NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

For today’s gem, I’m featuring a guest post from another newsletter I think you’ll love. Below is one of my favorite issues of GirdleyWorld, written by entrepreneur & investor Michael Girdley (who I respect and admire) on increasing your private deal flow. Every week he sends out interesting content about investing, entrepreneurship, or business in general.

If you like it, you can subscribe here for free.

“It’s all about who you know.”

Here’s the big problem every private investor has:

How do you find deals?

It’s all about maximizing your “surface area” to ensure you see deals that others don’t see. The more (and better deals) you get to see, the better your results.

I’ll run you through 10 ways to 10x your private deal flow in this issue.

At the end we’ll boil it down to the key themes.

Here we go:

Create Incentives

My friend Chris Powers runs a real estate private equity fund, and has a genius scheme.

He knows that real estate brokers have all the deals, so he pays them an extra commission for bringing him a deal. Brokers are coin-operated, so this works like a dream.

His firm has now transacted over $2bn. His system works.

An incentive doesn’t always have to be cash. Think outside the box: where does your business come from, and what do they want?

Get Out From Behind the Keyboard

A picture’s worth a thousand words, and a ten minute conversation face to face is worth a thousand emails.

Go meet business owners in person. If you have a target niche, go to places those owners hang out. Find local meetups, annual trade shows, or conferences.

Just show up. And be a real person – don’t just go to shove your business card in people’s hands. Be your authentic self.

If everyone is cold calling, go to their office or show up at an event.

Be Persistent

Humans have bad memories, so we often reach out to what is recent.

You’ve probably forgotten most of the people you’ve spoken to in your life. But I bet you remember who you spoke to last.

When you find a broker or a person that might have a deal flow you want sent your way, create a system where you’re in touch regularly.

Call, email, text – whatever works, and 6-weeks or monthly is a good cadence. Try it and adjust.

Tell Unlikely People

Every chance you get, tell people what you’re hunting for. It doesn’t matter where.

A friend of mine used to have “Buying Wonderful Businesses” in his profile. I have friends that mention their business in real life at every event.

Social media, parties, your local Chili’s — the best deals can come from odd places!

Be Specific

Deal flow that doesn’t match your target is a waste of everybody’s time.

If you can only move on a certain kind of deal, make sure that’s obvious and easy to find. Name your price, amount, stage, market, industry, etc.

The narrower your parameters, the quicker you can be “that person” for your specific target.

