NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

Sponsored by Atlasview Equity

Atlasview is an investment firm built for founders.

If you’re considering selling your business, find out why Atlasview is the ideal capital partner to scale what you’ve built while preserving your legacy. Contact Atlasview today to set up an intro call!

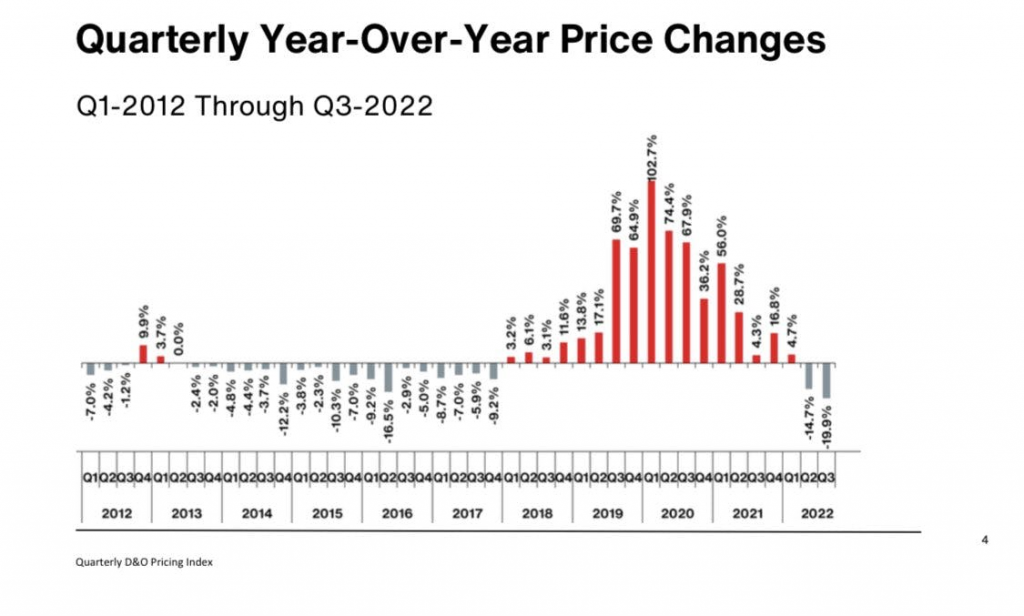

Today’s gem is this chart displaying public company D&O insurance prices:

This is quite a fascinating chart if you take in what’s going on here.

D&O (directors & officers) insurance protects directors and officers of a company from personal losses as a result of being sued. I have D&O insurance for the boards that I serve on and I believe all publicly traded companies actually require it.

The chart illustrates how the premiums spiked during the mania. Insurance companies are in the business of underwriting risk, and when they are increasing premiums by 70-100% YoY, what does that tell you?

It’s a clear signal that insurance companies were expecting a large increase in shareholder lawsuits. Directors/officers are liable when they breach their fiduciary duty. So basically, this chart is saying “prepare for a large increase in directors/officers not acting in the best interest of shareholders.“

Given all the craziness that happened in 2020/2021 (and the subsequent blowups that are still ongoing), it seems obvious in hindsight.

I took this chart from this Twitter account.