I’m excited to announce the launch of Atlasview Equity, my new investment firm. I wanted to take some time to discuss how it came about, what the strategy is and what the future holds. Let’s dive in.

Background

Although I’m sharing that Atlasview Equity is a “new firm“, the reality is that it has existed for a while. Those that read this blog or follow me on Twitter know about the acquisitions that I’ve recently made with Bloom Equity Partners. In the past year, we closed two platform acquisitions – Viostream and Soutron Global. Both deals were actually done as a joint venture between Bloom & Atlasview but marketed under Bloom since it was a more established brand.

This year, we decided I’d start formally marketing Atlasview as its own brand and re-defined the strategy as Bloom and Atlasview increasingly employ different approaches to seek outperformance in the lower middle market. Joining me at Atlasview is Ryan Khan who I’ve had the pleasure of working with for over 8 years now. Ryan and I met in my early days of entrepreneurship when I was grinding to grow my first business. We worked on many projects since, but one thing has always remained the same – our shared values and investment approach. I’m excited to have him join me and help shape the future of Atlasview.

My partner at Bloom Equity, Bart MacDonald, and I will continue sitting on the boards of the aforementioned companies and seeking out more joint-venture investment opportunities where our respective firm strategies overlap.

In short, nothing has functionally changed. Bloom and Atlasview still share overlap across investment team professionals and portfolio companies, and we hope to add more joint venture investments in the future. The official launch of the Atlasview brand allows for broader latitude in the deals we pursue, and how we pursue them (which I’ll explain below).

Thesis Overview

As the title of this blog post suggests, Atlasview’s guiding principle is free cash flow. This shouldn’t be a surprise to those that are familiar with my content. If there’s one thing I love, it’s free cash flow.

In the current environment of low interest rates and high inflation, there’s no better asset to own than a cash-flowing software or tech-enabled business. Businesses that have low ongoing capex and pricing power are well-positioned to perform well in an inflationary environment. Combine that with high margins and a high level of free cash flow, and you have a defensible asset in the event of a market downturn. These types of businesses will never be at the mercy of the market in order to deliver predictable returns on invested capital.

The lower middle market is the only place where I’ve found these opportunities at attractive prices. Oftentimes these businesses are owner-operated and too small for institutional acquirers. Businesses with passionate owners who are approaching retirement, or ready to exit to focus on other aspects of life, typically present a great opportunity for an entrepreneurial investment firm like Atlasview. It allows us to bring our expertise in capital allocation and to implement tried and true operational practices that further maximize free cash flow.

Atlasview isn’t looking for moonshots, we’d rather climb mountains – steady, building on established investing principles, and in collaboration with our partners towards the summit. Success is a series of small continuous improvements and creating systems that deliver predictable results that compound and build over the long term.

Target Business Profile

My expertise is in small, asset-light, B2B businesses that have a niche offering. I have over a decade of experience operating, advising, and investing in these types of businesses, so this is where I’ve developed my edge and where Atlasview’s focus will be.

Atlasview aims to acquire North American-based vertical niche software and tech-enabled businesses that are generating between $1m to $5m in annual free cash flow. These businesses provide software or services to a single niche industry. Example niche industries may include law firms, libraries, medical spas, mortgage brokers, and government agencies.

Here is why these businesses are so attractive:

- Pricing power – Vertical niche software businesses have incredible pricing power. These businesses provide software that powers their customers’ entire operation or at least a key function/department. This makes it incredibly expensive and risky to switch to a competitor, no matter how compelling the offer may be. This makes many vertical niche software businesses mini-monopolies in their own right.

- Low ongoing capex – Vertical niche software businesses typically don’t need to continually launch new features and functionalities to stay competitive. The high switching costs combined with the small addressable market typically insulate them from having to spend an exorbitant amount on R&D to keep up with the market. The maintenance capex that’s required is fairly minimal, depending on how well the codebase has been structured and maintained.

- Low disruption risk – Because the total addressable market is generally small for niche vertical businesses, it doesn’t attract many new entrants. It’s especially unattractive to VC-backed entrants since they’d be unable to generate outsized returns in these small niche markets.

- Operating leverage – In addition to pricing power, these businesses typically have net dollar retention rates that exceed 100%. This means that revenue per customer increases annually with no changes to the cost structure, driving significant operating leverage.

A combination of all the above results in businesses with strong moats that have the potential to deliver high returns on invested capital.

Target Seller Profile

The businesses described above are often family-owned. These owners have built their businesses over a long period of time and are now approaching retirement. Without an ironclad succession plan in place, they often turn to investor-operators, and this is where Atalsview comes in to provide value.

