NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

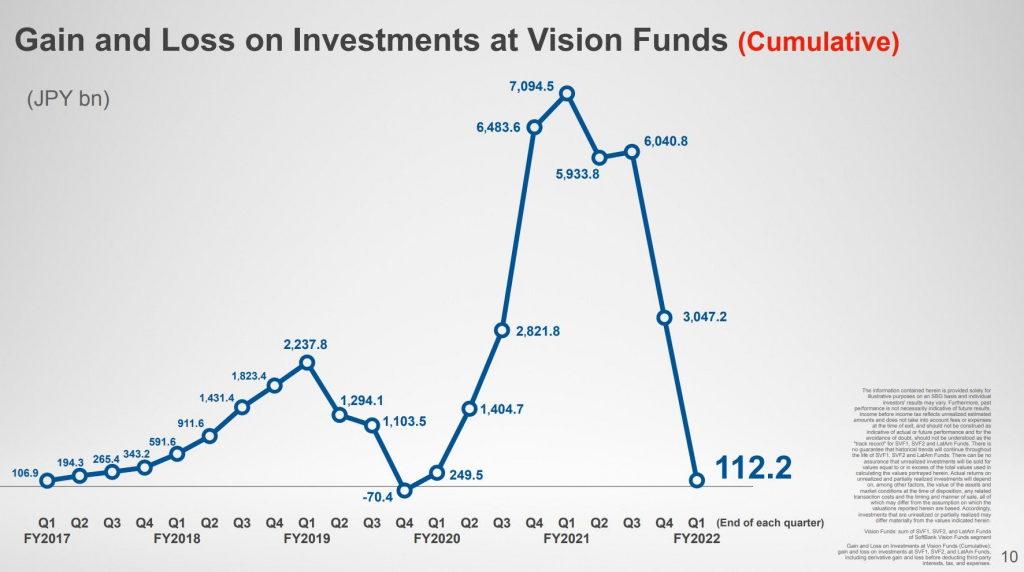

Today’s gem is this chart showing the cumulative returns that SoftBank’s ~$130bn Vision Funds have generated (112bn JPY = $840m). $840m is roughly 0.6% cumulative profit on ~$130bn.

There is a lot to unpack in this chart, but three main things stick out to me:

1) Investing is HARD

Don’t let anyone tell you otherwise. Investing is a hard sport, regardless of how smart you think you may be. I don’t share this chart and as a way to put down SoftBank or anything. Believe me, I’ve had my fair share of losses this year. Bull markets can make everyone feel (and appear) smart. A good ole fashioned bear market is what makes reality set in.

As Buffett once said: only when the tide goes out do you discover who’s been swimming naked.

2) Investing large sums of money is HARD x2

Investing is hard as it is, but effectively investing $130bn+ is an insanely hard feat.

Size is the enemy of returns. Why? Because as the pool of money gets larger, your options become severely limited. Asset prices become more efficient (and dare I say… overvalued). And markets become ultra-competitive. This results in returns compressing. Just think, in order to just meet market averages of say ~7% per year, SoftBank would need to generate roughly $9bn in profit per year.

In order to meet this hurdle, you simply cannot invest in small companies, where inefficiencies and juicy returns generally exist. Atlasview Equity is focused on the lower middle market, where we come across plenty of opportunities that exist simply because they are relatively small and thus overlooked.

3) Stay humble

In this line of business, hubris always leads to humility. Success is never permanent and needs to be earned and protected every single day. Staying curious, willing to constantly learn, accepting opposing views, and seeking feedback is the only way to stay in the game over the long run.

I never get too excited whenever I experience a big win, because I know there’s a humbling waiting for me just around the corner.