, $50 into every B and B+ loan and $25 into every C and C+ loan.

With the auto-invest feature, your money is put to work on autopilot and you don’t have to spend time selecting loans.

If you prefer to manually select the loans you want to invest in, Lending Loop provides detailed information on each loan/borrower.

Borrower Information

The marketplace displays all of the currently available loans you are able to invest in. Lending Loop provides critical information on each business and the loan they are applying for.

Borrower and loan details include:

- Industry

- Credit rating & interest rate

- Loan amount

- Loan terms

- The legal name of the business

- Financial statements

- Personal and corporate guarantors

There is even a Q&A section where lenders are free to ask the borrowers anything they’d like. Lending Loop provides all the necessary information about borrowers in order for you to assess risk. The credit rating is a major factor and it fast-tracks lender decision making.

Not to mention, they do their due diligence by obtaining and verifying all of the necessary documents (my company went through this as a borrower). But there are some other key risks to consider here.

Investment Risk and Statistics

Interest rates reflect the riskiness of the borrower and small businesses are a very risky group to lend to. Some of the interest rates you could earn appear very attractive, but there is a hidden cost.

Small businesses have a high probability of failure, and so as a lender, you need to account for default risk (the risk that the small business won’t pay you back).

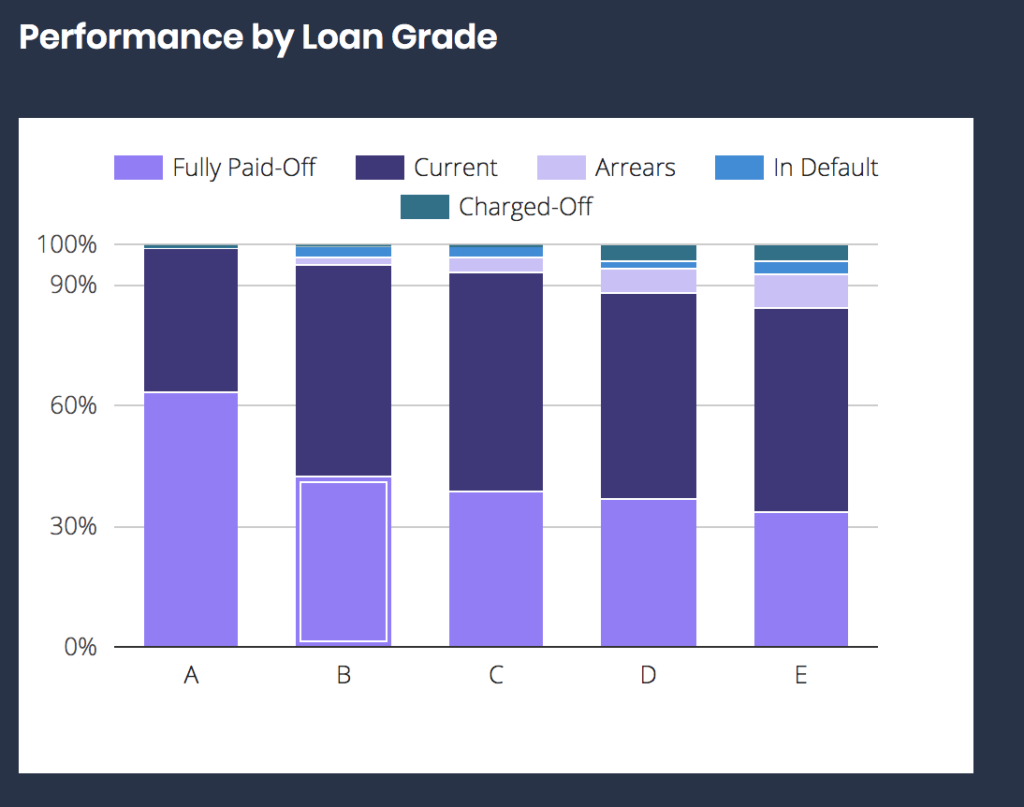

Lending Loop posts many of their loan statistics publicly on their website, however, this is probably the most important one:

Default/charged-off rates go from about 1% for A loans to about 10% for E loans. It’s a good idea to keep this in mind when selecting loans or setting up your auto-pilot. Whatever interest rate you are expecting to make in a specific credit rating, deduct the estimated default rate from that interest rate.