These business owners make perfect partners, here are a few reasons why:

- Bootstrapped – We can work directly with the owner-managers to craft a win-win deal without outside investors/parties vying for different interests.

- Owner earnings – The term “lifestyle business” often has a negative connotation, but it shouldn’t. The way I see it, a lifestyle business is simply a business that produces enough earnings to fund an owner’s lifestyle. It may not be fully optimized, but it means that the business must be economically sound with the existence of actual cash earnings (as opposed to shenanigans around net profit or EBITDA).

- Resilience – Many of these owners have purposely built their business in a conservative manner, building resilience into their operations. This includes investing in infrastructure, avoiding large amounts of debt, and training employees to always watch the downside. This results in a fortified business that is capable of surviving potential economic storms.

- Value-add opportunities – The points above are indicators that these types of businesses aren’t typically fully optimized. This is where a data-driven, result-focused investor-operator like Atlasview can help implement best practices and proven strategies to fine-tune the operations and maximize free cash flow.

Atlasview strives to be great stewards of the businesses we own. This means, not just driving a return for shareholders but taking care of all stakeholders including employees and customers. Setting everyone up for success with minimal disruption and the utmost respect for the people that make these businesses exist in the first place. Retiring owners have built their businesses carefully over several years (sometimes even decades), and we want to ensure we continue to carry on their legacy.

Value-Add

The core operational ethos at Atlasview is continuous improvement. We seek businesses that already have measurable and repeatable processes in place. We also seek to implement some of our own proven systems, processes, and best practices. Over time, small but steady improvements will lead to compound results and outcomes. Atlasview will work closely with CEOs and operating partners to execute our value-add plans.

Without revealing our proprietary formula, here are some examples of our operational value-add tactics:

- Marketing – This is my forte, given my experience running a growth marketing agency. Allocating marketing dollars to the right programs can have a dramatic effect on any business. This means concentrating efforts on direct response marketing programs, which are proven to have the highest dollar ROI for B2B businesses.

- Finances – Implementing best practices to optimize the cash conversion cycle and increase cash float within the business. Many software businesses already have negative working capital, but small improvements can unlock further cash flow.

- Pricing – Effective pricing is critical to a business’s health, but often overlooked by owners. Price-increase strategies can drive significant operating leverage, and generate more revenue without changing the overall cost structure.

- Outsourcing – Globalization has flattened the world over the years, and it was expedited by the pandemic. Emerging technologies and applications have made it easier than ever to hire and manage overseas talent. The implementation of an outsourcing program can be a force multiplier in any business.

These value-add initiatives may mean reallocating existing capital and resources within the business. But ultimately, the aim is to drive significant free cash flow growth annually. This will help insulate the business from inflationary pressures, create optionality (discussed further below), and increase its enterprise value.

Delivering Returns

There are 2 key ingredients that a business requires in order to generate compound returns over the long run:

- Free cash flow

- Reinvestment opportunities

Let’s dissect each component individually.

Free cash flow

Of the 2 components, free cash flow is the one that is absolutely mandatory for the businesses Atlasview targets, hence the title of this blog post. A high level of predictable free cash flow (relative to the equity invested) de-risks the investment and unshackles the business from being at the mercy of the market. It also creates optionality to pay out a dividend, pay down debt, or allocate to reinvestment opportunities. Not only is a business’s free cash flow fairly easy to assess as an investor, but it’s also predictably optimized as an experienced operator (by executing proven strategies).

