NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

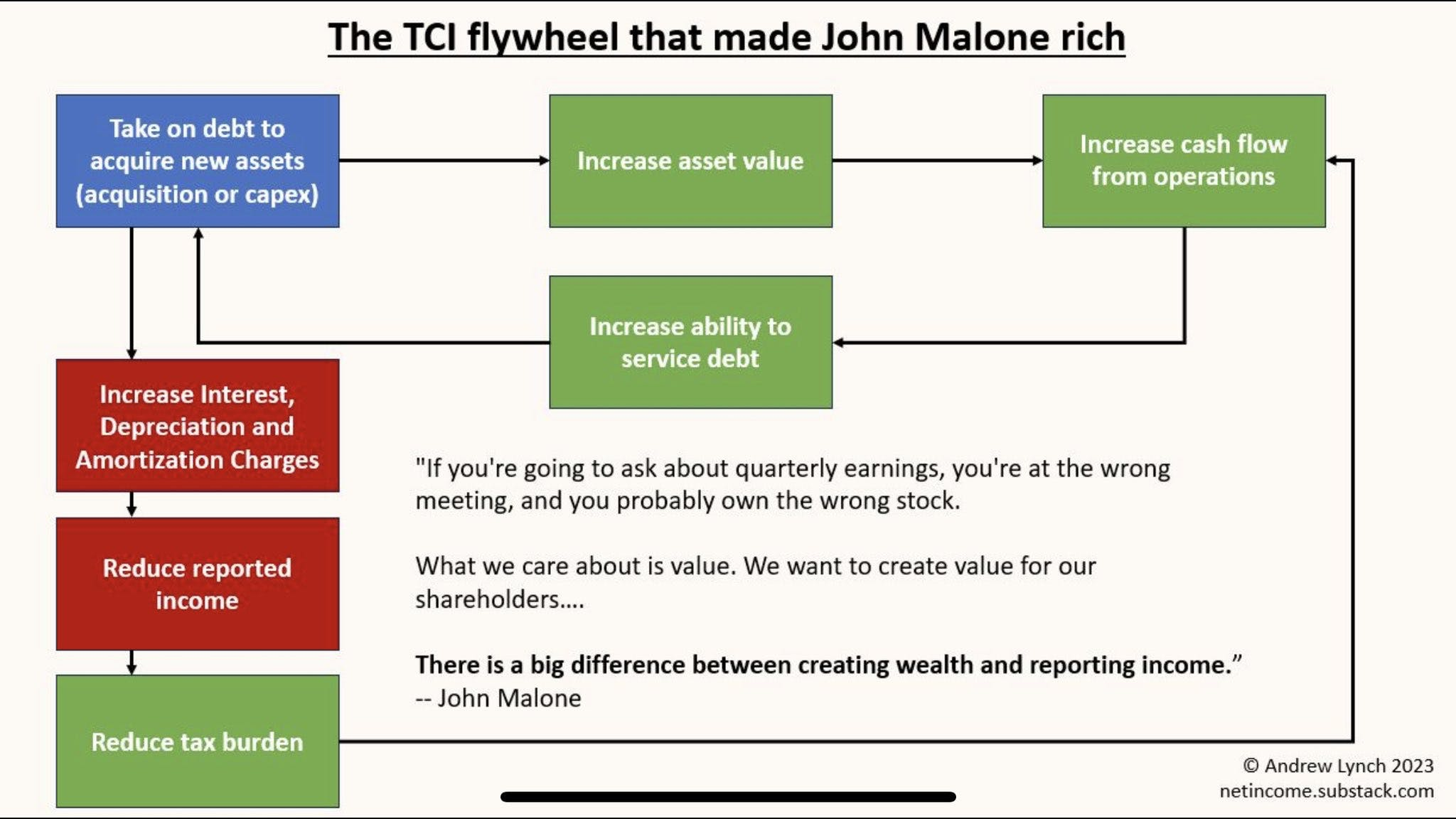

Today’s gem is a flow chart that depicts the general framework that John Malone used in building TCI. The framework outlines how Malone borrowed an obscene amount of money, massively reduced taxes… and minted a multi-billion dollar fortune for himself.

But before we dive in, a quick word from our sponsor:

I’ve used virtual assistants my entire career, and it’s truly been a game-changer for my businesses. They help with everything from managing my inbox to monthly bookkeeping and a wide range of admin tasks.

If you’re looking to hire an EA, check out Athena. They will set you up with an amazing (yet very affordable) full-time executive assistant based in the Philippines who works in your time-zone and speaks fluent English. What impressed me most is that they have a library of playbooks that you can copy-and-paste capabilities directly into your EA.

They’re providing a great deal for my newsletter subscribers – if you sign up before September 31st, you skip the waitlist (it’s long!) and save $1500 along with personalized onboarding. Take advantage of this offer asap here!

This flywheel enabled John Malone to compound shareholder equity at 30% per year for 25 years. During the period between 1973 and 1989, TCI (a cable company) completed 482 acquisitions, one every other week. TCI was eventually acquired by AT&T 1999 for $60bn ($110bn in today’s dollars).

John Malone loved 2 things: borrowing money + avoiding taxes.

He loved borrowing money so much that he invented an entirely new metric (EBITDA), just so he could borrow more money. He felt that net earnings weren’t accurately portraying the amount of cash that TCI had available to service debt. So he convinced banks to lend based on EBITDA instead, thus allowing TCI to borrow more money, to buy more assets, to increase EBITDA, to borrow more money, and so on…

This financial reporting innovation has obviously led to widespread adoption. EBITDA is literally used everywhere today. Even companies that shouldn’t be measured by EBITDA, are being measured by EBITDA. And, all thanks to Mr. Malone’s stroke of genius, everyone is able to borrow more money.

John also boasts that he didn’t pay a dime of corporate taxes in 30 years while building a multi-billion dollar cable empire. Buying tax-depreciable assets that actually appreciate in economic value (all while deducting interest on borrowed funds) can do wonders in minimizing/eliminating the tax bill while increasing wealth. His obsession with reducing taxes isn’t unique, and in fact, is a commonality among many legendary capital allocators.

Shoutout to Andrew Lynch for putting this together. Give him a follow!

P.S. For further reading on John Malone, check out the book Cable Cowboy. It’s a fascinating read.