NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

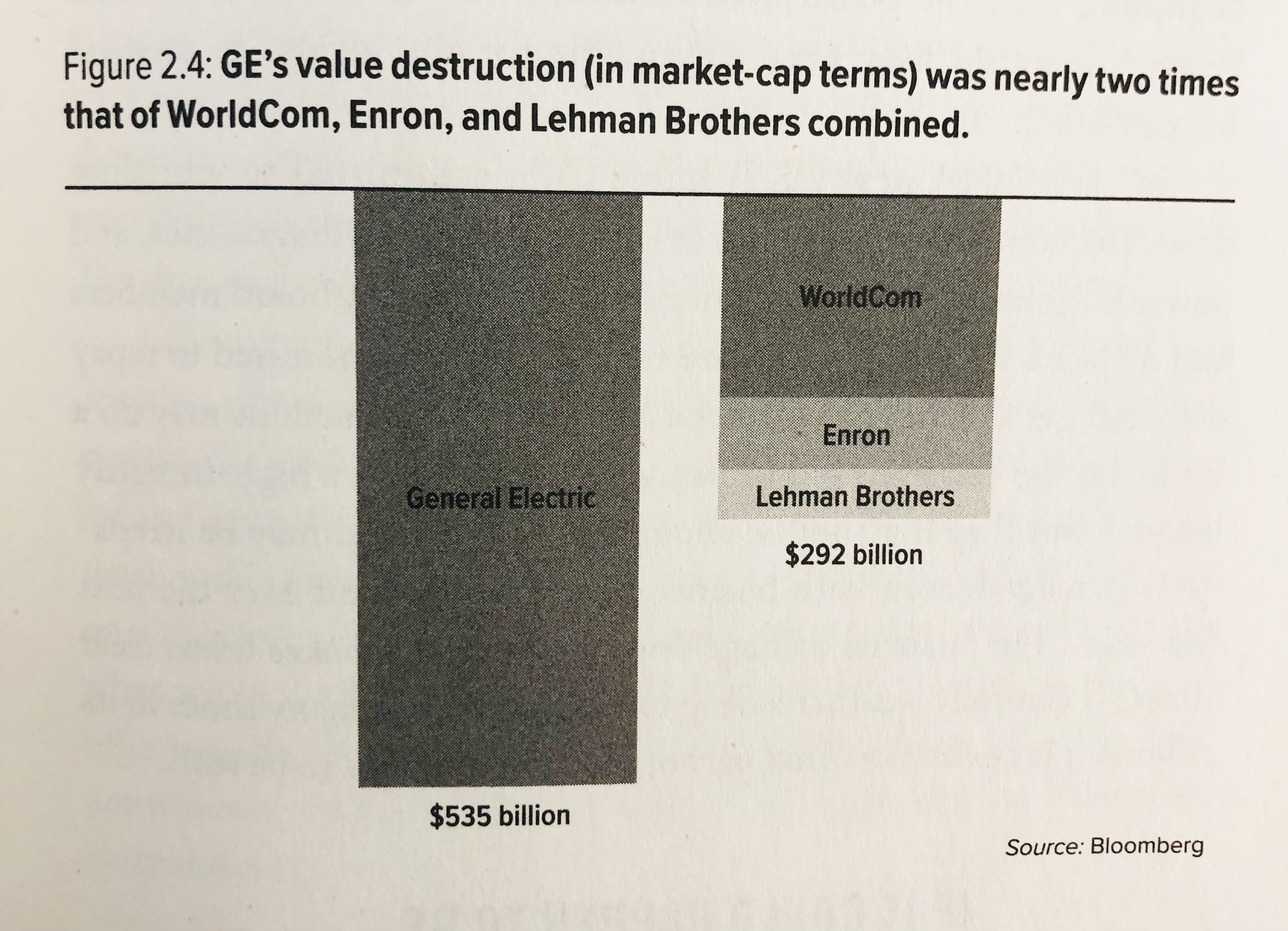

Today’s gem is a chart depicting General Electric’s (GE) epic value destruction and some discussion around the rise and fall of the company.

Let’s dive in, but first, a quick note from our sponsor:

Looking To Grow Your Biz Through M&A?

Could you double your business if you acquired a competitor? How about a supplier or an adjacent business?

Atlasview Equity is a flexible capital partner that can help you scale your business rapidly through M&A. Take some chips off the table today, and have the capital to take your business to the next level.

Do you know what’s better than studying a super successful company? Studying a once-super successful company turned average (or failure).

GE traces its origins back to the late 1800s as a manufacturer. It grew into an industrial powerhouse before becoming a bloated stallworth.

Enter Jack Welch.

Jack was famous for his ruthless management style. He took the helm in 1981, and within just 5 years he axed 100k employees (25% of its workforce). He implemented aggressive policies like:

- Each year, no matter how well the company performed, GE ranked all of its employees and fired its bottom 10%

- If a company division wasn’t #1 or #2 in its category, it was put up for sale

- Manic obsession over keeping costs down, examining every line item, and maximizing cash flow

Jack grew GE both organically and inorganically. He had a string of blockbuster M&A deals that delivered high ROIC, and great returns for shareholders. GE reached a peak valuation of $600bn in 2000 ($1.2tn in today’s dollars). Jack was lauded as one of the great capital allocators of our time, and GE, after compounding returns at nearly 30% for ~20 years achieved legendary compounder status. However…

Nothing lasts forever

Jack eventually retired in 2001 and was replaced by Jefferey Immelt. Here’s what happened next:

Now I don’t mean to point the finger at Jack’s successor because there were a lot of things happening at GE that led to its stock dropping rapidly, and never recovering. Jack just got out in time ;).

But here are some overarching lessons from GE’s spectacular collapse:

Over-priced & over-extrapolating

At its peak, GE was trading at around 40x earnings. Investors were overestimating the future growth of the company because of its historic performance. Overextrapolation is a feature of capitalism and a common culprit for investor loss. I’ve previously discussed what happens when you pay too much for a business.

Harder to deploy capital as you get larger

Repeat after me: size is the enemy of returns.

At a $1.2tn market cap, in order to create a return that even just matches the S&P 500 average… you need to create ~$80bn+ in value…every…single…year. The M&A opportunities at that size are little to non-existent. This was just an impossible feat. At its peak size, GE was set up to generate subpar returns at best and completely destroy value at worst.

Gravity pulls all companies back down

As we’ve seen with Thomson Newspapers, nothing can ever compound to the moon. All businesses go through a cycle, and decline is part of that cycle. GE compounded at a high rate for a long time, it was easy to conclude that nothing bad could ever happen to the business. It’s always good to get an understanding of where a business is in its cycle.

Ruthless culture can backfire

What jumpstarted the GE turnaround in the 80s, ended up harming them in the long run. The obsessiveness around earnings growth led to management manipulating earnings. This was easily achieved via GE Capital (their financial services arm). Accounting rules for financial-based businesses give management a ton of discretion around reported earnings.

GE is a lesson in company culture as much as it is operations or M&A. If you examined GE’s culture you’d see the red flags all along. The egotistical bravado, the defensiveness, the “my way or the highway” attitude basically shunned all investor criticism.

Business is hard, the future is unpredictable and ego kills every single time. Management of companies that care about longevity should remain humble, be forthcoming and candid with mistakes/failures, be conservative with any projections, and always welcome outsider criticism.

There are many companies today that may be in their “GE legendary compounder phase“. So hopefully these lessons will keep everyone on their toes!