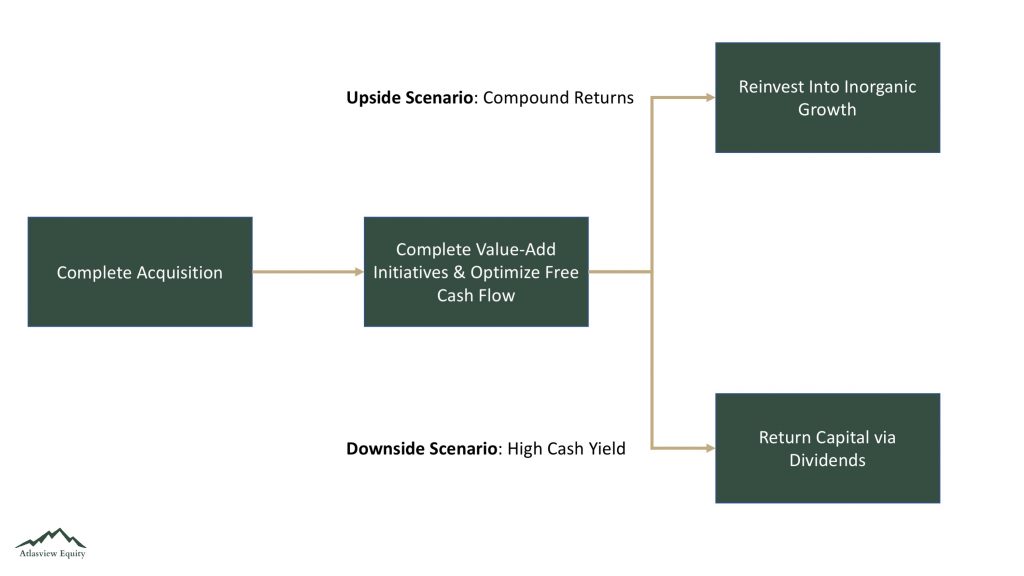

The implementation of value-add strategies should lead to a surplus of free cash flow that is generated from the business within a couple of years of ownership. We will underwrite the investment so that the cash surplus alone will drive a sufficient enough ROI. Atlasview will aim to fully return capital via dividends, resulting in a high cash dividend yield. This is unless we discover attractive reinvestment opportunities.

Reinvestment opportunities

Reinvestment opportunities within a business or industry are far more difficult to assess at acquisition. As a buyer of a private business, there will always be information asymmetry working against you. This is why it makes sense to spend the first little while getting familiar with the business, team, industry, and competitors so you are able to accurately assess reinvestment opportunities.

Business owners have often already tried many organic growth initiatives. The nature of the high-switching cost moat that niche-vertical businesses enjoy, their competitors enjoy as well. This often makes organic growth a low-ROI endeavor, as it’s very costly to get customers to switch to your software. Not to mention, these niche markets are typically mature and over the software adoption curve, resulting in little demand growth.

However, it’s rare that a business owner has attempted inorganic growth because it’s time-consuming, deemed relatively risky, and requires a specialized skillset (M&A). Within a couple of years of ownership, we will have obtained more information about the business and its niche. With this informational edge, we would know if increasing our bet size would make sense. And if it did make sense, we would allocate the surplus cash to inorganic growth instead of returning capital. We would work closely with management to execute and integrate add-on acquisitions. Given our team’s experience/expertise in leading deals, this should be an area where we would add significant value.

Over the long run, this would result in compound returns, the holy grail of investment returns (and the 8th wonder of the world according to Einstein).

Atlasview plans to hold each business without an arbitrary exit date that most PE firms have. Not quite permanent capital, but patient capital. This means we will look to opportunistically sell each business when the market conditions are right or better opportunities exist to redeploy the capital. We will continually assess the return each business is generating on the invested capital, and decide accordingly.

Capital

Up until the acquisitions of Viostream and Soutron Global, I’d never taken in any outside capital for any of my investments. Previously, all of my investing was done via my wholly-owned holding company (Vasantharajah Investments Ltd.). Those acquisitions taught me that I thoroughly enjoy building relationships with like-minded investors. As well, by partnering with investors I’m able to take advantage of larger and better opportunities. For these reasons, I have decided that Atlasview will continue to raise outside capital for its acquisitions.

Atlasview will be raising money on a deal-by-deal basis, giving us flexibility over the structure, mandate, and holding period of each business. We want to avoid the pressure to deploy capital and avoid being incentivized by ever-increasing management fees. I look forward to investing alongside like-minded capital partners with patience for uncovering unique opportunities, and long-term investment horizons.

We will be patient in our search for great opportunities, perhaps completing only a single deal per year. Each business will be assessed and underwritten rigorously. This is in contrast to many PE firms, who aim to construct a diversified portfolio of businesses across several funds. Instead, Atlasview seeks to build a highly concentrated holding of only the absolute best businesses we come across over a long period of time.

You’re lucky if you got four good assets. If you’re trying to do better than average, you’re lucky if you have four things to buy. To ask for 20 is really asking for egg in your beer. Very few people have enough brains to get 20 good investments.

Charlie Munger

If you are an accredited investor or a qualified purchaser and are interested in learning more about Atlasview, please inquire here. Looking forward to connecting, adding you to my investor list, and keeping you in the loop as opportunities arise.

Final Thoughts

I’m excited for what’s ahead and sharing my journey in building Atlasview Equity. It’s been an absolute blast working closely with our current portfolio companies and investors, and I’m looking forward to all new opportunities ahead.

Stay tuned!

Hi there! I’m Jay Vasantharajah, a Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences and passion for investing, entrepreneurship, personal financial management, and traveling the world.

Subscribe below, to get a couple of emails a month with free, valuable, and actionable content.

3 thoughts on “Atlasview Equity: The Pursuit of Free Cash Flow”