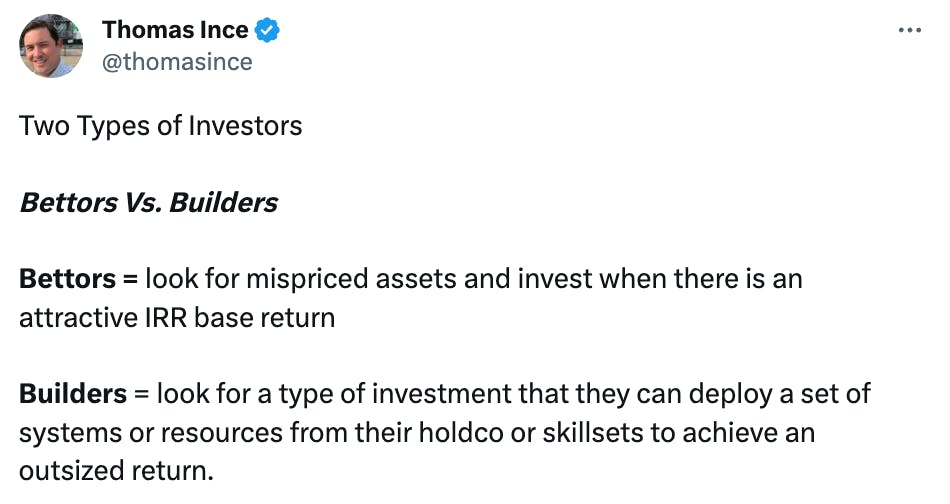

This week’s gem is a tweet that summarizes two types of investors, bettors vs builders.

I generally agree with this framework. Both types can make money. Both types also have their limitations:

For bettors – markets are generally quite efficient, so finding mispriced assets is a rare feat. Not to mention, the market might be pricing the assets correctly and you might be missing a major risk.

For builders – over time the synergies get priced in. Similar to the previous point, markets are generally efficient, and prices will correct to include your set of systems that (initially) generate an outsized return. Learned secrets become widely dispersed, and copycats emerge, pushing asset prices up and IRRs down. We’ve studied this with Thomson Newspapers and many other rollups.

So of the 2 types am I?

For my public equities investments, I am obviously a bettor, since I lack control over these companies (there’s nothing I can “build” or influence). I look for companies that I believe have a reasonable shot at compounding capital at an attractive rate of return, run by competent management, and which I can purchase at an attractive entry multiple. Attractive entry multiple (mispricing) is important because without it you could be looking at a great business but a bad investment.

For my private equity investments, though I have systems/resources/skillsets I deploy to influence returns (reach out to learn more about Atlasview’s playbook) AND the ability to change CEOs/management… I still lean towards bettor. This means I am still seeking assets I can purchase at an attractive multiple (aka mispriced). That attractive, mispriced, entry point is critical, especially in private markets investing because mistakes are unforgiving. It’s hard to sell out of a position, and the transaction costs are immense. You need to make money on the buy, that margin of safety needs to exist in case your projected synergies post-acquisition don’t pan out as expected.

Thomas is a sharp investor and shares a lot of useful content on Twitter, give him a follow!