NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

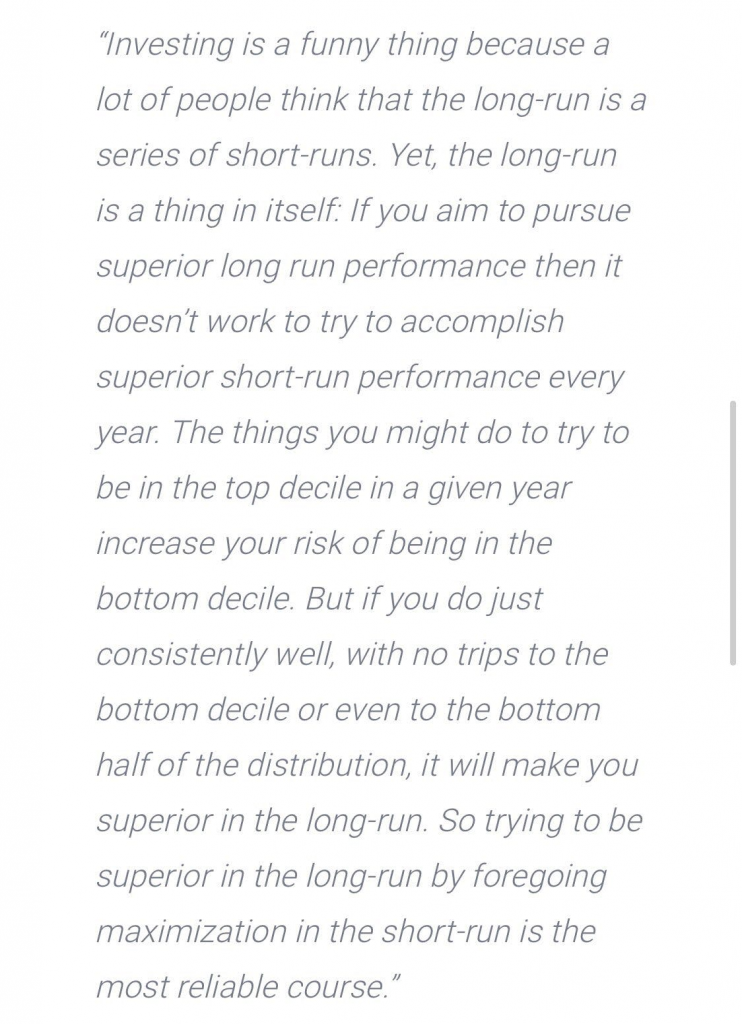

Today’s gem is this anecdote from Howard Marks on long run vs short run investment performance:

Incredible (and accurate) framework. The key to extraordinary returns over the long run… is being able to survive the long run.

If your goal is superior long-run investment performance, you should be willing to sacrifice maximizing short-term returns. Sounds easy but, in my opinion, it’s actually hard to do in practice. Investors are human, and humans are prisoners to psychology. We get FOMO, greedy, envious, and fall into the trap of trying to maximize short-term returns, for both financial reasons and (worse yet), bragging rights.

The next time you get FOMO from seeing another investor post an extraordinary top-ranking return for a single year – keep in mind, there’s a high chance of undue risk which will unwind that return in future years. If you examine the last few years, you will find plenty of examples of this.

Optimize for consistency + longevity instead of trying to hit home runs each year. Good risk management means purposely leaving money on the table, no matter how tempting it looks on paper.

2 thoughts on “Issue #43: Howard Marks on Long Run vs Short Run”