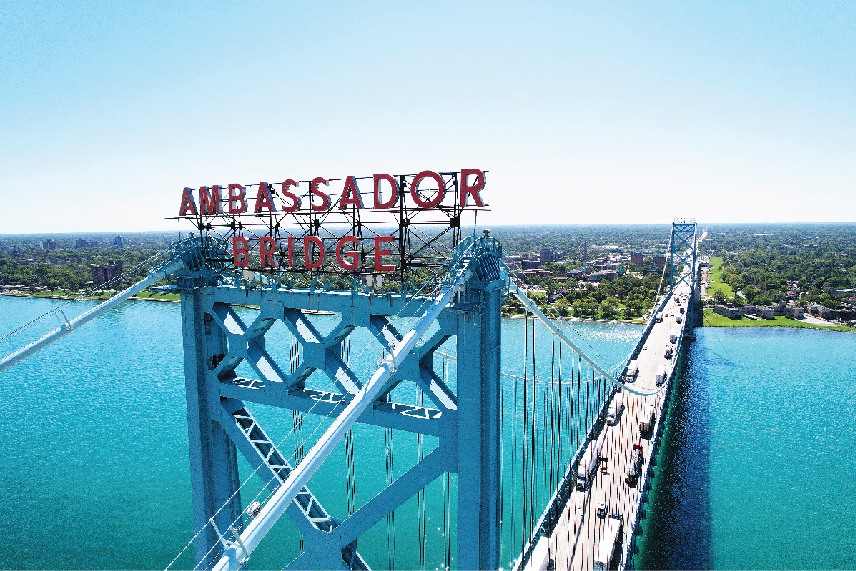

A little while ago, I shared a gem on the Detriot International Bridge Company with some discussion on Twitter. People asked for modern examples of this type of business, and some even concluded that these kinds of opportunities no longer exist.

These businesses (and therefore investment opportunities) do in fact exist in the modern era. I want to share an example of one, but before that, let’s discuss what’s so special about toll bridge businesses.

Toll Bridge Businesses

A “toll bridge business” exhibits the following characteristics:

- Large one-time initial capex to build: an immense amount of resources and or government approvals are required to build the asset. This creates a high bar for replacement cost and a strong entry barrier.

- Little to no alternatives: as a result of the above point, it’s nearly impossible for a new entrant to set up shop.

- Sustained demand/volume: access to the bridge is critical for a large universe of customers, and will continue to be for a very long time

- Low marginal cost of each customer: low COGS and opex plus maintenance capex should be relatively small compared to the initial capex. The result is high operating leverage and ample cash flow as revenue increases (important for the next point).

- Unregulated pricing: owner has the privilege of increasing tolls at any time, without any government intervention.

- Large value-to-price gap: the toll is relatively small compared to the value gain for customers (generally avoidance of massive pain, inconvenience, or costly detours). This paves a long runway for price increases.

The result of the above is an ever-increasing ROIC, as the capital base stays constant while the income just keeps increasing every year. For any long-term investor, these are incredible businesses to own – albeit very rare to find in the wild.

It doesn’t need to be a literal bridge, however. Let’s examine a more “modern” toll bridge business.

Enter Dye & Durham

Many of you may be familiar with the company because they’ve been constantly in the news for the past few years. Between the activist battles, sibling rivalry, outrageous price hikes, excessive leverage, competition bureau investigations, and multiple take-private rumours … the company has been non-stop drama since it IPO’d in 2020.

However, underneath all this noise exists what I believe to be a modern “toll bridge business”. Dye & Durham’s core product is real estate conveyancing software. Their software executes the transfer of ownership in a real estate transaction. It connects directly into multiple land registries across Canada on one side and into all of the various banking software on the other. Dye & Durham is quite literally a digital toll bridge for real estate transactions. Using the toll bridge characteristics described above:

- Initial capex: Connecting into the various land title registries and banking software requires a ton of money and all kinds of government approvals. Takes years and immense resources to build this infrastructure.

- Alternatives: as a result of the above, there are little alternatives at DND’s scale and functionality. DND has somewhere around 80% market share in Canada

- Demand: some cyclicality here, but over the long run, real estate transactions are a near certainty

- Marginal cost: it’s software, so the marginal cost is very minimal

- Pricing: DND is famous for hiking prices over 1000% since the original acquisition

- Value to price gap: DND charges around $285 per conveyance. This amount is tiny considering the time lawyers save using DND. Not to mention errors in conveyancing are extremely costly, considering the value of what’s being transferred (DND significantly reduces chance of errors).

The Proud brothers acquired the original business for $5m in 2013 and have built it to over $2bn in EV today (and one could easily argue this is undervalued for many reasons). That’s over a 72% per year EV growth over 11 years or a cool 400x increase.

There are modern toll bridge businesses out there – keep hunting 🙂

If you’re curious about the origins of Dye & Durham, check out this article here. The article was written by plasticnewt3… Also, compoundpapi puts out a lot of great content on the business as well. Suggest giving them both a follow if you’re interested in learning more about Dye & Durham.

Disclaimer: The author may or may not own any securities mentioned in this post. Nothing written above constitutes financial advice. It is for informational purposes only. Consult a qualified financial advisor before making any investment decisions.