NOTE: this was a past issue of my weekly newsletter, Timeless Gems. Join my free mailing list so you don’t miss out on future issues.

Sponsored by Tegus

It’s simple, inefficient investor workflows hamper opportunities.

Stop wasting time and energy searching for the information you need and start with the data everyone else finishes with. Let Tegus be your end-to-end research operating system and surface actionable data that helps you drive better, faster investment decisions.

For a limited time, readers of my newsletter can trial Tegus for free.

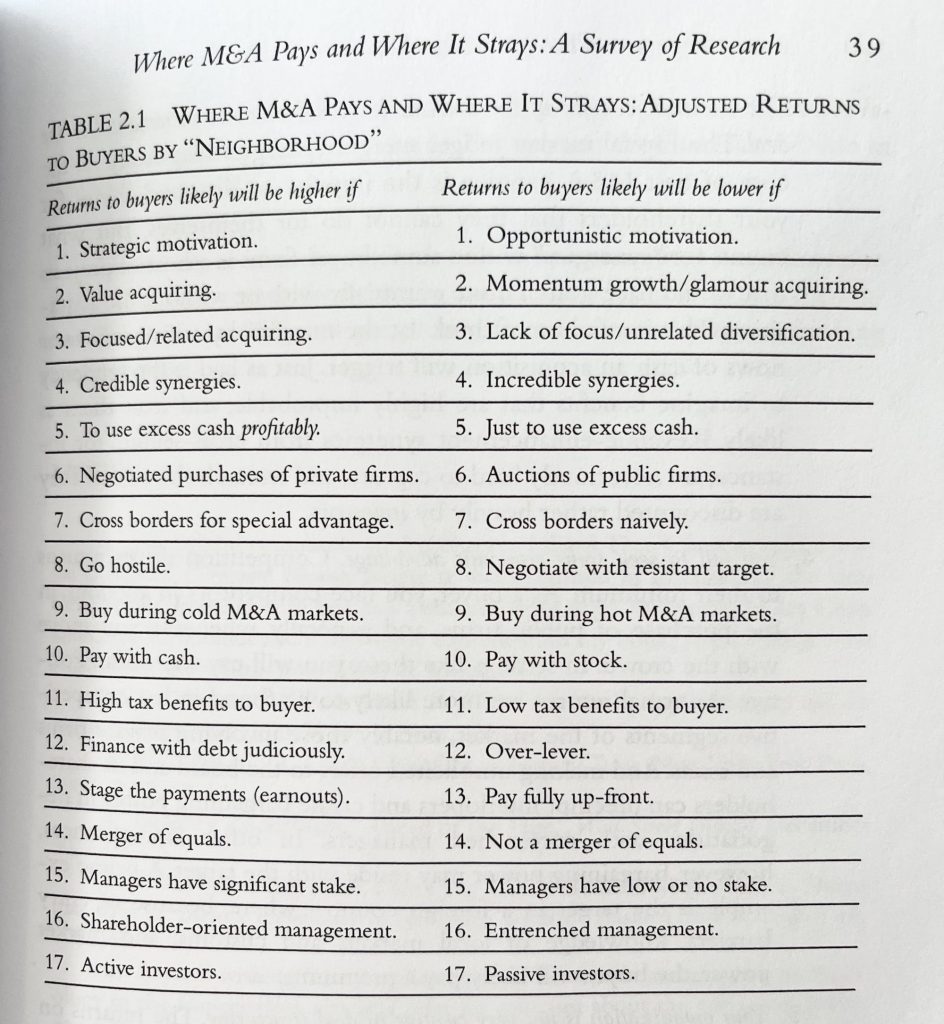

Today’s gem is this chart which lays out 17 factors that improve/reduce the odds of M&A success:

This chart was put together after studying ~3000 M&A transactions. Though most of the transactions studied involved larger businesses, I think these lessons are relevant for business buyers of all sizes. Many of these lessons may be obvious but still requires discipline to execute.

#9 might be one of the most important factors in my opinion. Buy when others aren’t buying and vice versa (cue the greedy/fearful Buffett quote). Great timing can cover up many sins, like when Coca-Cola bought a movie studio for a 75% premium, ran it to the ground, but still made a $2bn profit on it.

We are heading into a cold M&A market, so attractive opportunities will present themselves for patient acquirers. My firm, Atlasview Equity, is starting to see more and more of these attractive opportunities that didn’t exist in the hot M&A markets of 2020/2021.

This chart was taken from the book Deals From Hell. It’s a great read, I recommend checking it out.