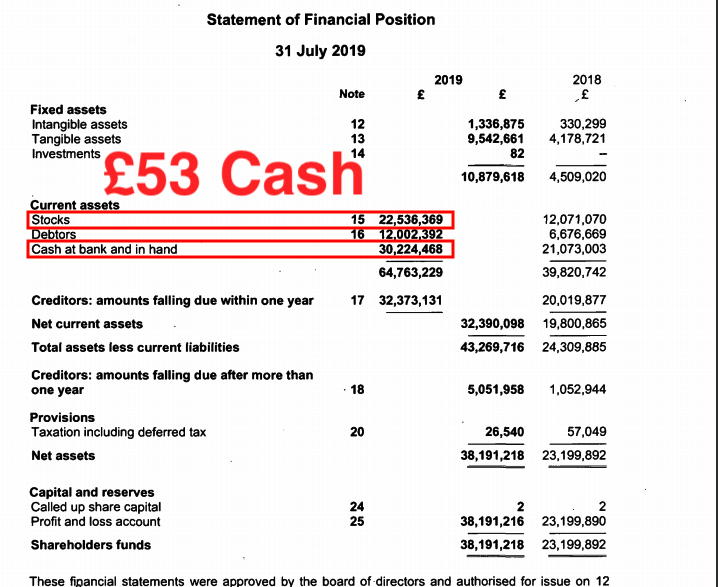

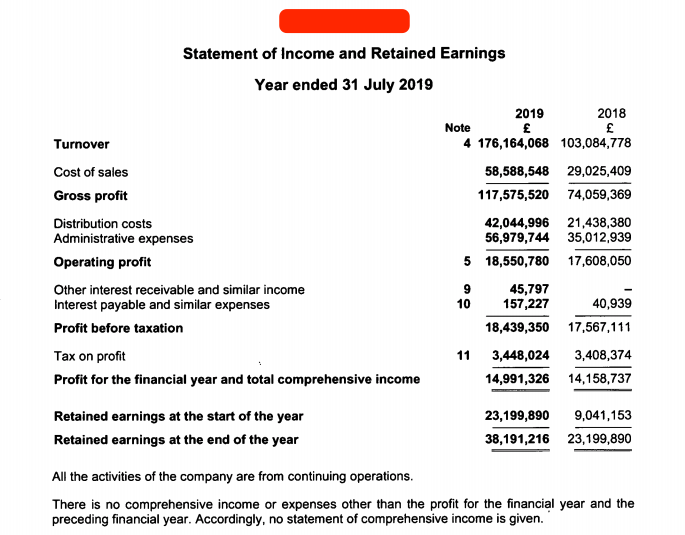

Recently, the financial statements of Gymshark, a £177m/year eCommerce business, were made public by Sam Parr. There are so many things that impressed me about their financials, but what stood out the most was their £53m ($67m USD) cash balance.

This cash position, of nearly 4x their 2019 after-tax profits, gives their business an incredible amount of power and options.

Considering their rapid growth, the fact that they have very little long-term debt, and no outside investors (the founders own 100% of the business), you might be wondering, how is it possible to have that much cash?

The answer: a negative cash conversion cycle.

Anyone running an eCommerce business knows what rapid growth can do to your cash balance. As you pay down suppliers and order more inventory, in a blink of an eye, your cash can drain to zero.

Here are some short-term cash solutions for your business if you’re really in a pinch. However, for a long-term strategy, optimizing your cash conversion cycle can prevent this cash drain from happening.

In this post, I’ll show you how Gymshark achieves a negative cash conversion cycle and share strategies you can implement for your own business.

What is cash conversion cycle?

