NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

Before we jump into this week’s issue, check out Atlasview Equity’s latest post on The Lindy Effect. We discuss longevity driving resilience and why we optimize for businesses that stay stable over time.

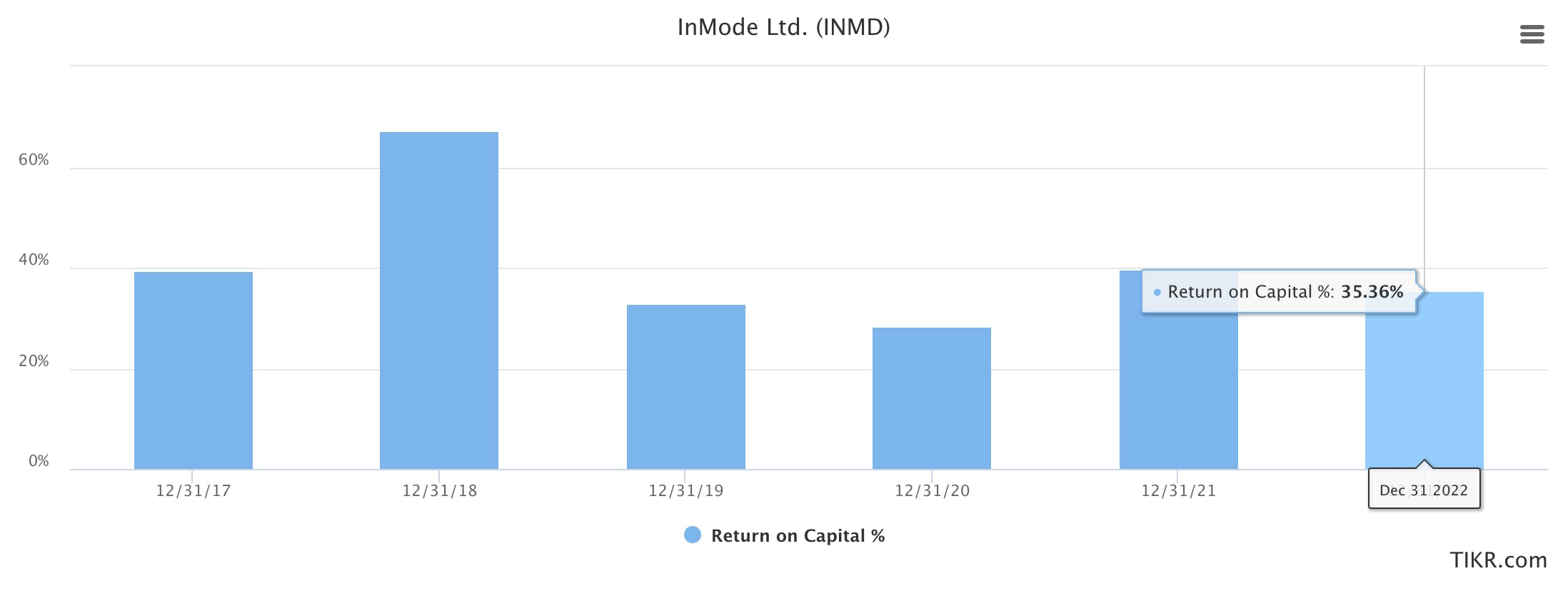

A good business generates a high return on its invested capital (ROIC). The basic ROIC equation is profits divided by invested capital, aka the capital needed for its operations.

Asset-light businesses are businesses that don’t require a ton of capital for operations. That includes both working capital (inventory, accounts receivable, etc). and fixed assets (plant, property, equipment, IP, etc.).

So because the denominator is small (invested capital), it doesn’t take much in the way of profits for an asset-light business to produce a high ROIC.

Let’s take InMode for example, a company in my stock portfolio (wrote a short piece on the biz a few years ago). The business doesn’t require a lot of capital to manufacture its patent-protected medical devices. Their customers use 3rd-party financing, so InMode gets paid upfront (no A/R, little inventory). And finally, the company operates with high gross and net margins. As a result, they’ve been able to produce an astounding 30%+ ROIC consistently.

So what’s the problem?

