NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

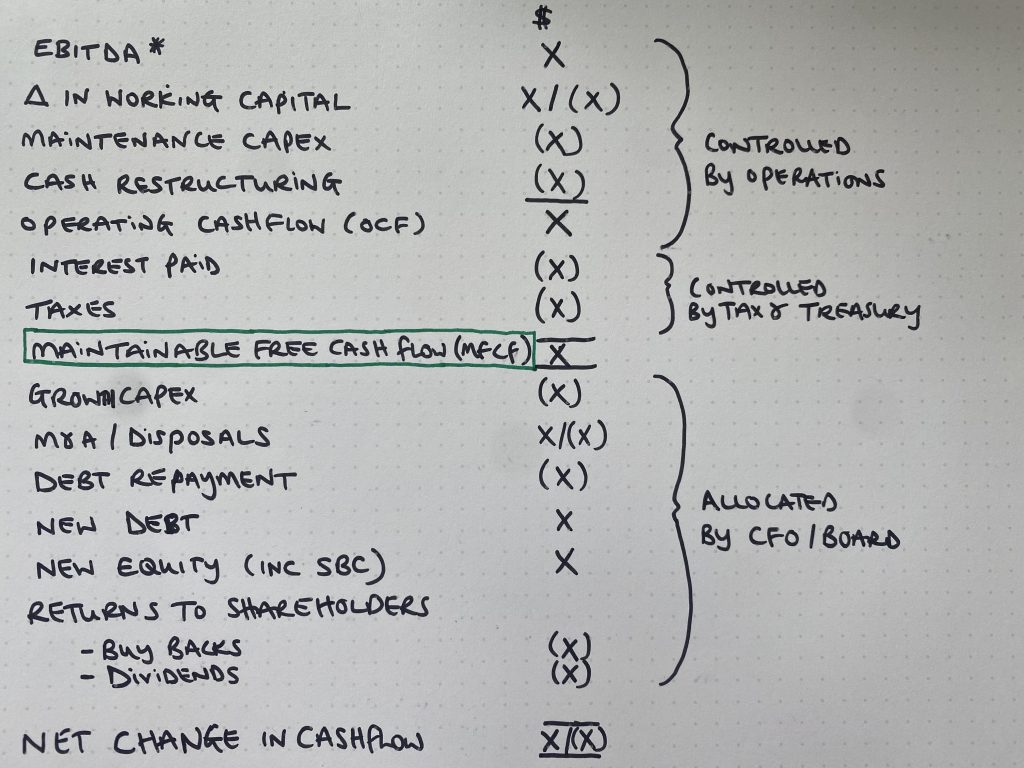

Today’s gem is this calculation of maintainable free cash flow, and this thread by SecretCFO where he breaks it down:

This is a great visualization of the distinction between:

- Cash Generation: cash flow line items that are attributable to operations

- Capital Allocation: cash flow line items that are attributable to the board/CEO/CFO

The major change between Maintainable FCF and just the regular FCF is moving Growth Capex below the Maintainable FCF line. However, sometimes it’s difficult to distinguish between growth capex and maintenance capex for software businesses. But making that distinction is important because you need to know how much cash flow the steady-state business generates.

Many entrepreneurs focus solely on 1 (Cash Generation) and overlook the critical importance of 2 (Capital Allocation). It’s the classic “working in your business” vs “working on your business” problem. I’ve previously written about how to approach capital allocation as an entrepreneur.

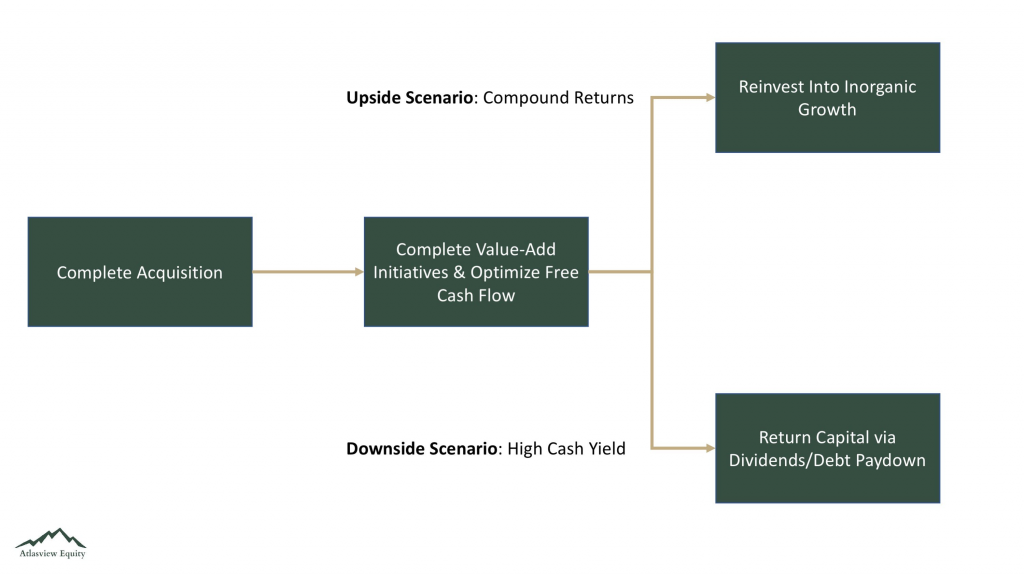

When Atlasview Equity acquires a business, we spend the first year or so making improvements to 1 (Cash Generation). Implementing best practices for sales, marketing, working capital/cash, talent/offshore resources, etc.

Once that’s complete our focus shifts to making decisions around 2 (Capital Allocation). Depending on what we learned about the business/industry during that first year in operations, we make decisions accordingly.

Our general framework for capital allocation is summarized as follows:

If you’re interested in learning more about Atlasview’s strategy for valuation creation, subscribe to our blog.