Also keep in mind that, as of writing this post, we are in the greatest bull market in history. If default rates range from 1%-10% now, what will they look like during a market downturn or recession?

Lending Loop takes a general securities agreement (GSA) and a personal guarantee from the owners, so if a payment is missed, they have the right to liquidate the business and or personal assets in order to repay the loan. If the business nor the owners have any assets – the loan could easily go $0 and the lenders lose the remaining principal.

Something else to consider is that Lending Loop doesn’t lend any of its own money, and therefore it has no “skin in the game”. This is an important consideration when thinking about defaults. Lending Loop doesn’t have much monetary motivation to pursue borrowers in default.

Another key consideration is that, unlike other P2P lending platforms, Lending Loop doesn’t have a secondary market. You cannot sell loans in your portfolio to another investor. This means you need to ride out each loan right to maturity.

What happens if Lending Loop goes under?

Lending Loop, like any other start-up, is susceptible to outright failure and closing down their operations. I have spoken to individuals on the Lending Loop team, and in this scenario, here is what would happen:

- All uninvested cash is held within a Canadian Big 5 Bank, which is protected by CDIC. So lenders will easily get this cash returned within days.

- All loans would continue to be serviced under a “skeleton” Lending Loop infrastructure, based on the technology they’ve built. Lenders will continue to earn interest without interruption.

- If 2) isn’t possible, worst-case scenario, the loan book may be purchased by a 3rd party loan servicing company. Lenders will continue to earn interest without interruption, however, there may be some added servicing fees.

They are venture-backed and well-capitalized, so the probability of this appears to be quite low. Even if Lending Loop did shut down, it appears that lenders’ money and loan portfolios will still be safe.

Is Lending Loop Worth It?

For borrowers, more options are always better. The interest rate charged is going to reflect your creditworthiness. For A and A+ borrowers, from what I’ve seen, the Lending Loop interest rates are comparable to BDC, Big 5 banks and other large/reputable institutions in Canada.

Not to mention, many of the institutional lenders in Canada are notoriously conservative. Most of them don’t do any sort of small business lending and have very rigid boxes your business needs to fit in. Lending Loop is a lot more flexible as individual investors are taking the risk of investing in your business.

The process of obtaining the loan for PureFilters was very simple and transparent. We have an account manager and an online portal where we can view payments, amortization schedule and all other matters related to the loan.

It takes no more than 5 minutes and a few documents to apply. So if your business could use some credit, why not give it a shot? You have nothing to lose (it won’t affect your credit score), just more options to grow your business.

For lenders, you should never invest anything that you cannot afford to lose (this holds true for any type of investment opportunity). In an environment with near-zero interest rates, low real-estate cap rates, and overpriced equities – Lending Loop offers an alternative investment option that could generate an attractive return.

You can get started with just a small deposit, and build your portfolio up slowly. There are no big commitments, so why not start small and see how it goes? Get yourself familiar with the platform and the type of borrowers on the marketplace.

Practice good capital allocation standards and diversify to the best of your ability. The idea is to invest small amounts (1% or less) in each business in order to build a resilient portfolio. This will reduce concentration and default risk dramatically while still earning an attractive yield.

The auto-invest feature is great for those investors that are simply too busy to constantly analyze individual loans. Private credit could make a great addition to your overall investment portfolio.

A few of my friends are a part of the team at Lending Loop and I can tell you first hand, they are very hard-working and intelligent people. I am rooting for them as they make waves in the small business financing industry in Canada.

I’ve personally invested 5 figures into the platform so far, and have been adding more over the past 6 months. My loan portfolio includes businesses rated from A to C and I have zero defaults to date (knock on wood).

I plan to make future posts on my progress and share my loan portfolio statistics here, so stay tuned!

Are you a Lending Loop borrower or lender? What has your experience been like? Leave your comment below!

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

One thought on “Everything You Need To Know About Lending Loop”