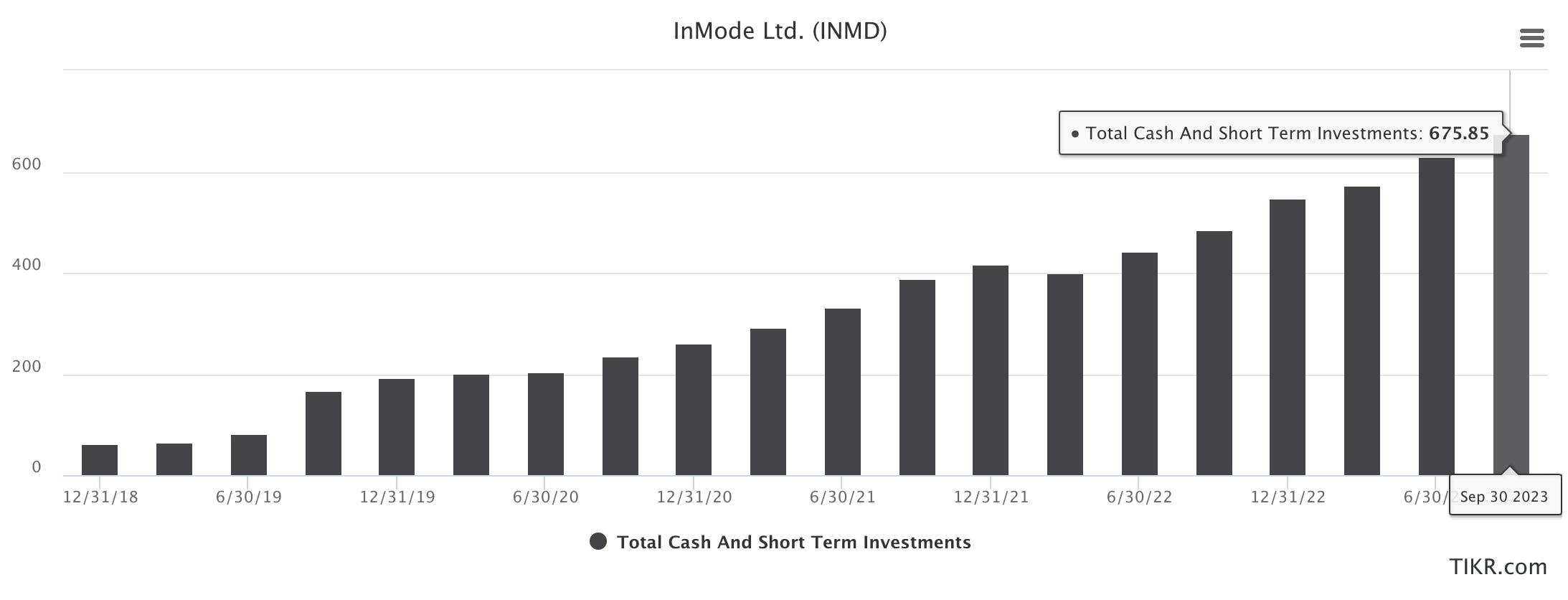

It appears that they’ve run out of organic opportunities to reinvest their massive profits in. They have generated so much cash, that they literally don’t know what to do with it. In fact, there is more cash on their balance sheet today (~$675m) than the value of the entire company when they went public in 2019 (~$400m).

InMode has the same problem as Frank Lopez from Scarface, as he describes here.

This is the double-edged sword of asset-light businesses. They typically produce a high ROIC, but often don’t have opportunities to reinvest their profits in. Since the business doesn’t require much in the way of assets, InMode isn’t able to reinvest a substantial portion of its cash into growth capex, at least not on a risk-adjusted basis.

Businesses that can’t reinvest the profits they generate will have a hard time generating compound returns for their owners.

(I’ll add one caveat here: in very rare cases, there are exceptional businesses that can grow exponentially without incremental capital, like the UFC.)

