This week’s gem is an article about Thomson Newspapers. It’s a fascinating read, and a mandatory one for anyone invested in a compounder company, such as Constellation Software. Thomson Newspapers is what the end state looks like.

You can read the Thomson Newspapers article here (there’s also a link to Part 1 in the article, which I recommend reading too, but if you’re short on time, just read Part 2). This has to be one of the best articles/case studies I’ve read this year.

Thomson Newspapers was a rollup of small/niche local newspaper businesses. Roy Thomson stumbled upon the opportunity in his 40s, after several failed businesses.

Roy discovered that these local newspapers were mini-monopolies, they had strong pricing power and low capex requirements – delivering incredible cash flow relative to invested capital. The TAM for each local newspaper was very limited, and there wasn’t much interest (at first) in these businesses because they were so small, so Roy could acquire them cheaply. The idea was, he was going to continually reinvest the cash flow to acquire/aggregate many of them, and keep them all decentralized.

If this strategy sounds familiar, it’s because it’s near identical to Constellation Software. In fact, Mark Leonard has said that Roy Thomson was his inspiration and business hero.

Thomson Newspapers acquired around 170 newspaper businesses and became known as one of the greatest compounders of its time. They compounded earnings at 20% for 38 years (this is truly mind-blowing). It catapulted the Thomson family to become the wealthiest family in Canada (a title they still hold today).

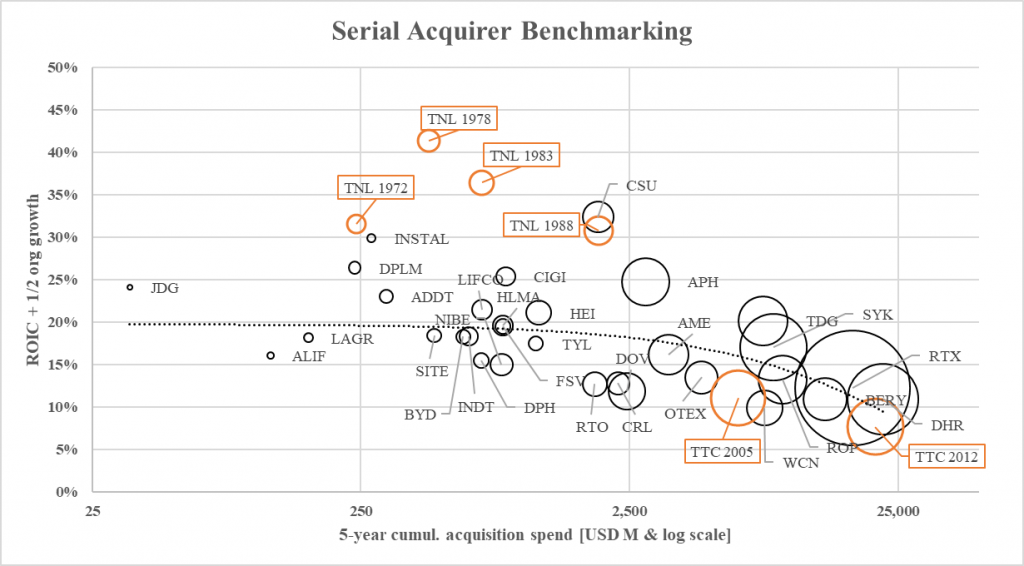

However, competition to acquire these newspapers rose sharply, and as a result, they became more expensive to acquire. This inevitably put downward pressure on ROIC. In the end, the entire business was disrupted by Cable TV. Take a look at how ROIC tracked over time below, in comparison with other serial acquirers:

The author did an incredible job researching and putting together such an insightful article. I think the key takeaways section he included at the bottom of the article really nailed it. I’ll rehash some of them here:

- Everything is cyclical, it’s just some cycles are longer than others. But all business models have an expiry date. Be careful of extrapolating historically positive metrics far into the future.

- “Growth” via price increases alone can be misleading for investors. It can mask a deteriorating industry, and make the product/service offering unattractive to customers compared to alternatives. As someone who frequently talks about pricing power, this one was a tough pill to swallow.

- Everything is supply and demand. Attractive acquisition opportunities will spawn copycats (demand goes up, capital flows in). This will inevitably push purchase price up and ROIC down, reverting an attractive opportunity back to an average opportunity. Pay attention to capital flows.

A quick shout out to Jock for sharing this article with me and Fabian for writing it.

3 thoughts on “Issue #48: Thomson Newspapers”