NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

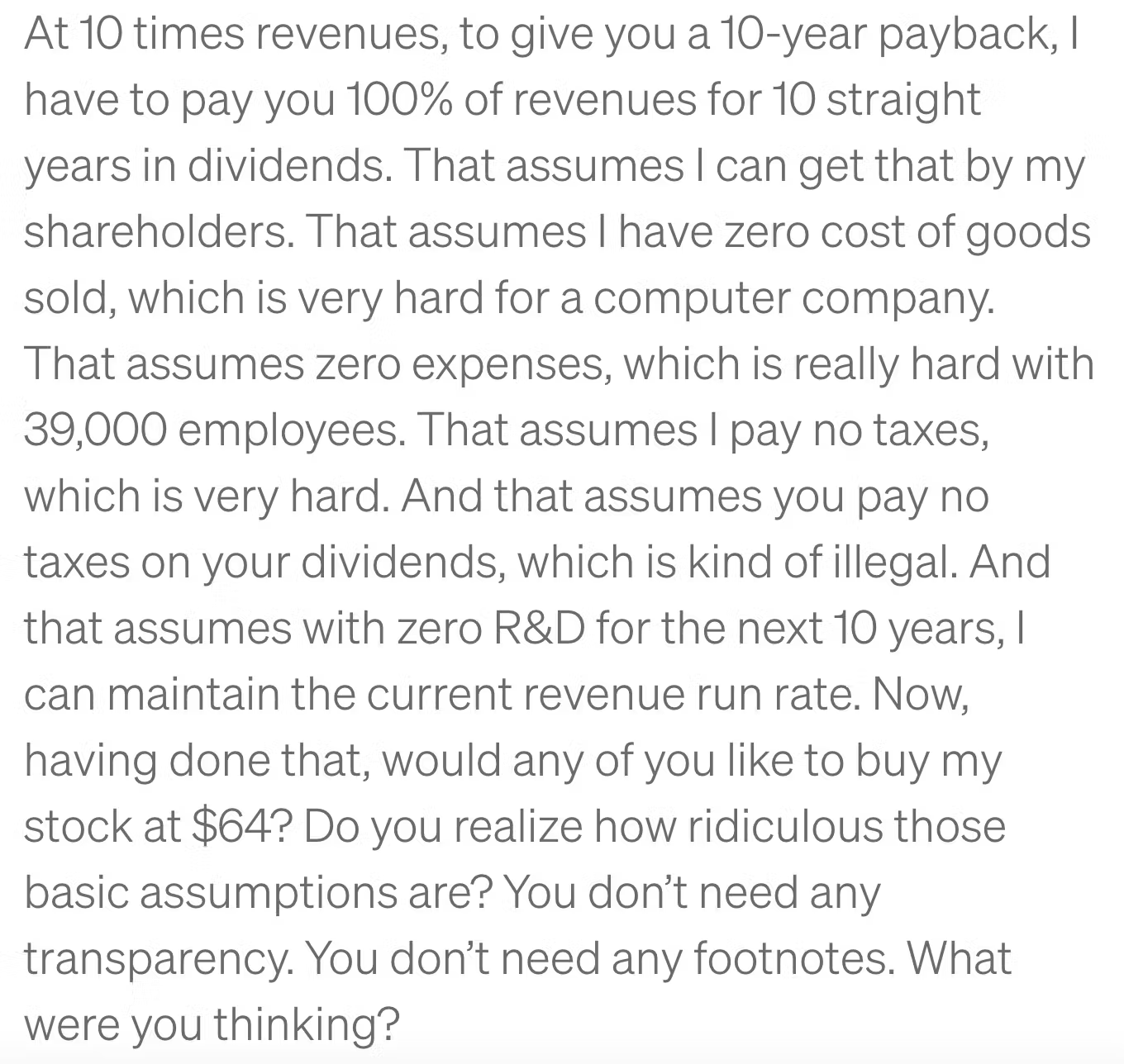

Today’s gem is this 2002 interview excerpt where Scott McNealy (former CEO of Sun Microsystems) explains to shareholders the ridiculousness of a 10x revenue multiple:

This is a wild thing to say to shareholders, but seriously, what were they thinking?!

During the dot com bubble, Sun Microsystems stock shot up from $5 to $64. It then collapsed back down to $5 before being acquired by Oracle for $9. Ouch.