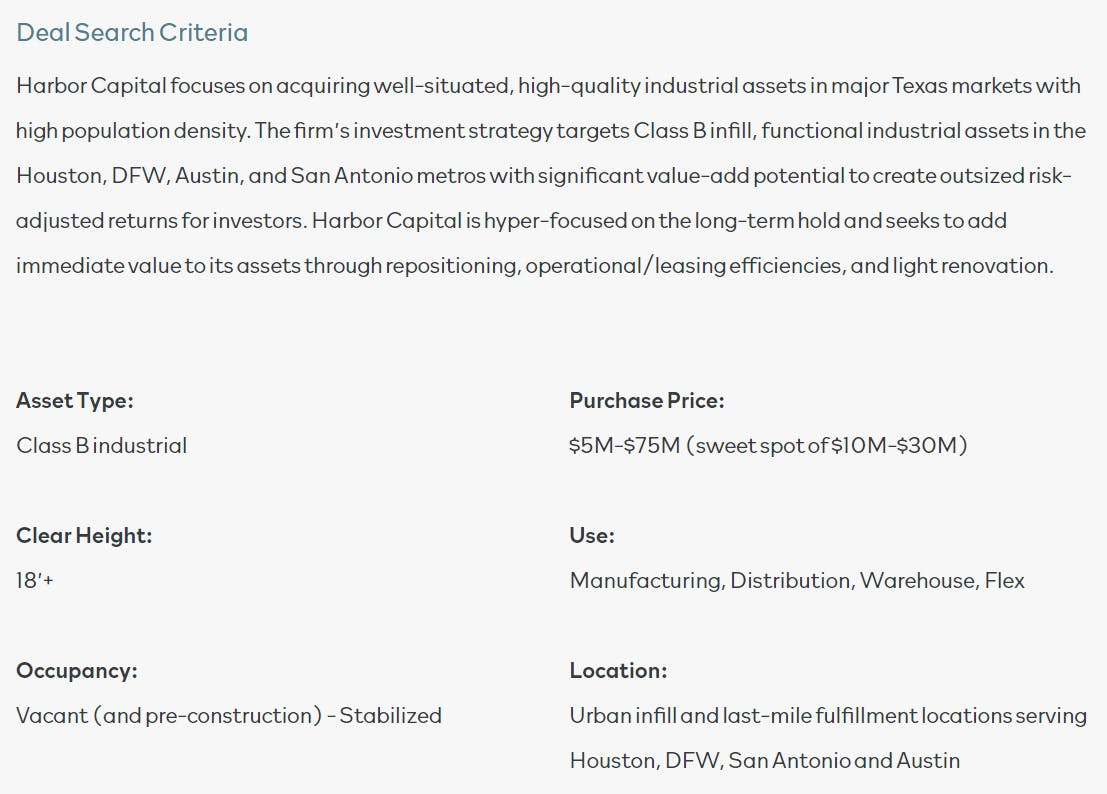

My buddy Levi James’s company Harbor Capital does a great job on this:

Produce Free Content

I’m an introvert (no, really!). But I can reach people that might have deals I like by giving out useful knowledge.

Twitter, LinkedIn, newsletters, podcasts — I spend a lot of time giving stuff away for free, and then I get to tell people who I am and what I’m looking for.

Making lots of free stuff is also a great way to be persistent and tell unlikely people.

Do The Lunch Circuit

This is like the pro-level version of “Get out from behind the keyboard”.

My friend Matt Willes told me this technique:

When he wanted to expand in a particular city, he’d take every broker/CPA/lawyer there to lunch. After an hour with him, these people saw Matt was great.

And the deals flowed.

Sub out “broker” for whoever controls the deal flow in your niche, then run this play.

(The part Matt does intuitively here is Be a real person. Can’t overstate that one.)

Host Events

Know people who might have deal flow for you? Bring them together for a useful, good event.

Spend the time to make sure the event is really valuable, really fun, or (ideally) both. If that sounds intimidating, there’s a really great book that breaks down how to do this well.

Or get ambitious, and look at stuff like Capital Camp or HoldCoConf. They find a fun angle and go all out. (Capital Camp’s tagline is: “Serious investing conversations in shorts and sandals.”)

It puts together incentives — networking, food, drink, activities — and “get out from behind the keyboard”.

Start a Co-Office

There’s a famous spot in San Antonio where all the self-storage developers officed. Like-minded people hustling out of a single place. Working their own projects, but in parallel.

I wanted that. So I started a coworking space called Rainwater.

We rented out spaces to people who are solving the same problems. Now not only do I have a great place to work, but deals get shared over hallway chats and coffee all the time!

(I wrote a whole thread about it here.)

Build a Machine

Build a repeatable, scalable process to hunt for deals. This might be tech, or human resources, or a combination of the two.

Entrepreneur Sara Moore needed a way to cover more ground, so she hired dozens of interns on Craigslist. Over the next year, they looked at 100,000 businesses.

With some hacks (or by outsourcing with a company like Near), it can be affordable!

Recap

Here’s the ten tactics we’ve just gone over:

- Create Incentives

- Get Out from Behind the Keyboard

- Be Persistent

- Tell Unlikely People

- Be Specific

- Produce Free Content

- Do The Lunch Circuit

- Host Events

- Start a Co-Office

- Build a Machine

I’ve either used these or seen them work wonders. And a lot of them are clever executions on two basic themes: be a real person, and give people something they value.

That might be an event or an office for networking, or sharing your expertise for free. Or it might just be sharing a meal and having a pleasant human interaction.

My friend said once to me, “Sales motions create sales.”

Creating deal flow is the same thing. Get out there – but do it smartly.

If you want more issues of Michael’s newsletter, it comes out every Saturday. Click here to subscribe!