NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

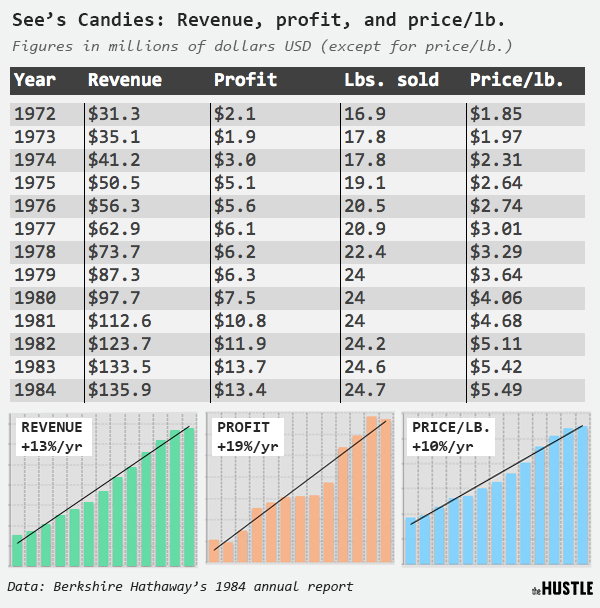

Today’s gem is this chart illustrating key figures for See’s Candies in the 12 years following the company being acquired by Berkshire Hathaway.

Warren Buffett noticed how loyal See’s Candies customer base was and concluded the business had pricing power (which wasn’t being realized to its potential). The first thing he did post-acquisition was implementing 10%/yr price hikes.

Without these price hikes, the business would’ve only grown around 3%/yr (the growth in Lbs. sold), barely keeping up with inflation. But as the chart shows, the 10%/yr price hikes grew profits by nearly 20%/yr. The business has a couple more important features: stable opex & low ongoing capex. This allowed the business to nearly 7x profits in the first 12 years post-acquisition.

Berkshire Hathaway paid $25m for the business and didn’t have to put up any more money post-acquisition. This means that, within just a decade, the business was generating profits of over 50% of the total investment…every year! Berkshire still owns See’s Candies to this day, and the business has generated over $2bn in lifetime earnings. Not bad for a $25m investment that they haven’t even sold yet!

These are the types of businesses Atlasview Equity looks for: mini See’s Candies. Businesses that have pricing power, with low ongoing capex and relatively stable capex. We get especially excited when we find businesses with untapped pricing power potential.

The chart is from this article, which I recommend reading. And in case you missed my blog post from last week, here is Why I’m Obsessed With Pricing Power.