NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

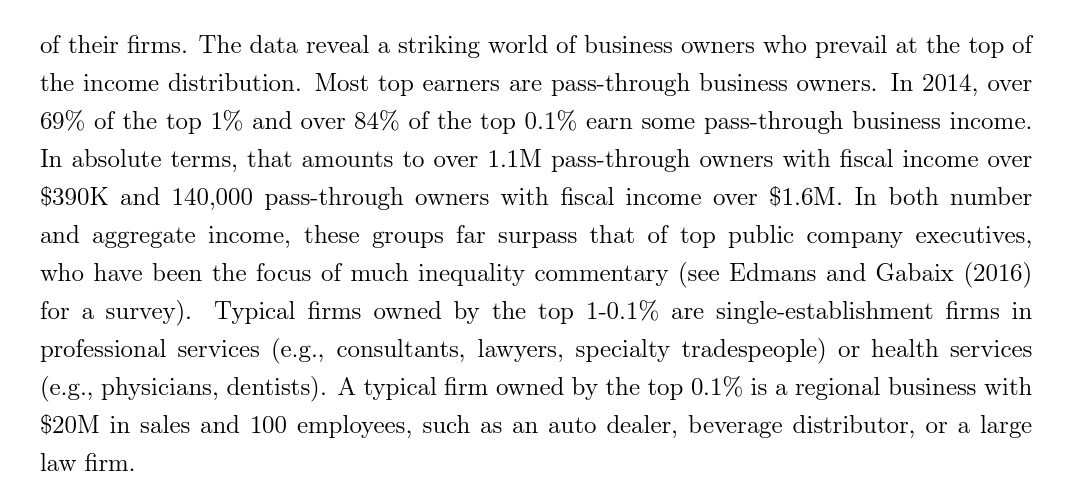

Today’s gem is this excerpt from a study conducted in 2019 which examined 11m business tax returns:

The last sentence is particularly intriguing: A typical firm owned by the top 0.1% is a regional business with $20m in sales and 100 employees, such as an auto dealer, beverage distributor, or a large law firm.

The study also categorized the largest industries within the top 0.1%.

1) Legal services ($28.6B)

2) Other financial investment activity ($28.2B)

3) Other professional and technical services ($8.2B)

4) Offices of physicians ($8.0B)

5) Auto dealers ($6.7B)

Keep in mind that the tax returns examined were those of pass-through entities (LLCs, LPs, S Corps), which generally tend to be used by small to medium-sized businesses. Large corporations usually don’t use pass-through entities, instead opting to utilize C Corporations.

What I found particularly interesting about this study is that the top businesses (SMBs) tended to be labour-based (aka human capital). It seems counterintuitive to me because selling labour typically doesn’t scale well (as opposed to selling software/media/etc.). But it seems that you don’t even need to scale well to make it to the top 0.1% since the study mentions that the typical 0.1% firm was regional!

You can read the full study here. I stumbled upon this study via this YouTube video on auto dealerships titled: Why it’s Illegal to Buy a Car from Toyota. Auto dealerships are a fascinating business in itself, which I will save for a future email.