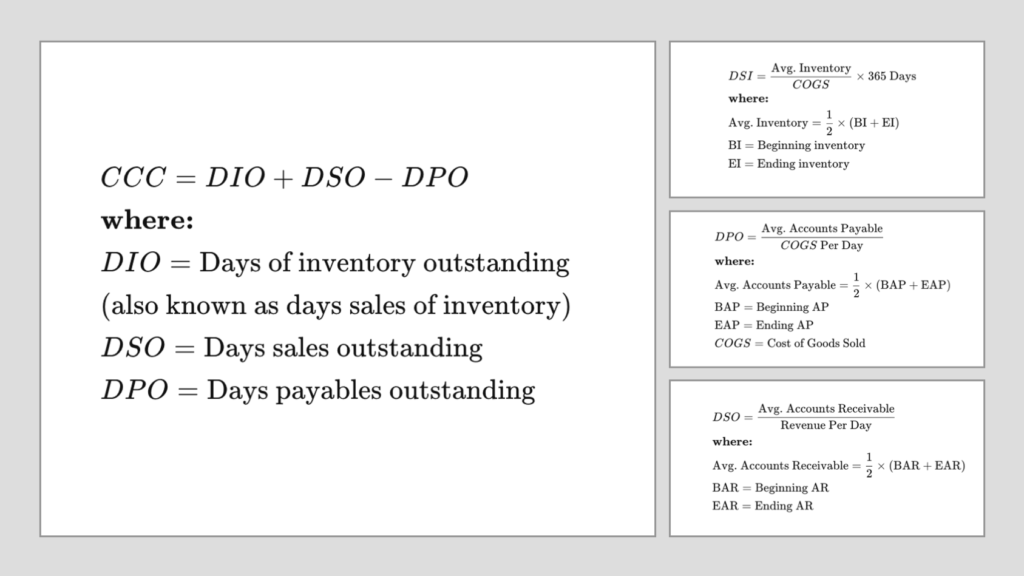

Cash conversion cycle (CCC) is a measure of how many days it takes for a business to turn invested cash (usually purchased inventory) back into cash in its bank account. CCC is a critical metric that any physical goods business should vigilantly track using this formula:

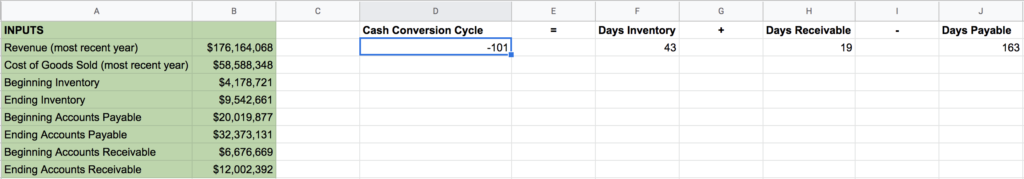

I know the formula looks a bit complicated, so I simplified it in Google Sheets (File > Make a copy). I also calculated Gymshark’s CCC and the result was -101 days.

A negative cash conversion cycle means that their vendors are financing their operations, which I’ll explain in detail below. No extra cash needs to be injected into their business as they scale. In fact, as their sales grow, their cash balance magically increases instantly.

Amazon and Walmart, two of the most successful retailers of all time, have a very low or negative CCC as well.

But most businesses do NOT have a negative cash conversion cycle. Typical eCommerce businesses I’ve come across have a CCC between 40 to 100 days. That means there is always 40 to 100 days of operating cash “stuck” in working capital. And as your business grows, the cash that is “stuck” will grow as well, meaning you’ll need to continually invest new cash into the business.

To give you an example, let’s say your CCC is 60 days and you’re selling $3k/day. That means that $180k worth of cash is always locked inside your business. And if your sales increase to $4k/day, that amount increases to $240k and you’ll need to invest $60k into the business.

This will keep your eCommerce business cash-poor.

I’ve experienced this myself with my eCommerce business. In the early days, rapid growth meant that I kept having to inject more money into the business. After a while, I started focusing on improving CCC, and we’re in a much better position today as a result.

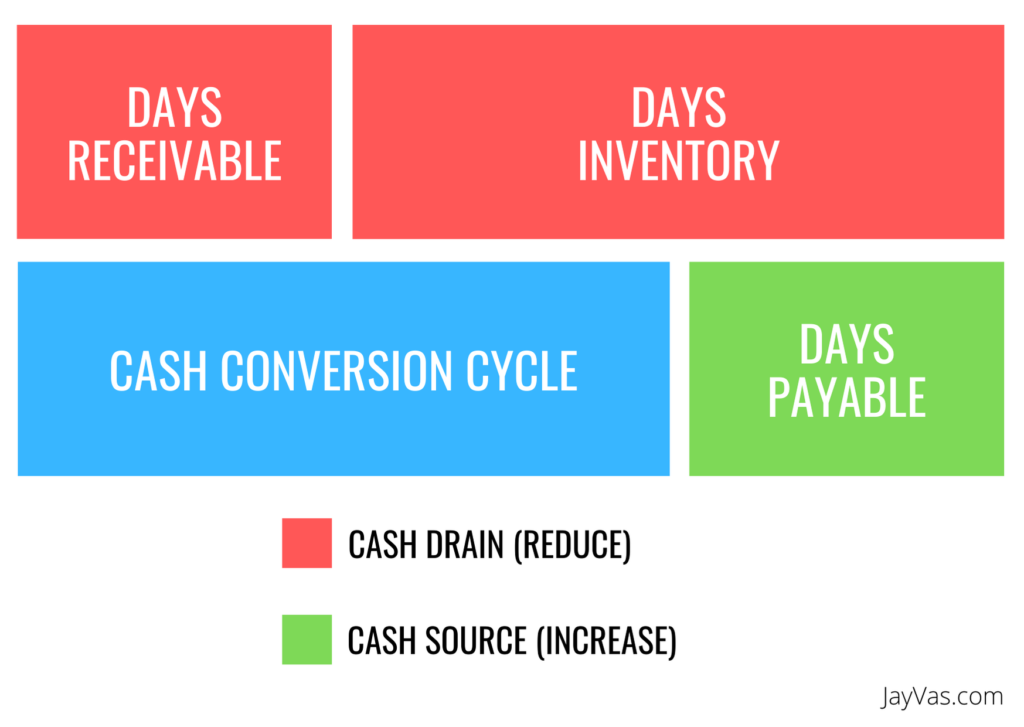

There are 3 levers you can pull to improve CCC:

- Increase accounts payable

- Reduce accounts receivable

- Reduce inventory

Increase accounts payable

The most important component, in my opinion, is your accounts payable.

