Today’s gem is this excerpt taken from Berkshire Hathaway’s last shareholder letter:

After 58 years, Warren Buffett concludes that it was really only 12 good decisions that led to $BRK becoming the $700bn+ behemoth it is today. That’s roughly 1 good decision every 5 years.

It’s both daunting and liberating to think that 99% of the decision you make really won’t have any sort of major impact on your career, net worth or overall life. But 1 truly good decision will trump many average and bad ones.

I reflected on what are the truly good decisions I’ve made so far (career/wealth-wise), and 2 came to mind:

1 – Starting early

I made the decision to quit my job, start a business and start investing in my early 20s. I didn’t have any real experience, I didn’t have any mentors, nothing. It seemed super risky at the time. But starting early, despite all the apparent risks, was the best decision I made.

On the investing front, everyone should know by now, time is your best friend in compounding. The longer you can stay invested, the larger the effects of compounding. So it goes without saying that starting as early as possible is the best thing you can do to grow your portfolio. Starting at any point later than I did would have been a worse time to get started.

On the entrepreneurship front, risk tolerance generally goes down as you get older (and making changes to your lifestyle gets harder). The decision to quit and start my first business as early as I did got me comfortable with volatility. It forced me to learn critical key skills (like sales and marketing). And, more importantly, it enabled me to create much more wealth for myself. If I had waited any longer, the probability that I would’ve been able to quit would continually decrease.

2 – Building an audience

Around 2020, I made the decision to write regularly and build an audience. It coincided with another decision I recently made (roughly 6 months prior) to switch careers from running a marketing agency to buying businesses.

I can’t overstate how much building an audience has rapidly accelerated my career. In fact, I don’t believe I wouldn’t gotten half as far into my career switch without Twitter. I didn’t have any relevant network or prior experience buying businesses at all. Building an audience really allowed me to “hack” my way into the business and changed my entire career trajectory. It’s given me access to people and opportunities I wouldn’t have had otherwise.

My only regret is that I wish I knew about Twitter and building a personal audience early in my career. It would have saved me a lot of pain and wasted resources!

—

So knowing that 99% of your success will be the cause of 1% of the decisions you make, you want to optimize your decision-making systems,. Here are some things I do to try to optimize the quality of my decisions.

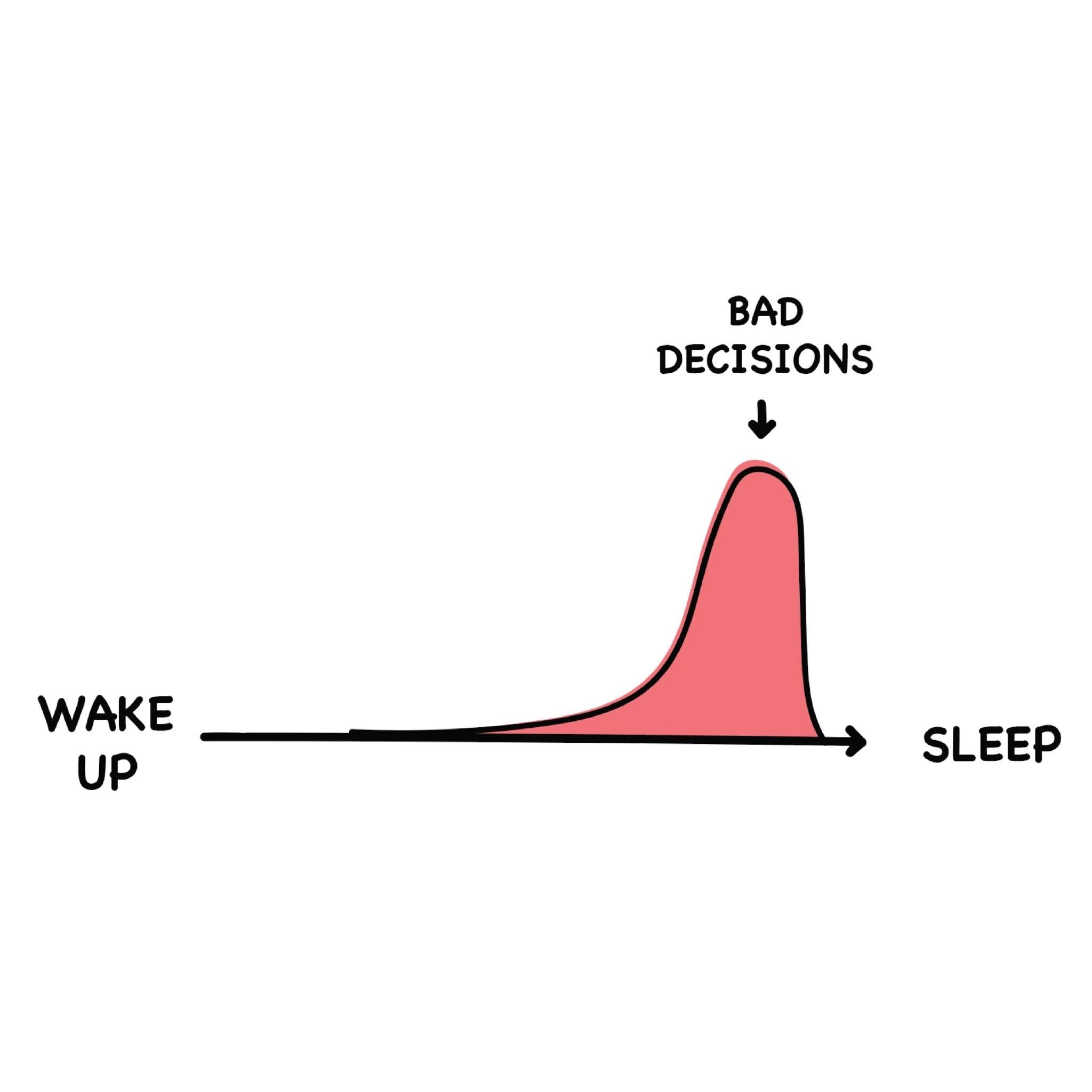

Make big decisions early in the day

Decision fatigue is real. Schedule important meetings earlier rather than later. And definitely don’t make any (especially major) decisions before going to bed. Sleep on it, and decide in the morning.

Limit the quantity of decision you make

I keep a to-do list, and try to circle 1-2 major things to do each day, and just focus on those items. I try to remind myself that it’s the quality of decisions that matter, not the quantity.

Write it out

Keep a habit of writing out your rationale for key decisions. I always put together an investment memo mapping out all the key factors before making an investment. I believe this is a great practice, not just for investing, but all kinds of decision making. It allows you to clarify your thoughts, and also create a history of notes you can reflect back on in the future (handy when trying to assess decisions that turned out to be really good or bad).

Relax

Remember, 99% of your decisions have very little impact on your career/wealth. Knowing that, I think Michael sums it up nicely here

One thought on “Issue #52: 12 Decisions Built Berkshire”