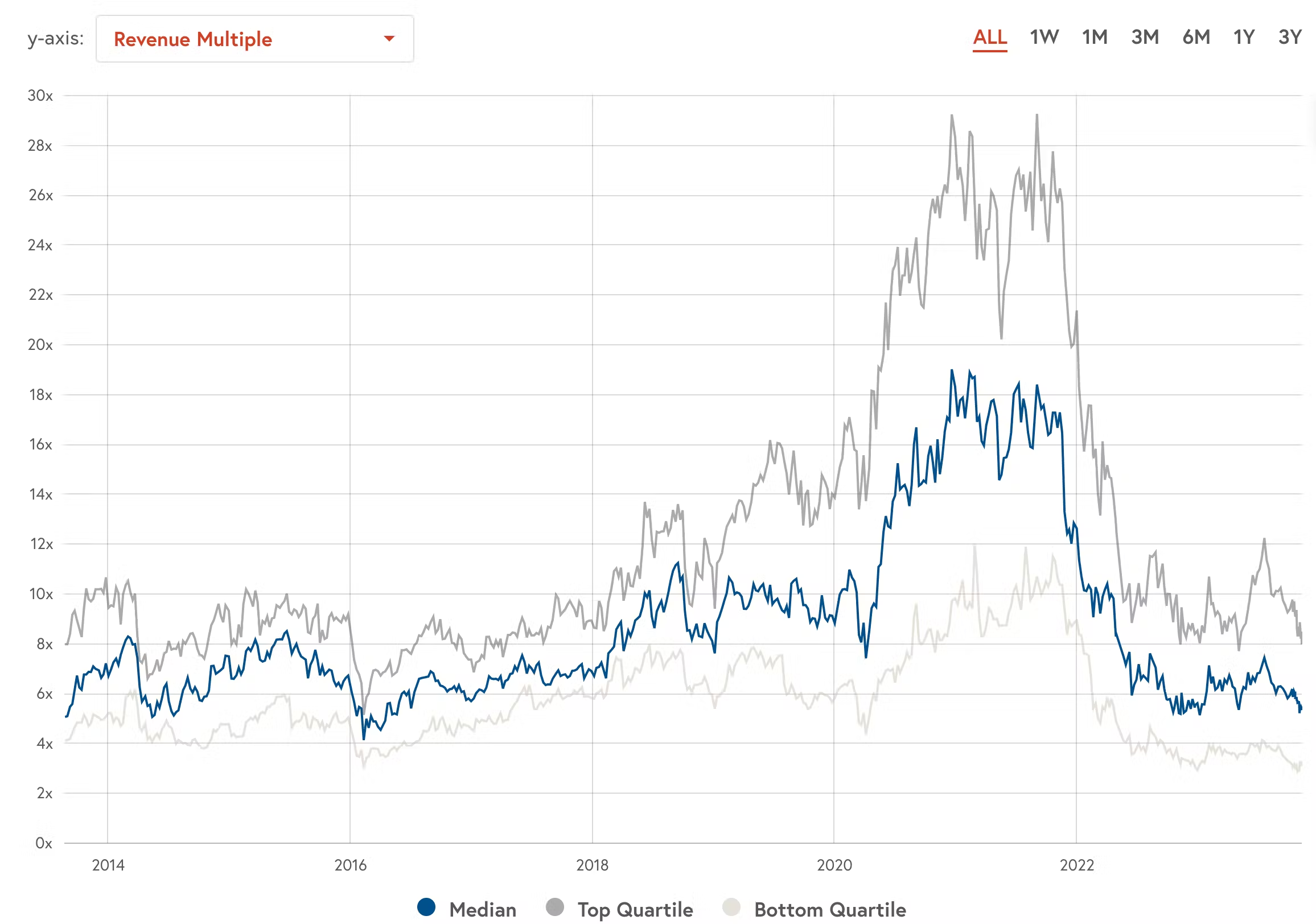

The dot com bubble feels like ancient history but, up until the recent crash, ARR (annual recurring revenue) multiples were all the rage for software companies. Some companies traded at several times their ARR – and investors treated that as completely normal.

Apparently, greed causes investor amnesia because investors forgot this important lesson: valuing a company based on revenue is foolish. In fact, I’d say valuing a company based on anything other than its cash flow is foolish.

Scott’s words cut to the core problem of revenue multiples: if the company you’re investing in will never have the ability to pay you back your investment, how are you going to realize a profit?

The common answer: sell the investment to the next person (aka a greater fool). But, as you can see from Sun Microsystems’ collapse, eventually those greater fools disappear.

Payback period

Understanding the payback period is a great heuristic for valuing a company. If this company had to deliver me investment profits (or even just return my money), how long would that take?

The answer is completely dependent on the company’s current and future cash flows (hence, my earlier point on company valuation should only be based on its cash flow). The longer the payback period, the riskier the investment. After all, the future is inherently unpredictable, growth is rarely sustained, and Oracle might buy the company an 86% discount!

At Atlasview we always map out the potential payback period on each deal we look at. We don’t want to solely rely on greater fools to generate profit. We outlined our approach in a recent blog post titled Upside vs Downside.

Shoutout to Jacob for unearthing this gem.