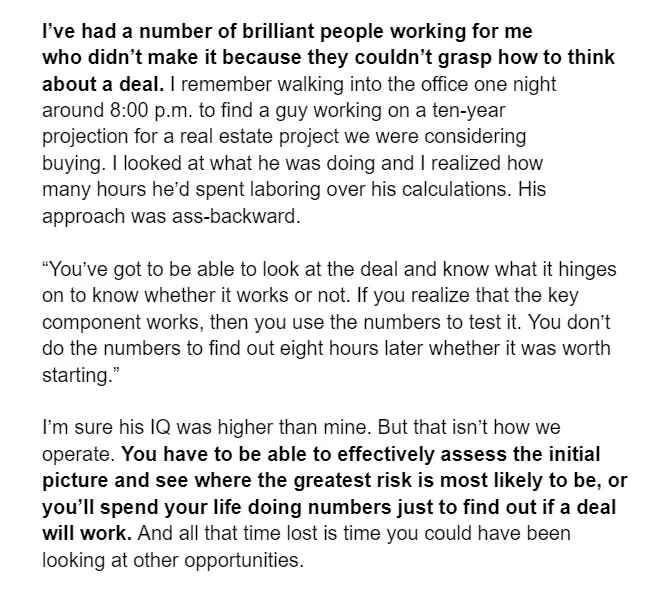

Today’s gem is this anecdote from Sam Zell (rest in peace) on assessing an opportunity:

More research & analysis doesn’t result in better investment performance. But oftentimes (and dangerously so), it results in more confidence, and at the very least, wasted time.

Talented investors can quickly determine what are the 3-5 value drivers for an investment, and the 3-5 key risks. And then focus efforts on analyzing, researching, and diligencing these factors.

At Atlasview, aim to quickly determine what are the main ways we’d make money on a deal, and the main ways we’d lose money. Sometimes we can figure out these things by looking at the business, its industry, and its financials (we have set criteria we look for). Sometimes we can figure out these things by speaking with the management or their advisor. But once we determine what the key value/risk factors are, we formulate our thesis and then focus our diligence efforts accordingly.

As an investor, your time is precious so the opportunity cost of wasted time is high. It doesn’t make sense to get lost in the 11th tab of Excel, or reviewing the 78th customer contract if your deal or overarching thesis doesn’t make sense in the first place. Prioritize your time accordingly!

Shoutout to Frederik for sharing this gem. He is a great follow on Twitter. And if you haven’t read Sam Zell’s book Am I Being Too Subtle? I highly recommend it. It’s a phenomenal read from one of the most legendary entrepreneurs of all time.