NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

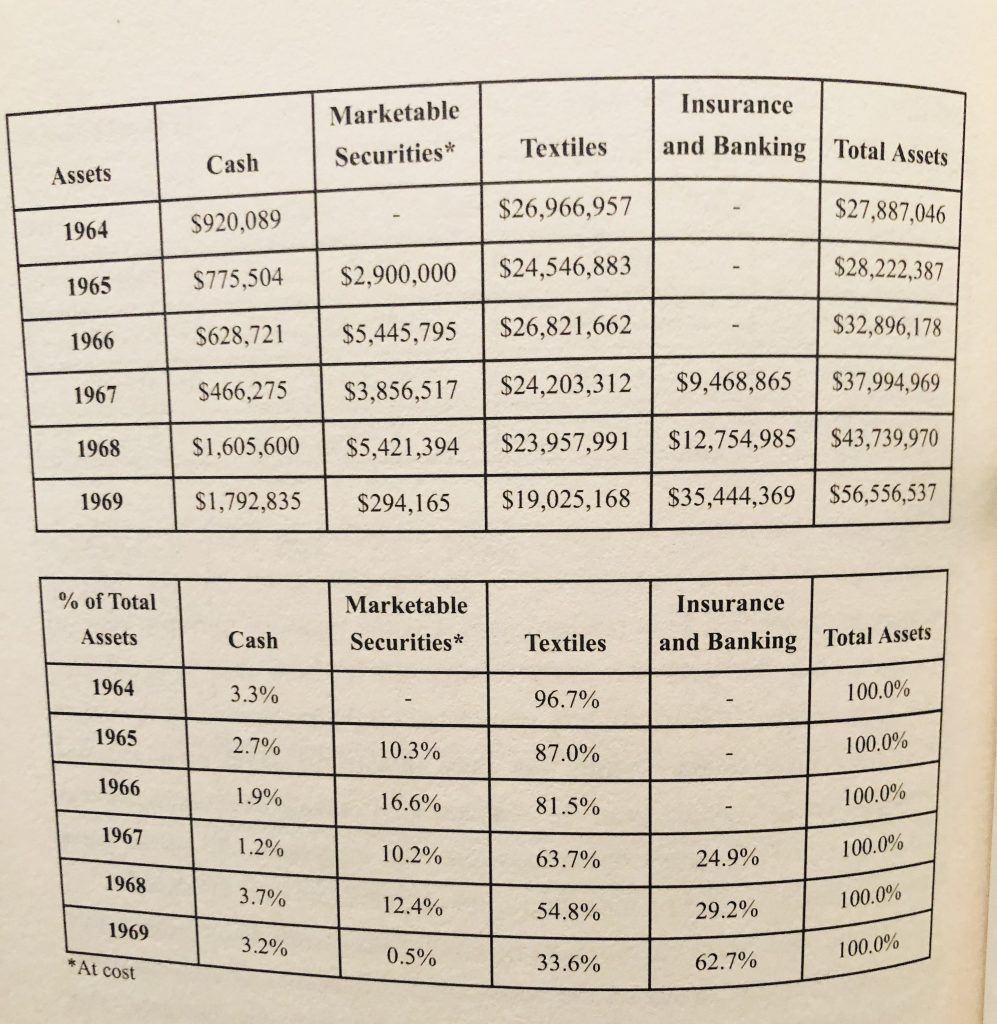

Today’s gem is this chart detailing how capital was allocated for Berkshire Hathaway from 1964 to 1969 (from the book Capital Allocation by Jacob McDonough). Warren Buffett took control of Berkshire Hathaway in 1964, and went straight to work.

This chart makes reallocating capital look very easy. Eloquent transition from textiles (low ROI) to insurance and banking (higher ROI) in a span of just 5 years. It hides the true reality of reallocating capital though. Things like laying off staff, shutting down factories, closing vendor accounts and canceling projects. Not to mention, the immense trust required from investors (BRK still had minority shareholders). Investors signed up to be owners of a textile manufacturer (as crummy as it was), and you’d have to communicate why shrinking that entire operation and allocating the cash to insurance/banking instead is better.

You also run the risk of capsizing the original ship, and perhaps overestimating the strength of the new ship. None of this is easy, and requires a skilled operator to execute, and communicate the plan. Reallocating capital results in short-term pain, but owners and the stakeholders that remain can benefit immensely.

And it’s not just failing old textiles manufacturers where capital reallocation proved to be a wild success. Tech startups often “pivot”, meaning they change course from the original idea to something completely different. This, in a sense, is a form of capital reallocation. Lots of short-term pain and immense trust are required from investors. All parties involved signed up for the original idea/vision, and convincing everyone to pivot to something new is no easy feat. But again, if pulled off can leave owners and remaining parties all in a much better position.

How is capital and resources currently allocated in your business(es)? Is there a better use of capital, and if so, is it worth reallocating?