NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

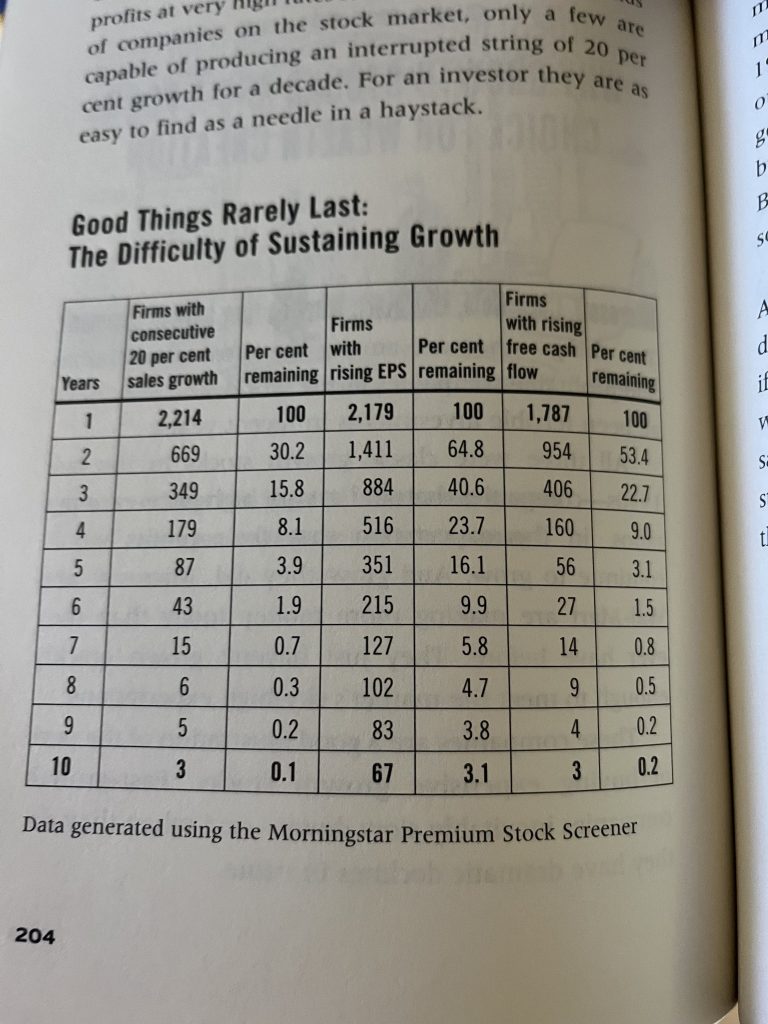

Today’s gem is this chart which shows how rare sustained revenue growth is:

Growth is hard. There are several reasons why it’s rare for a company to sustain revenue growth long term. Given the data above, as an investor, whichever company you are analyzing you can safely assume that it will not grow 20%/yr for 5+ years (let alone 10 years).

At Atlasview we generally avoid companies for sale that have experienced revenue growth by more than 20% year over year. Here are a few reasons why:

- Recency Bias: most businesses that are “growing” 20%+ year-over-year probably have only done so for a year or two. If they had been growing 20%+ for any longer period, they wouldn’t end up in Atlasview’s universe of opportunities (small businesses), and instead, they’d be a much larger business. Why should we project or assume the company will continue to grow 20%+ during our ownership? According to the above data, this would be the improbable case. Brokers and sellers are quick to assign a valuation multiple on the most recent year, but if it’s the business’s best year ever, how do you know that the growth won’t revert?

- Lack of Cash Flow: the majority of “growth” opportunities we see are generally cash flow negative or break even at best. This is because everything is being reinvested back into growing revenues This heightens the risk profile of the business as the lack of cash flow reduces optionality. If the growth doesn’t continue, you’ll need to perform major cost reductions (which is not fun or easy). Or hope there is a greater fool to sell the business to, so you can realize your investment returns.

- Unpredictable ROI: plowing cash flow into organic growth has unpredictable ROI. Even if the growth appears profitable, it could still be destroying value depending on your cost of capital. As a PE buyer in the lower middle market, we have a high cost of capital, and therefore a high ROI hurdle rate.

- Premium Multiple: this is the most important reason. Companies that are growing rapidly always trade for higher multiples. Investors take recent success/metrics and, often erroneously, project them out into the future. As a result, they justify paying higher multiples today for something they believe will happen in the future. We prefer not to operate in that regard, because the future is hard to predict. We believe in “making money on the buy” or having a margin of safety at acquisition. We achieve this by purchasing businesses on a reasonable multiple relative to the cash flow the business generates today.

I took the chart from Seymour Schulich’s book titled Get Smarter. Schulich shared the chart to evidence why he never invests in growth stocks – and I tend to agree with his rationale!

I bought his book to read while I was on vacation in Mexico, but it was so good I finished it on the plane ride there! I shared a few other gems from the book in this tweet thread.

One thought on “Issue #44: Rarity of Sustained Growth”