Most vendors typically give their customers 15 to 30 days to pay their invoices. That doesn’t mean you shouldn’t ask for more. As your business grows, and relations with your vendors improve, you should be constantly negotiating for longer terms or more credit.

Vendor credit is great. It usually doesn’t bear any interest, require personal guarantees, and it isn’t collateralized against any assets.

Gymshark’s days payable is 163, which means that on average their vendors give them 163 days to pay their bills. This is what I meant earlier when I mentioned that their vendors finance their operations. They purchase inventory and don’t have to pay their invoice until 163 days later, but they sell the inventory well before then.

Obviously, a lot of it has to do with their reputation and size. But I am sure they started with 15 to 30-day terms just like any other eCommerce business.

Reduce accounts receivable

Most eCommerce business don’t have an accounts receivable balance. The most they’d ever have is a couple days worth of deposits receivable from a payment processor.

However, it’s possible to have a negative accounts receivable, commonly known as unearned income (in traditional accounting standards). This situation happens when your customer pays you for a product upfront that you don’t have yet or a service that hasn’t yet been rendered.

Most dropshipping businesses usually have negative AR. But if your suppliers aren’t dropshopping for you, there are 3 other ways you can have negative AR.

- Take preorders – if you have a new product in the pipeline, start taking preorders (Elon musk style). For a long-term play, launch new products frequently.

- Batch shipping – this works if your supplier is located close to your warehouse. Order inventory once a week based on the customer orders received that week (rather than ordering inventory upfront). This way, you get cash upfront and purchase inventory after.

- Annual memberships – selling customers on paying for an annual membership upfront, rather than monthly billing, will vastly improve your cash. This one is more for SaaS and subscription eCommerce businesses

You’ll need to work with your customers and suppliers and tweak your processes to pull off these tactics. But if successfully implemented, it can do wonders to your long-term cash flow.

Reduce inventory

Last but not least, we have inventory. Inventory is probably the biggest drain on any physical goods business. There are a bunch of ways to reduce inventory which you can easily find on Google. But here are 2 non-obvious strategies I’ve used to reduce inventory:

- Ask suppliers to set aside inventory – ask your supplier to set aside commonly ordered inventory for you at their factory/warehouse, and only bill you for it once it has been shipped out of their warehouse. This will help with the batch shipping strategy mentioned above, and reduce or eliminate inventory you hold.

- Reduce the amount of SKUs you hold – hold only the most popular SKUs at your warehouse. For unpopular SKUs, simply increase the delivery time for your customers. This will allow you to order inventory for unpopular SKUs, subsequent to receiving customer orders for it.

You want to be able to sell all ordered inventory before your vendor’s bill is due (that’s how to achieve a negative CCC).

Final thoughts on cash conversion cycle

Gymshark is an incredible story. They grew from zero to nearly £200m/year without taking on a bunch of long-term debt or outside investors.

Many people see Gymshark as a company with amazing marketing and great leadership. But after seeing their financials, it’s obvious that they’re also a company with incredible financial management.

If you’re running an eCommerce business, you should be measuring and optimizing your cash conversion cycle regularly. Your CCC can mean the difference between being cash-poor or cash-flush.

The ultimate goal is to have a negative cash conversion cycle. Once you achieve this, you have a business that is a cash-generating machine.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

9 thoughts on “The Power Of Having a Negative Cash Conversion Cycle”

Thanks a lot for this one. It will help me in my ecommerce business

Super helpful article! A question: would you calculate your beginning inventory by simply calculating how much inventory you have in stock? For example, you sell a bracelet for $5, and you have 500 units of these in inventory, therefore you have $2500 in beginning inventory? Thank you!

Brilliant article. It’s hard to find this type of practical, technical advice

Great article, Jay. I don’t run an ecommerce business, but for someone interested in financial management, your breakdown on CCC was insightful and fun to read. Thanks.

Hi Jay! Thank you so much for the article – it was very interesting and a useful walk-through. I do not mean to nitpick, but I noticed a very minor number off in the Google Sheets – COGS should be $58,588,548 as opposed to $58,588,348. It’s immaterial, but thought I would let you know. Thank you again; I really enjoyed the post. Best, Kelleigh