NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

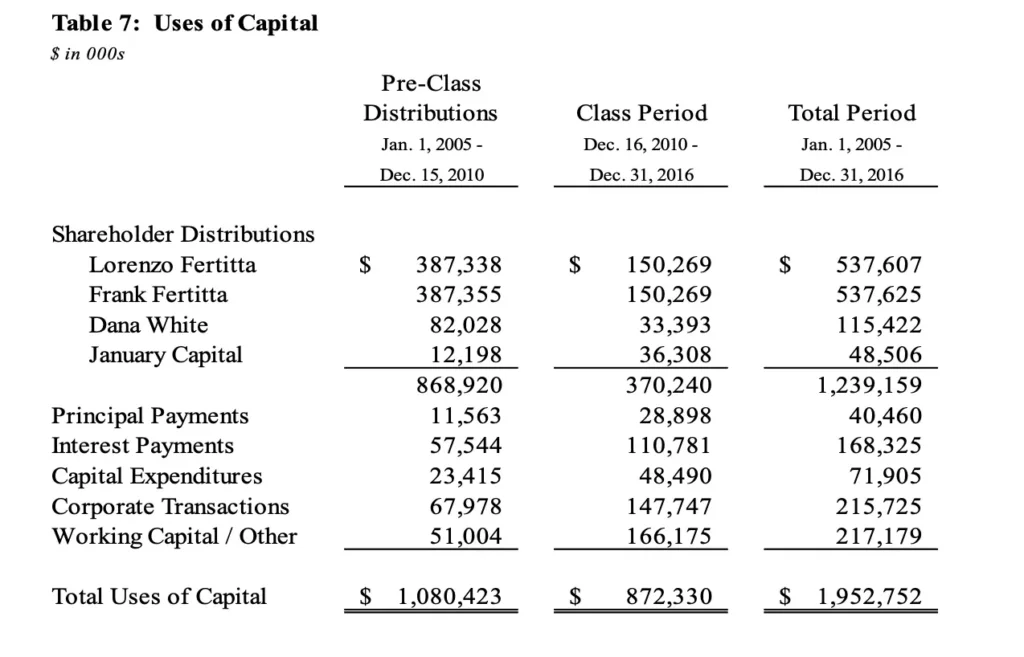

Today’s gem is this chart which shows the UFC’s uses of capital from 2005 to 2016 (note the $1.239bn in total shareholder distributions):

The Fertitta brothers acquired the UFC for $2m in 2001, and installed Dana White as CEO, granting him a 10% equity stake. From 2001 to 2005 the brothers invested an additional $36.4m into the business.

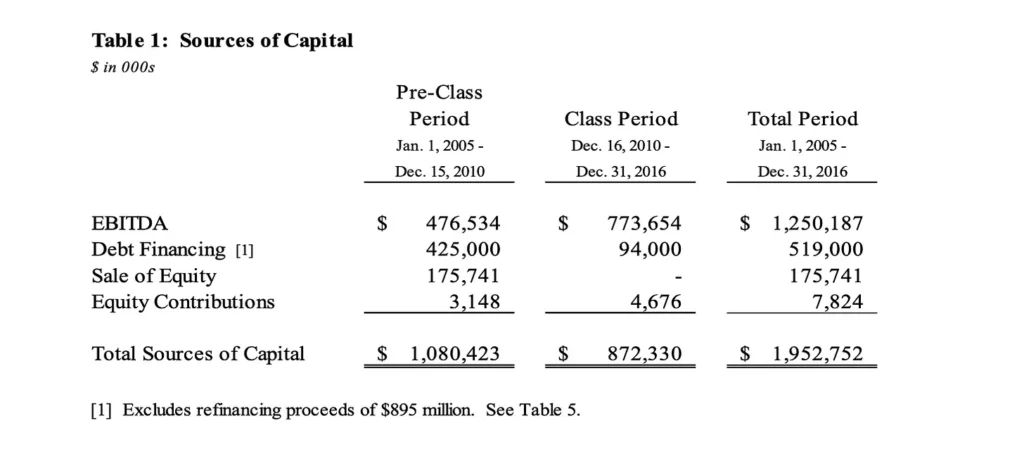

Between 2005 and 2010, the Fertitta brothers took home over $775m in distributions, generating a 21x multiple on their invested capital (MOIC). By 2016, their total distributions amounted to $1.07bn (28x MOIC). The source of capital is as follows:

Then, in 2016, the brothers sold the UFC to WWE which netted them an additional ~$3bn. This would mean that, within ~15 years the UFC generated a ~107x MOIC for the Fertitta brothers. What an investment!

Though I am not a huge fan of the UFC, I like this case study because of the substantial amount of investment return generated from the cash flows of the business. The UFC generated $1.25bn EBITDA between 2005 and 2016, which supported the massive dividends. A rare example of a business that returned a substantial amount of cash flow back to shareholders, while still growing astronmically.

The source of the chart and numbers can be found here.