NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

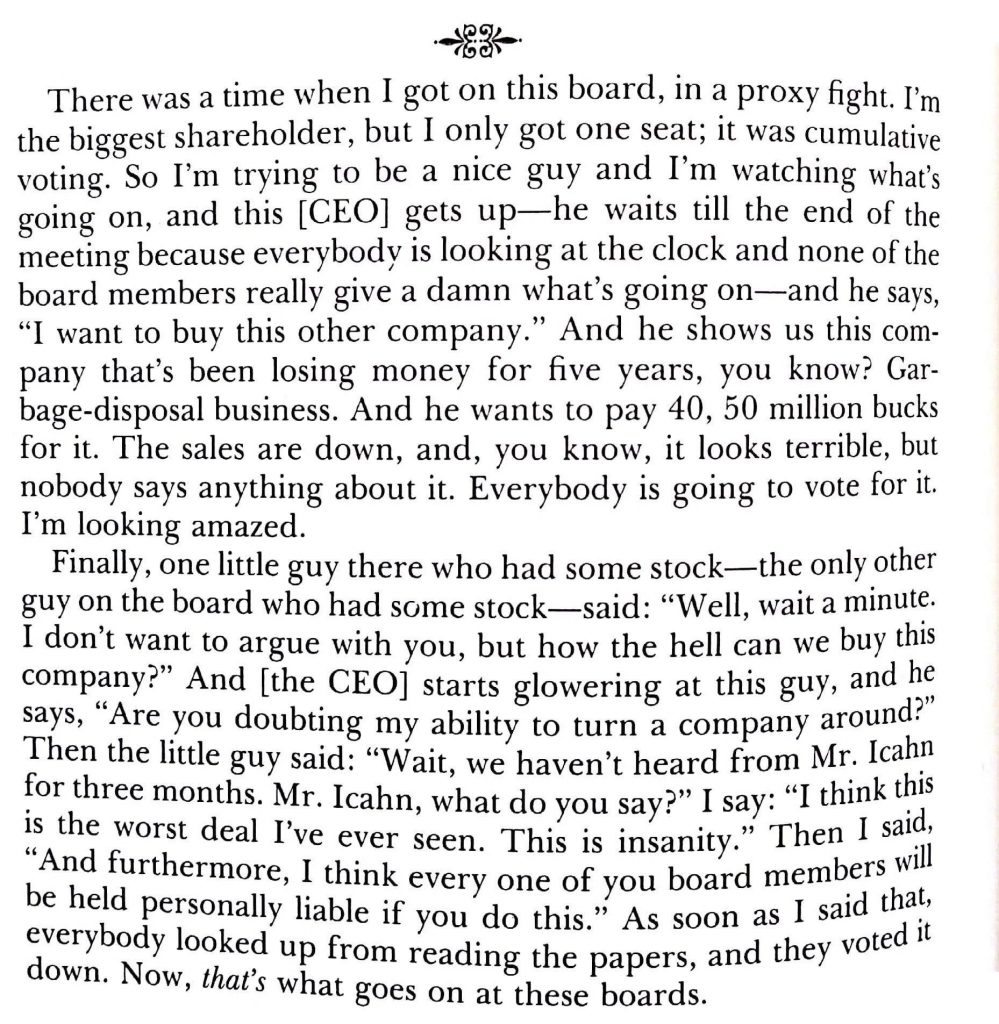

Today’s gem is a book excerpt describing a board meeting with Carl Icahn.

Classic Icahn is famous for being tough on CEOs and holding board members accountable. There are a couple of things to unpack here:

- Groupthink/bystander effect – it’s wild how a group can become so apathetic when it comes to decision-making (especially when making tough decisions). It’s like the ole saying if everyone is responsible – no one is responsible.

- Skin in the game – I’ve seen this happen far too many times at publicly traded companies. Ownership disperses over time and you end up with a company that has no real owners. $TWTR is a great example – none of the board members had a meaningful stake in the company. How can you claim to represent and protect the best interests of the shareholders, if you are not a shareholder yourself?

This is where boards of private-equity-backed companies significantly differ.

Firstly, the PE firm is ultimately responsible for the performance of the companies they own. It is impossible to become apathetic when you have LPs to answer to, and performance is being closely measured. Tough decisions are made all the time by PE-backed boards like replacing CEOs, changing strategies, reallocating budgets/capital, etc.

Secondly, PE-backed companies have a single owner, and their board best represents owners because… they’re one and the same. Concentrated ownership is a great way to ensure there is accountability.

I took this excerpt from this tweet (which was taken from a book, shared in the replies).

P.s. Speaking of Timeless gems, Carl Icahn is literally a walking, talking gem. Highly recommend checking out his HBO documentary, he is quite an entertaining character!

One thought on “Issue #14: Icahn Board Meeting”