NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

I recently read the book Daring To Succeed, which is the story of Couche Tard and its founder Alain Bouchard. I am willing to bet that not many people outside of Canada (or probably even inside of Canada) have ever heard of either of those names. Couche Tard is the second largest operator of convenience stores in the world, behind 7-11. Over a 40-year period, they grew (mostly through acquisition) from 0 to 15,000 locations that generate $72bn in revenue and employ 128k people worldwide. Their most popular brand is Circle-K, which many of you in Canada & the US may recognize.

What I find really interesting about Couche Tard is that they built this empire despite convenience stores/gas stations being mediocre businesses on their own. They have low barriers to entry, low margins, compete with various alternatives, and sell products that face a bunch of headwinds (tobacco/gas/unhealthy snacks). This is very different than say, acquirers of vertical market software (Constellation) or aftermarket airplane parts (Transdigm), both of which are economically strong business models on a standalone basis.

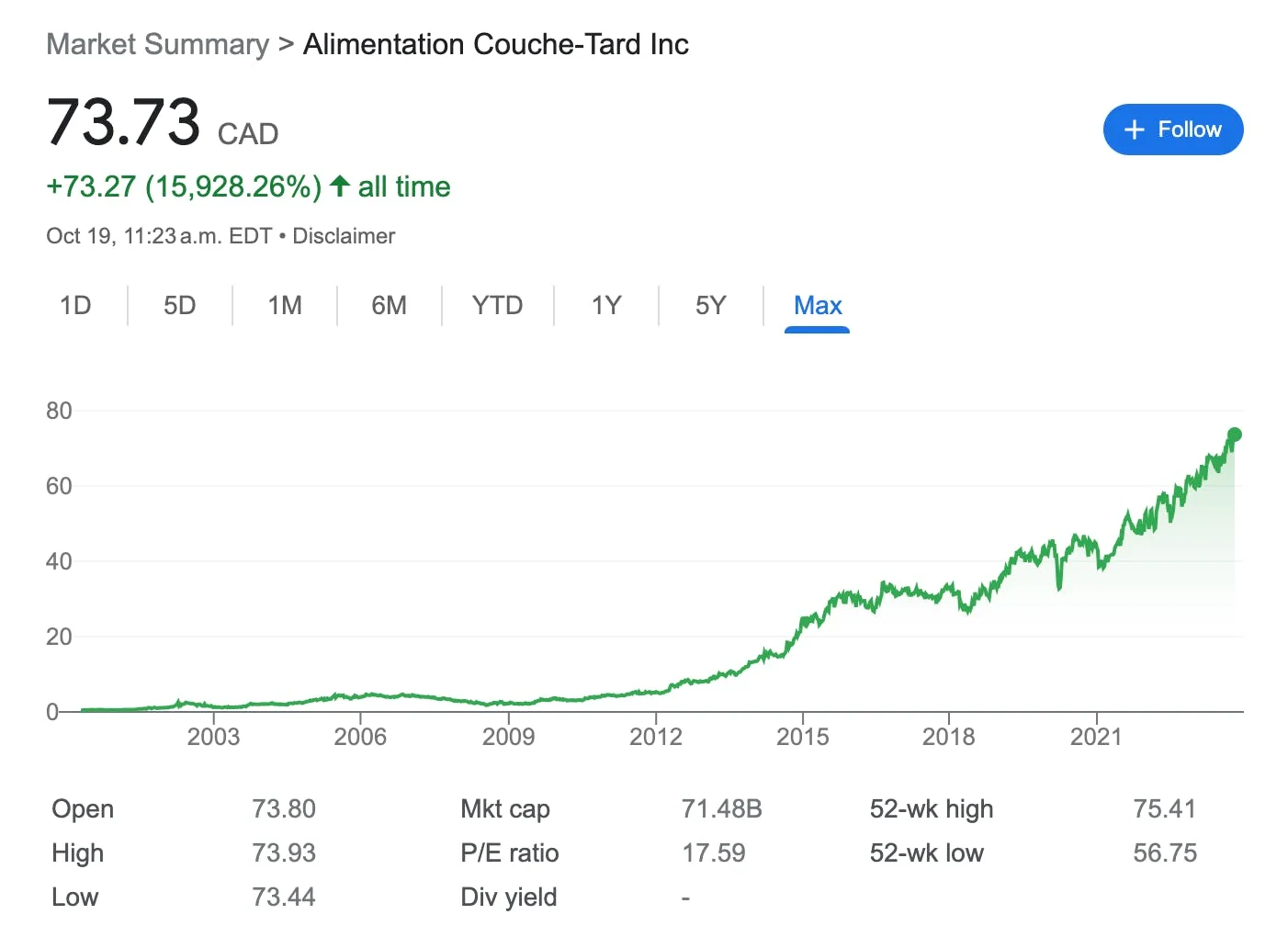

Yet despite all of this, Couche Tard has delivered outstanding performance consistently since its inception. The stock has compounded at 22% over the past 24 years, delivering a 160x return to shareholders. Add them to the list of legendary compounders!

So what’s the key to the success of Couche Tard if convenience stores/gas stations are such crummy businesses?

Culture.

I know that sounds like a cop-out, but I honestly believe this is the driving force behind Couche Tard’s success. They are a great example of the far right box in this chart I shared a few weeks ago on what drives investment results.

Some of the key points of their culture that I noted:

- Humility at the top – things like having a small HQ, not spending lavishly on executives, etc. These things don’t have a direct financial impact when you have multiple billions in free cash flow, but they set the tone for the entire company. They create a culture of frugality and resilience (which will have direct financial impacts).

- Decentralization – since inception, Bouchard has always pushed down responsibility as far as possible. Store managers are empowered to make key decisions.

- Bottoms-up approach – the company has maintained that it’s the front-line, store-level employees that hold all the secrets. They are closest to the customer, and therefore, have critical intel for strategic decision-making. Visiting individual stores, and speaking with managers/store employees was never above Bouchard, no matter how big the company became.

- Constantly innovate – Couche Tard promotes the kaizen model of continual improvement. As consumer preferences changed over the years, they’ve always adapted well.

- Risk-taking – Couche Tard has done several, uncomfortably large, acquisitions which transformed the company each time. Risk-taking is promoted and rewarded in the company, and Bouchard has always avoided complacency.

- Discipline – they’ve continually improved margins by having discipline around opex/overhead (back to the first bullet point). As well, they’ve maintained good discipline around capital allocation, never letting their debt load get too high and never overpaying for an acquisition.

Couche Tard is an incredible company and a great entrepreneurship-through-acquisition story. It is certainly worth studying closely. Even though it’s a $72bn market cap company, it still feels under-the-radar and under-appreciated.

One thought on “Issue #72: Couche Tard’s Culture”