NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

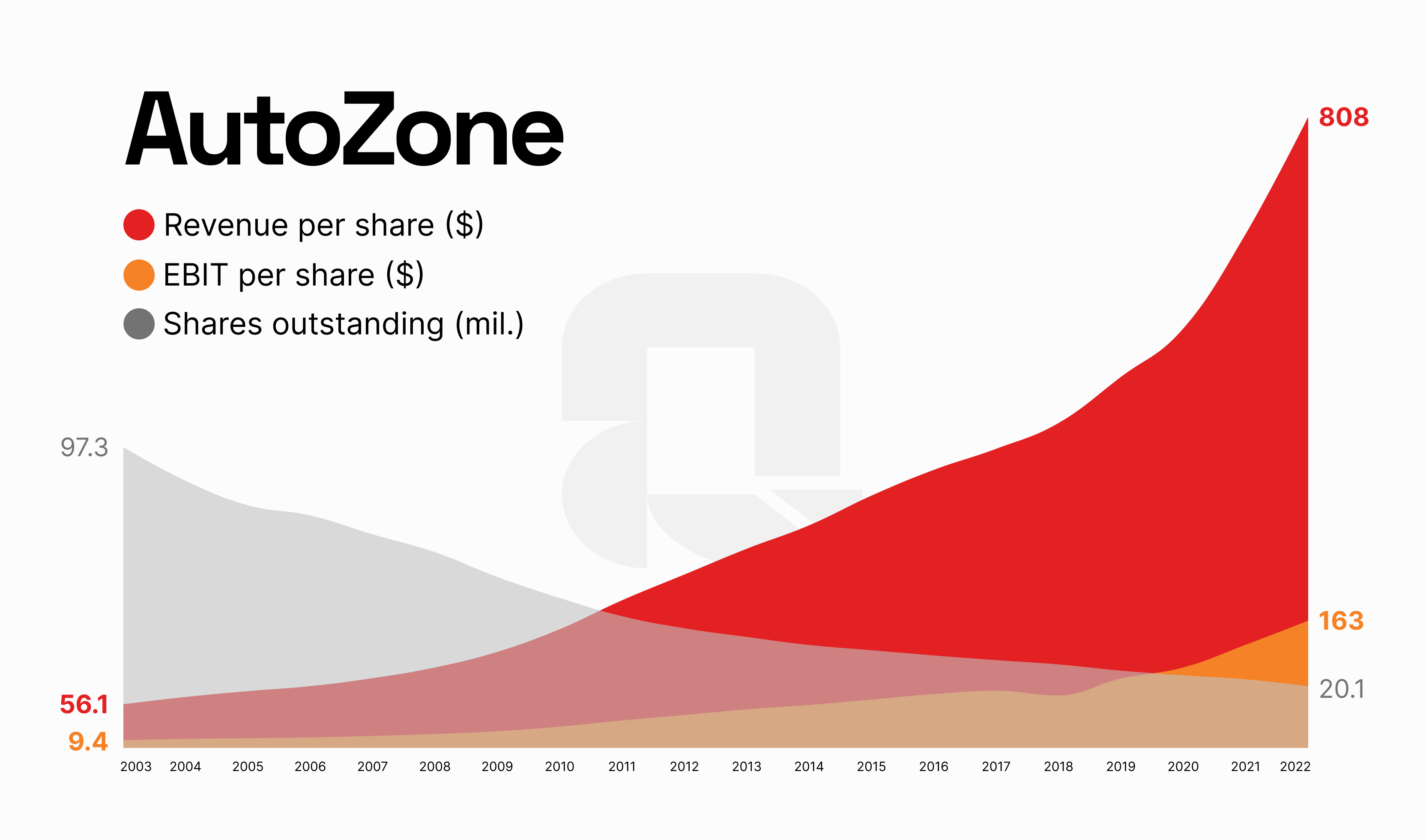

Today’s gem is this chart depicting Autozone’s epic share buyback as well as some discussion around management returning capital back to shareholders.

Autozone has reduced its shares outstanding by well over 80% over the past 20 years. In fact, if you zoom out to 1997, their shares outstanding went from 188m to 18m today. This share buyback program, combined with the steady growth of their business, has delivered a 357x return to AZO shareholders since IPO.

I don’t have any opinions on Autozone’s business or stock, but I am amazed at its management team’s commitment to returning capital back to its shareholders. This is quite rare.

My thoughts on returning capital

According to a discounted cash flow model, a company is worth the present value of all of its cash it will generate in the future. However, the biggest flaw in a DCF model is assuming that all of the cash that a business will generate will eventually make its way back to shareholders.

Management teams (and CEOs specifically) avoid returning capital back to shareholders for 2 main reasons:

- Lack of skill: in most successful companies’ CEOs and executives get to where they are by skillfully deploying capital. Hiring staff, spending money on fruitful R&D programs, expanding sales & marketing initiatives to fuel growth, etc. Their entire careers are built on spending cash to grow the enterprise. They’ve never had to consider returning capital or capital allocation in general. So when it comes time to return the capital back (attractive reinvestment options disappear), can shareholders really expect them to do so? It’s a completely different mindset/skillset that needs to be honed.

- Incentivized to build bigger: executives always benefit from running a bigger business. Bigger business means bigger salaries, bonuses, perks, bragging rights, etc. Faced with the option of returning capital or spending it on questionable projects/acquisitions that have even the slimmest chance to grow the business, they are incentivized to choose the latter. Even if reinvesting into growth destroys shareholder value, management will always try to rationalize it to avoid giving the money back.

This is why I respect management teams, like Autozone’s, who take a disciplined approach to capital allocation and are completely comfortable returning cash back to shareholders.