Solving the asset-light problem

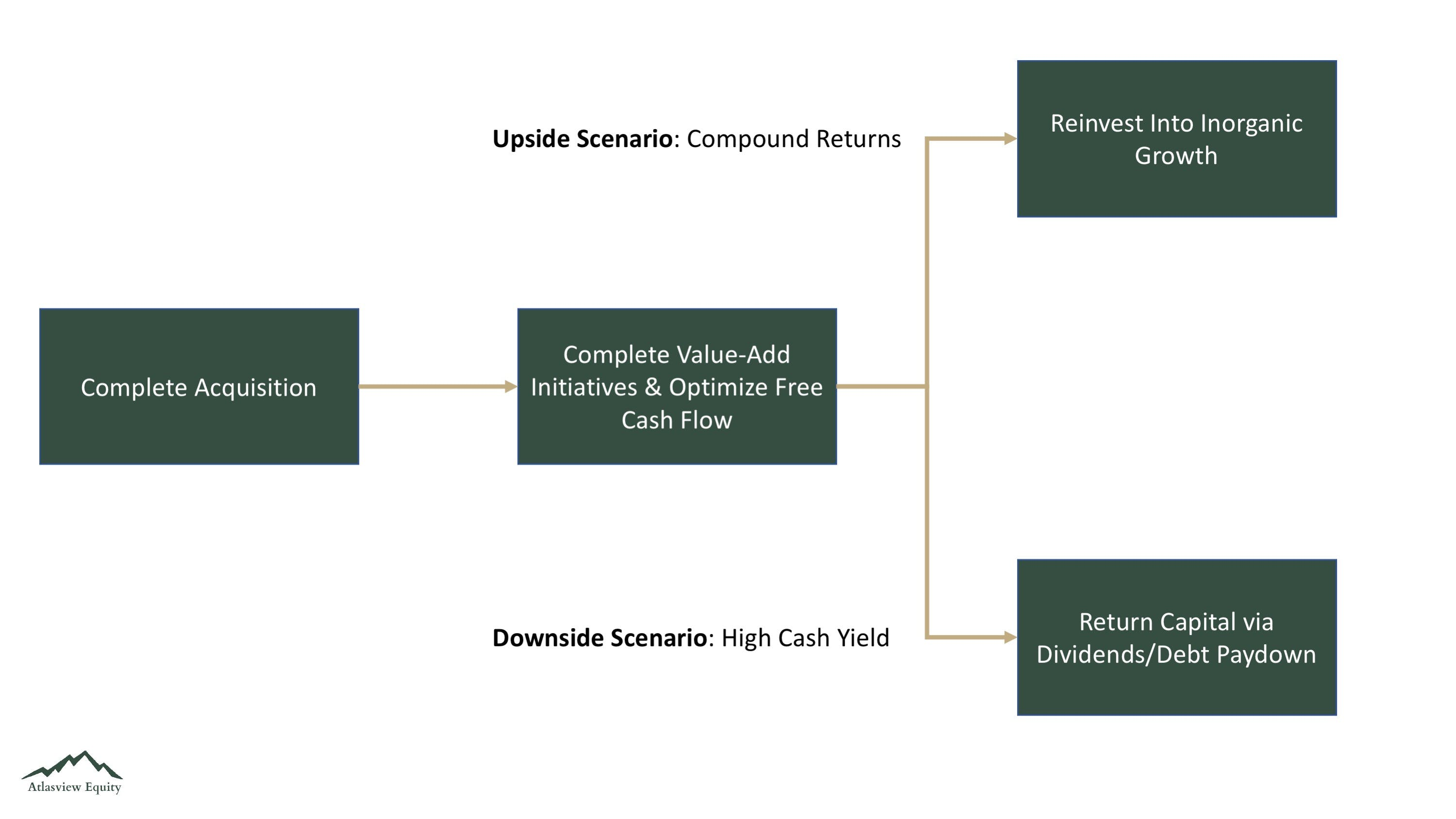

My investment firm, Atlasview Equity, specializes in buying asset-light businesses. The scenario with InMode is pretty typical of most mature software businesses: high ROIC but no reinvestment opportunities. Though these businesses produce a high level of free cash flow, there aren’t obvious organic initiatives (like sales/marketing/R&D/ops) to reinvest that cash in.

So how do we solve for this?

In 1 of 2 ways:

- Return the cash to investors while the business grows modestly, still generating a respectable ROI (see Autozone)

- Reinvest the cash externally to the business via acquisitions (aka inorganic growth) and generate compound returns

This chart summarizes what we do with the asset-light businesses we buy:

Reinvesting externally to buy other complementary businesses requires a lot of capital, and opens up an entirely new universe of opportunities. As a result, the reinvestment runway for inorganic growth can be very long. Last week, I wrote a piece on serial acquirers that covers this in further detail (and in case you’re wondering, the mystery non-serial acquirer business I mentioned in that piece is indeed InMode).

So to conclude…

Good businesses generate a high ROIC but great businesses reinvest at a high ROIC. Asset-light businesses often fall into the former category, but with good capital allocation, can still deliver fantastic returns.

—

For whatever reason, InMode has been reluctant to return the cash back to shareholders. Investors have pressed the CEO on this, and based on this response, doesn’t look like share buybacks will happen anytime soon. A classic example of a great operator =/= a great capital allocator. If any of my readers are activist investors…InMode’s board could use someone with capital allocation experience!

Disclaimer: none of this is investment or financial advice. Always do your own due diligence and consult with your advisors before making any investment or financial decisions.