I often think about this (paraphrased) quote from Sam Zell:

“Every day you choose to hold an asset, you’re also choosing to buy it. Would you buy the assets you own at current prices? If the answer is no, then you should sell.”

The more experience I gain as an investor, the more this resonates with me.

I’m increasingly seeing investors claim they only buy businesses they can hold forever and claim to be permanent owners. This sounds nice on paper, but businesses worth holding forever are extremely rare.

To justify holding a business forever, three things need to be true:

- The business will reinvest its cash flow at a high rate of return in perpetuity

- The market will never offer you an irrationally high price for the business

- You’ll never find a better opportunity to reinvest in

Combine these three elements and you can see how difficult it would be to conclude that a business is worth holding forever at any point during your investment hold period.

It’s worth regularly assessing and comparing:

- Estimated rate of return from holding the business (on a go-forward basis)

- Estimated rate of return from selling the business, paying taxes/fees, and re-deploying net proceeds in another opportunity

Doesn’t have to be a precise calculation, just a general idea of the two over a reasonably predictable period. There will likely be periods when the difference between 1 and 2 is obvious and massive.

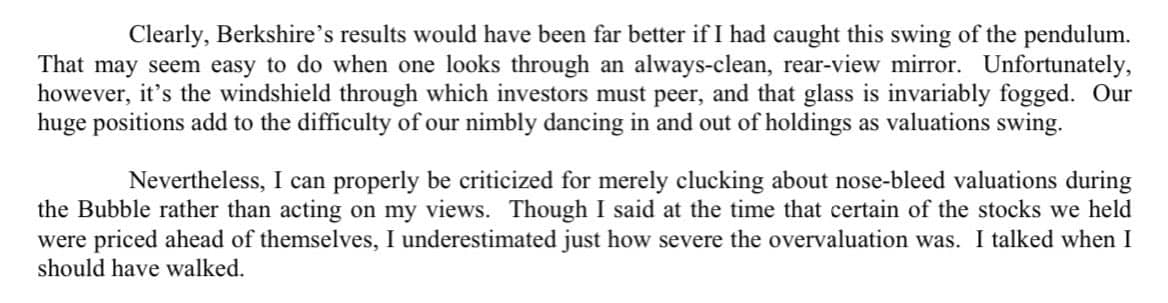

For example, in the 2004 Berkshire shareholder letter, even Buffett wished he would’ve sold his “Big Four” businesses during the bubble when he knew they were overvalued. This included Coke, which was down 50%+ from its peak, and led to two decades of flat returns, adjusting for inflation (1998 to 2018).

I’ll admit that knowing when to buy is a lot easier than knowing when to sell. And to make matters even more difficult, the cost and effort to sell privately held businesses are immense. That said, assets should always be considered for sale, given the points described above. Concluding any business is “hold forever” is a flawed investing framework that should be challenged.