Cash return reluctance: InMode

I’ve been invested in a business called InMode (NASDAQ: INMD) for ~4 years now. It’s an Israeli-based medical device manufacturer, you can read my original thesis here. The company has done very well since its 2019 IPO, so well that it currently has so much cash they don’t even know what to do with it. At the time of writing, the company has a market cap of $2.5bn but has a cash balance of $630m. They have more cash today than their entire market cap was when I first invested (~$580m).

The business is asset-light with high margins, so reinvesting that amount of cash into organic growth doesn’t make sense. Paying down debt isn’t an option, because they don’t have any. And there doesn’t appear to be many logical M&A targets (not to mention, M&A in the medical aesthetic device space has always resulted in disaster).

This leaves returning the cash back to shareholders as the only remaining option. To me, this seemed like the most logical choice especially considering how volatile the stock has traded – ample opportunity to buy back stock at an under-valued price. However, management has been reluctant to do so, opting to “keep all options open” (their words). As a minority shareholder, I have no choice but to respect that decision (or sell my stake). A situation like this really increases my appreciation for companies with skilled capital allocators at the helm.

Private equity & control investing

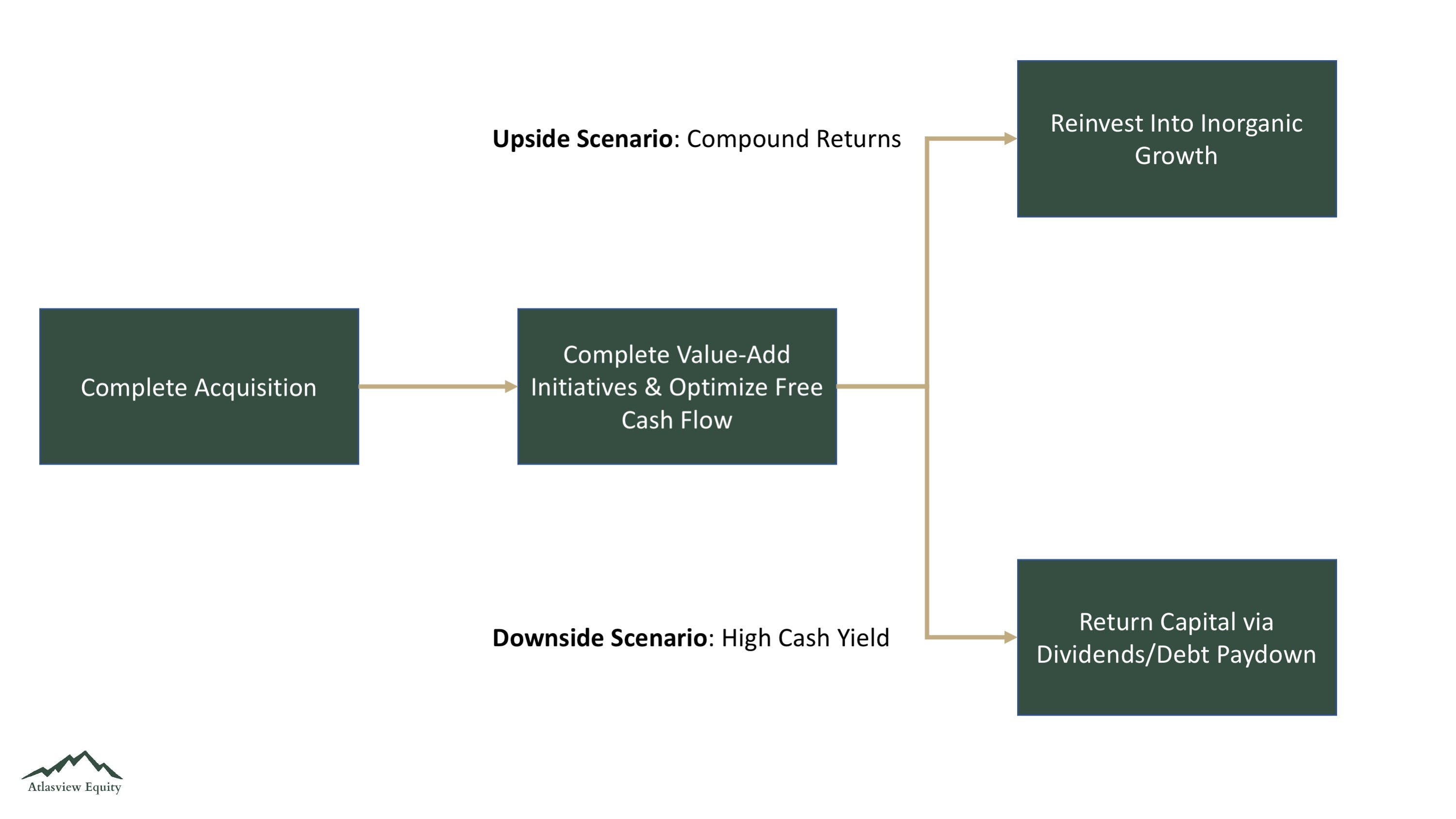

This is one of the advantages of the control investing that Atlasview Equity specializes in. We aren’t at the mercy of management and ultimately get to make capital allocation decisions for the companies we invest in. Reinvesting capital is always compared to returning it back to equity/debt holders:

Another great feature of private equity investing is that generally, all outside capital injected into a company has hard costs attached to it. Debt, obviously, has interest, but equity usually has a mandatory preferred dividend that accrues (if it’s not paid out). This reminds everyone in the company, including management, that the money costs money – there is a real tangible/measurable ROI to returning it back!

I have 2 more related capital allocation/return topics I want to talk about: 1) why I like serial acquirers and 2) predefined capital allocation rules. But unfortunately, this email is getting too long so I will have to save it for another time.