NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

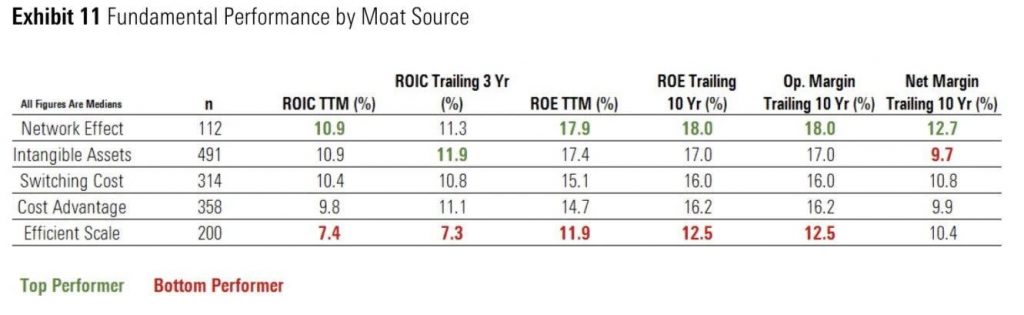

Today’s gem is this chart which ranks 5 types of moats by their performance (based on a study of 1500+ businesses).

Which of these moats does your business(es) currently have or are building towards?

Businesses with network effects or efficient scale moats typically have a winner-take-all dynamic. The top dogs in the industry capture the lion’s share of the value. Very hard to achieve either of these moats and virtually no business in the small business or lower middle market space has either.

Most of the businesses we come across at Atlasview Equity have 2 types of moats: intangible assets and switching costs. Intangible asset being software code and customer contracts. Switching cost being the risk, difficulty, and high costs associated with customers switching software providers. These 2 moats enable even small players within a specific industry to have defensibility. These “mini-monopolies” can deliver fantastic returns on invested capital.

The chart is from this tweet thread, which contains some other interesting charts and insights I recommend checking it out. The data is from a Morningstar study.